تعلّم تداول الذهب

الذهب هو سلعة ذات قيمة عالية على الرغم من تطبيقاته الصناعية المحدودة. يُعتبر على نطاق واسع مخزنًا للقيمة ووسيلة للتحوط ضد التضخم.

الذهب هو سلعة ذات قيمة عالية على الرغم من تطبيقاته الصناعية المحدودة. يُعتبر على نطاق واسع مخزنًا للقيمة ووسيلة للتحوط ضد التضخم.

جاذبية الذهب تكاد تكون عالمية، واسعاره تتقلب بناءً على ديناميات العرض والطلب. بالإضافة إلى ذلك، تؤثر عوامل خارجية مثل قوة الدولار الأمريكي وصحة الاقتصاد العالمي بشكل كبير على القيمة السوقية للذهب.

يأمل المتداولون في الذهب في الاستفادة من تقلبات الأسعار من خلال التعرض للذهب، وذلك بشراء الذهب عندما تكون الأسعار في ارتفاع وبيعه عندما تنخفض أسعار الذهب.

ما هي أنواع الذهب المختلفة التي يمكن تداولها؟

يتم تداول الذهب بعدة صيغ متنوعة، بما في ذلك العملات الذهبية، والسبائك، والمجوهرات، والشهادات الورقية للذهب. ومع ذلك، فإن أشهر صيغة للتداول هي سوق سبائك الذهب. السبائك هي القضبان التي تحتوي على ذهب نقي تقريبًا وتزن 400 أوقية تروي أو 12.40 كيلوغرام.

تُعتبر هذه السبائك "مقبولة للتسليم الجيد"، مما يعني أنها مقبولة من قبل المتداولين والبنوك في أسواق السبائك. يوجد سوق نقدي أو فوري للسبائك الذهبية، بالإضافة إلى سوق العقود الآجلة للمعدن الأصفر.

عند تداول عقود الفروقات على الذهب (CFDs)، لا يتعامل المتداولون مع الذهب المادي. بدلاً من ذلك، يتداولون في عقود نقدية غير قابلة للتسليم توفر تعرضًا اقتصاديًا لأسعار الذهب دون الحاجة إلى التعامل الفعلي مع أو تسليم سبائك الذهب. عادةً ما يتم تداول الذهب بالدولار الأمريكي للأوقية، ولكن يمكن أيضًا تسعيره بعملات أخرى.

يمكن أيضًا التداول في الصناديق المتداولة في البورصة (ETFs)، التي تتعقب سعر الذهب. تُدرج الصناديق المتداولة في البورصة في البورصات وتُتداول بنفس طريقة تداول الأسهم والأسواق.

لماذا يتم تداول الذهب؟

الذهب غالبًا ما يكون في طلب عالٍ ويمكن أن يكون سعره مقياسًا لمشاعر السوق الأوسع، وبسبب هذه العوامل وعوامل خارجية أخرى، نادرًا ما يكون سعره ثابتًا. يعني تداول الذهب أنه يمكنك الاستفادة من تحركات الأسعار الديناميكية.

كما أن تداول الذهب يسمح بتنويع المحفظة الاستثمارية إلى أصل غير مرتبط بشكل كبير بالأسهم والسندات. بالإضافة إلى ذلك، يُنظر إلى الذهب غالبًا كوسيلة للتحوط ضد التضخم ومخزن للقيمة بسبب وضعه كسلعة نادرة نسبيًا.

وفقًا لبيانات من مجلس الذهب العالمي، فقد تم إنتاج 212.50 ألف طن من الذهب فقط في تاريخ البشرية، ومعظمها منذ عام 1950.

ما هي مخاطر تداول عقود الفروقات على الذهب؟

تحمل تداول الذهب مخاطر متنوعة. على سبيل المثال، يمكن أن يكون الاتجاه ضد حركة السعر المستمرة ضارًا. كما أن الإفراط في التداول عن طريق اتخاذ مراكز كبيرة جدًا أو عديدة بالنسبة لحجم حسابك يمكن أن يكون محفوفًا بالمخاطر.

بالإضافة إلى ذلك، يمكن أن يؤدي سوء إدارة المخاطر، مثل تحديد نقاط وقف الخسارة الكبيرة بشكل مفرط أو الحفاظ على نسب مخاطرة-عائد ضعيفة، إلى خسائر كبيرة. من الضروري إدارة هذه العوامل بعناية لتقليل الخسائر المحتملة في تداول الذهب.

تتحرك أسواق الذهب غالبًا بناءً على تغييرات في مشاعر السوق، والتي يمكن أن تحدث بسرعة وبالتالي يصعب التنبؤ بها.

تعمل سوق الذهب على مستوى الجملة، حيث يشارك فيها المتداولون المحترفون والمؤسسات إلى جانب البنوك المركزية.

عقود الفروقات على الذهب هي منتجات ذات رافعة مالية، والتي تكون فعالة للغاية في تضخيم الأرباح التجارية، لكنها بنفس القدر فعالة في تضخيم الخسائر التجارية.

كيف تؤثر الأحداث الجيوسياسية على أسعار الذهب؟

يمكن أن تكون الأحداث الجيوسياسية وعدم الاستقرار الاقتصادي تأثيرًا كبيرًا على سعر الذهب. في أوقات الأزمات، يميل المستثمرون والمتداولون إلى بيع الأصول العالية المخاطر والبحث عن نقل أموالهم إلى ما يُسمى بالملاذات الآمنة، والتي يُعد الذهب أحدها. يمكن أن تدفع هذه التدفقات "التحفظية" سعر الذهب إلى الارتفاع.

كما أن ارتفاع أسعار الفائدة وعوائد السندات يمكن أن يضغط على سعر الذهب. وذلك لأن الذهب لا يوفر دخلًا، مثل الفوائد أو الأرباح. عندما ترتفع أسعار الفائدة وعوائد السندات، قد يفضل المستثمرون هذه الأصول المدرة للدخل على الذهب، مما يؤدي إلى تقليل الطلب على الذهب.

تتجه رؤوس الأموال الدولية عادة نحو الأصول التي تقدم أفضل العوائد مقابل مستوى مقبول من المخاطر. بناءً على ذلك، يواجه الذهب في كثير من الأحيان منافسة مباشرة من الأصول الآمنة ذات الفوائد مثل سندات الخزانة الأمريكية خلال فترات ارتفاع الفائدة. قد يقوم المستثمرون بنقل رؤوس أموالهم إلى هذه الأصول التي تقدم عوائد من خلال مدفوعات الفائدة، مما يؤثر سلبًا على الطلب وسعر الذهب.

كيف يمكنني دمج التحليل الاقتصادي الكلي في استراتيجيتي لتداول الذهب؟

دمج التحليل الاقتصادي الكلي في استراتيجية تداول الذهب يتطلب فهم العلاقات الرئيسية. يمكن أن تؤثر التغيرات في قيمة الدولار الأمريكي بشكل مباشر على أسعار الذهب، حيث يتأثر الدولار ببيانات اقتصادية متعددة.

تعتبر البيانات ذات التأثير العالي، مثل بيانات الرواتب غير الزراعية، وبيانات التضخم، وقرارات أسعار الفائدة من البنوك المركزية، الأكثر تأثيرًا. متابعة تقويم الاقتصاد الكلي يساعد في تحديد هذه الأحداث مسبقًا.

غالبًا ما تستجيب الأسواق للمعلومات الجديدة، ويمكن أن تؤدي الانحرافات الكبيرة عن الاتجاهات والتوقعات إلى تحركات سوق ملحوظة.

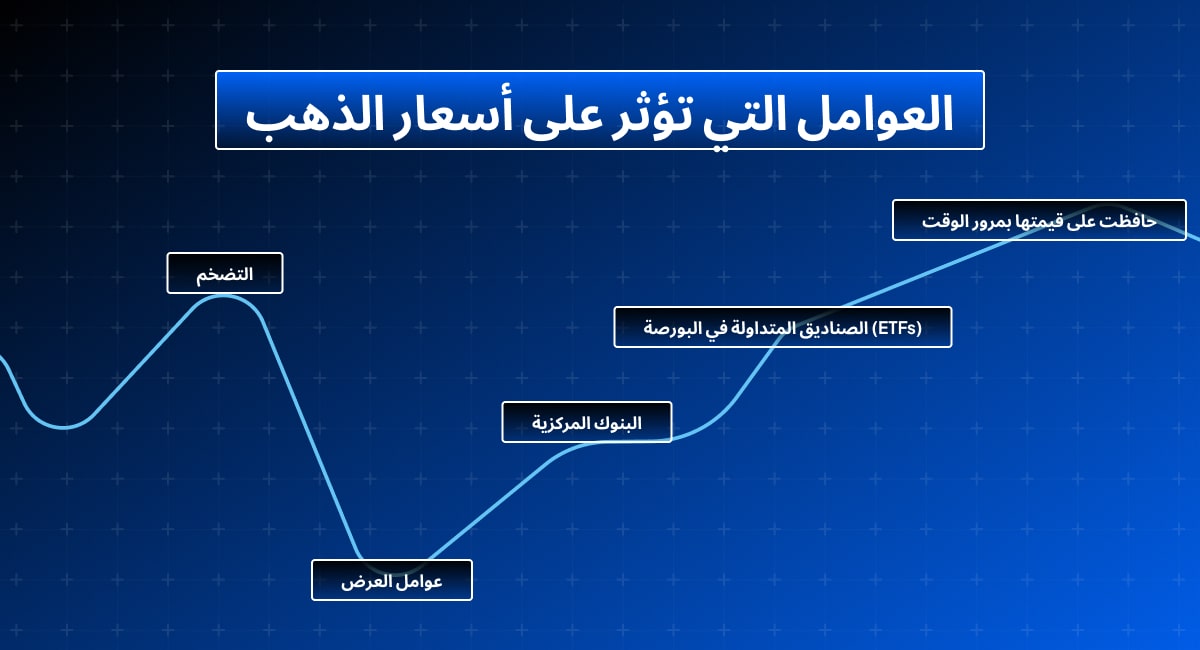

ما هي العوامل التي تؤثر على سعر الذهب؟

تتأثر أسعار الذهب بمجموعة واسعة من العوامل التي قد تشمل مشاعر السوق، إصدارات البيانات الاقتصادية، تقارير الإنتاج، إغلاق المناجم، النزاعات، والكوارث الطبيعية. ناهيك عن ديناميات العرض والطلب في سوق الذهب نفسه. ومع ذلك، فإن التغيير الأكثر أهمية واستمرارية هو التغيرات في قيمة الدولار الأمريكي.

يميل الدولار الأمريكي الأقوى إلى دفع أسعار الذهب نحو الانخفاض، بينما يتسبب الدولار الأضعف غالبًا في ارتفاع أسعار الذهب. يمكن أيضًا أن تتأثر أسعار الذهب بتقييم الذهب مقارنة بالمعادن الثمينة الأخرى والأصول الآمنة.

على سبيل المثال، بعض متداولي الذهب يراقبون عن كثب نسبة الذهب إلى الفضة، وهي سعر الذهب مقسومًا على سعر الفضة. يقوم المتداولون بمقارنة النسبة الحالية واتجاهات الأسعار مع المعايير التاريخية والأداء لتقديم توقعات حول تحركات الأسعار المستقبلية.

ما هي الطرق المختلفة لتداول الذهب؟

توجد عدة طرق لتداول الذهب:

١.الذهب المادي: يمكن شراء الذهب المادي كخيار. في حين أن السبائك ذات تسليم جيد متاحة، فإن السبائك الأصغر والأقل تكلفة والعملات الذهبية مناسبة أيضًا. ومع ذلك، يتطلب هذا النهج معالجة قضايا التخزين والأمن، حيث يتطلب الاحتفاظ بالذهب تأمينًا مناسبًا ولا يمكن تركه بدون حماية.

٢.صناديق الاستثمار المتداولة في الذهب (ETFs): بدلاً من ذلك، يمكنك تداول صناديق الاستثمار المتداولة التي تتبع سعر الذهب، مثل صندوق SPDR Gold Trust (رمز التداول GLD)، الذي يتعقب سعر الذهب من خلال الاستثمار في الذهب المادي.

٣.عقود الفروقات على الذهب (CFDs): طريقة شائعة لتداول الذهب هي من خلال عقود الفروقات على الذهب. لا تحتوي عقود الفروقات على أحجام عقود ثابتة أو تواريخ انتهاء صلاحية، ويمكن تداولها شراء أو بيع بسهولة. هذه العقود تُسوى نقديًا وغير قابلة للتسليم، ويمكن تداولها على مدار بضع دقائق أو عدة أيام، حسب استراتيجيتك والأطر الزمنية التي تستخدمها.

كيف أبدأ تداول الذهب؟

لبدء تداول عقود الفروقات على الذهب، هناك بضع خطوات بسيطة تحتاج إلى اتخاذها:

١) ستحتاج إلى فتح حساب مع وسيط عقود الفروقات مثل Pepperstone، الذي سيقدم لك خيارًا من منصات التداول والوصول إلى أسعار عقود الفروقات على الذهب.

٢) بمجرد فتح حساب التداول الخاص بك، ستحتاج إلى تمويله عن طريق إجراء إيداع.

٣) الخطوة التالية هي تنزيل منصة التداول ثم يجب عليك التعرف على كيفية عملها.

٤) يمكن للمتداولين الجدد التعرف على منصة التداول والأسواق من خلال استخدام حساب تجريبي يحاكي ظروف السوق الحية والتداول دون الحاجة إلى المخاطرة بأي أموال حقيقية.

٥) بمجرد أن تكون واثقًا من استخدام منصة التداول، ستكون جاهزًا لبدء تداول عقود الفروقات على الذهب.

٦) يتداول Pepperstone في ما يُعرف بعقود الفروقات على الذهب، وهي عقود تُسوى نقديًا وغير قابلة للتسليم. وهذا يعني أنه يمكنك التداول شراء أو بيع بسهولة متساوية، ولا داعي للقلق بشأن ملكية أو تسليم السلعة الأساسية.

ما هو الرافعة المالية وكيف تُستخدم في تداول الذهب؟

الرافعة المالية تتيح لك مضاعفة إيداعك في التداول، مما يمكنك من اتخاذ مراكز أكبر في سوق الذهب مما كان سيسمح به رصيد حسابك بشكل طبيعي.

تُطبق هذه الرافعة المالية أو التأثير من خلال التداول بالهامش، حيث يقوم الوسيط بزيادة الأموال في حسابك للتداول.

على سبيل المثال، إذا كان لديك ٥٠٠ دولار في حسابك ويقدم لك الوسيط رافعة مالية قدرها ١٠ مرات لتداول الذهب، يمكنك التحكم في مركز تصل قيمته إلى ٥٠٠٠ دولار في الذهب، وهو عشرة أضعاف قيمة رصيد حسابك البالغ ٥٠٠ دولار.

لتحقيق هذه الرافعة، يقوم الوسيط بتمويل الفرق بين الهامش الأولي أو الإيداع وقيمة التداول الاسمية.

إذا أبقيت الصفقة مفتوحة طوال الليل، ستتحمل رسوم التمويل أو الفوائد على القيمة الاسمية للتداول. ومع ذلك، لا توجد رسوم تمويل على الصفقات التي تُفتح وتُغلق في نفس يوم العمل.

يرجى ملاحظة أن معدلات الهامش أو الرافعة المالية تختلف بين المنتجات والسلطات التنظيمية.

كيف يمكنني تحليل اتجاهات سوق الذهب؟

تتأثر أسعار الذهب بعدة عوامل، العديد منها يمكن مراقبته بسهولة. تشمل المؤشرات الرئيسية:

قوة أو ضعف الدولار الأمريكي: راقب تقلبات العملات حيث يُسعر الذهب بالدولار الأمريكي.

إصدارات البيانات الاقتصادية الكبرى: انتبه إلى إصدارات البيانات الرئيسية وقارنها بالاتجاهات والتوقعات الحالية.

الطلب على الذهب وتحديد المراكز في العقود الآجلة: تتبع تقارير الالتزام بالتجار الأسبوعية التي تنشرها لجنة تداول السلع والعقود الآجلة الأمريكية (CFTC).

مجلس الذهب العالمي: استخدم الموارد والمعلومات المتاحة على موقع مجلس الذهب العالمي للحصول على رؤى حول الذهب واتجاهات السوق.

كيف يمكنني اختيار استراتيجية لتداول عقود الفروقات على الذهب؟

تتأثر استراتيجية تداول عقود الفروقات على الذهب بعدة عوامل، بما في ذلك حجم حسابك، خبرتك في التداول، أوقات اليوم التي يمكنك التداول فيها، وكمية الوقت التي يمكنك تخصيصها لمراقبة سوق الذهب.

يبدأ العديد من متداولي عقود الفروقات على الذهب باستراتيجية بسيطة، مثل شراء أو بيع الذهب بناءً على قوة أو ضعف الدولار الأمريكي أو مشاعر المخاطر الأوسع في السوق (سلوك المخاطرة/التحفظ). يمكن تعزيز هذه الاستراتيجية بنهج يتبع الاتجاهات.

على سبيل المثال، إذا كان الدولار الأمريكي يضعف وأسعار الذهب ترتفع، قد يكون شراء الذهب مناسبًا. على النقيض، إذا كان الدولار الأمريكي يقوى وأسعار الذهب تنخفض، قد يكون بيع الذهب هو الخيار الصحيح.

غالبًا ما يدمج المتداولون التحليل الفني البسيط في استراتيجيتهم لتأكيد الاتجاهات. إحدى أبسط الطرق هي تتبع التفاعل بين متوسطين متحركين بسيطين، باستخدام مزيج من المتوسطات السريعة والبطيئة. إذا تجاوز المتوسط الأقصر (الأسرع حركة) فوق المتوسط الأبطأ، فهذا يشير إلى زخم صعودي في الأسعار. على العكس، إذا عبر المتوسط الأسرع إلى أسفل المتوسط الأبطأ، فهذا يشير إلى زخم هبوطي في الأسعار.

كيف يمكنني إدارة المخاطر بشكل أفضل في تداول عقود الفروقات على الذهب؟

تتضمن إدارة مخاطر تداول عقود الفروقات على الذهب الفعالة الالتزام بعدد من المبادئ الأساسية:

١) تجنب الإفراط في التداول: يمكن أن تكون أسعار الذهب متقلبة وقد لا تتحرك دائمًا في اتجاه مواتٍ. تحديد عدد الصفقات يساعد في إدارة المخاطر.

٢) تحديد حجم المراكز بشكل صحيح: تأكد من أن حجم المركز أو عدد المراكز المفتوحة مناسب بالنسبة لحجم حساب التداول. هذا يساعد في تقليل تعرض المخاطر.

٣) اتباع الاتجاهات القائمة: غالبًا ما تكون الاتجاهات الطويلة الأمد في سوق الذهب مدفوعة بالمشاعر والنشاط المؤسسي الكبير، بما في ذلك البنوك المركزية. معارضة هذه الاتجاهات يمكن أن تكون محفوفة بالمخاطر. من الحكمة الانتظار حتى تظهر إشارات واضحة على تلاشي الاتجاه قبل النظر في اتخاذ مراكز معاكسة للاتجاه.

٤) استخدام أوامر وقف الخسارة: تنفيذ أوامر وقف الخسارة يساعد في تحديد خسائر التداول إلى مقدار محدد مسبقًا. من الضروري النظر بعناية في تحديد الموقع الأمثل لأوامر وقف الخسارة، مع مراعاة إمكانية الانزلاق السعري.

٥) مراقبة الدولار الأمريكي والبيانات الاقتصادية الكلية: تتأثر أسعار الذهب بتحركات الدولار الأمريكي وإصدارات البيانات الاقتصادية الكبرى. دراسة تقويم الاقتصاد الكلي وفهم توقعات السوق لإصدارات البيانات الرئيسية أمر أساسي لاتخاذ قرارات تداول مستنيرة.

من خلال اتباع هذه الإرشادات، يمكن للمتداولين إدارة مخاطر تداول الذهب بشكل أكثر فعالية.

كيف يمكن استخدام التحليل الفني بشكل أكثر فعالية في تداول الذهب؟

يمكن للتحليل الفني أن يشير إلى متى يضعف الاتجاه أو يتغير. يُعرف الاتجاه الصاعد بأنه سلسلة مستمرة من القمم الأعلى والقيعان الأعلى في سعر الأداة، بينما يُميز الاتجاه الهابط بسلسلة مستمرة من القمم الأدنى والقيعان الأدنى.

تحليل ما إذا كانت القمم الأعلى والقيعان الأعلى أو القمم الأدنى والقيعان الأدنى موجودة في حركة السعر يوفر رؤى حول قوة الاتجاه. يمكن لمؤشرات مثل مؤشر القوة النسبية (RSI) بفترة 14 يومًا أن تشير إلى متى يكون الذهب مبالغًا فيه أو مباعًا بشكل مفرط، مما يوحي بإمكانية حدوث انعكاس في الاتجاه.

بالإضافة إلى ذلك، يمكن أن تشير أنماط الشموع مثل "المطرقة" و"النجوم المتساقطة" إلى القمم أو القيعان في حركة السعر، مما يوفر توجيهًا إضافيًا حول اتجاه الاتجاه.

أسئلة شائعة حول تداول عقود الفروقات على الذهب

لماذا يُعتبر الذهب "أصلًا ملاذًا آمنًا"؟

يُعتبر الذهب "أصلًا ملاذًا آمنًا" نظرًا لوظيفته كعملة وأداة للحفاظ على القيمة ولجاذبيته العالمية تقريبًا.

تاريخيًا، كانت أسعار الذهب تُستخدم كمعيار لتحديد القيم النسبية للعملات في سوق الصرف الأجنبي. ولا تزال العديد من البنوك المركزية تحتفظ بكميات كبيرة من الذهب في احتياطياتها.

عرض الذهب نادر، وعلى الرغم من أنه ليس متينًا بشكل خاص، إلا أنه مقاوم لمعظم الأحماض ما عدا الأقوى منها. يُعتقد أن معظم الذهب الذي تم تعيينه في التاريخ لا يزال موجودًا حتى اليوم.

ما هو دور البنوك المركزية في سوق الذهب؟

تحتفظ البنوك المركزية بالذهب كبديل للاحتياطيات النقدية أو الورقية.

تشترى وتبيع البنوك المركزية الذهب كجزء من عملياتها المعتادة، حيث تزيد احتياطياتها عند بيع العملات وتبيع الذهب لشراء العملات أو الأصول الأخرى. ومع ذلك، فإن البنوك المركزية عادة ما تكون محافظة وتكون غالبًا حاملة طويلة الأجل للذهب.

وفقًا لمجلس الذهب العالمي، تمتلك البنوك المركزية في أوروبا حوالي 11,774 طنًا من الذهب في احتياطياتها.

ما هي عقود الفروقات على الذهب وكيف تعمل؟

عقود الفروقات على الذهب هي عقود ذات رافعة مالية تُسوى نقديًا بناءً على أسعار الذهب.

تتيح هذه العقود للمتداولين التكهن بارتفاع أو انخفاض أسعار الذهب دون الحاجة إلى امتلاك أو تسليم الأصل الأساسي، مما يسمح بأخذ مراكز طويلة وقصيرة بسهولة متساوية.

تُتداول عقود الفروقات مباشرة بين الأطراف المقابلة، وبشكل محدد بين وسيط عقود الفروقات والمتداول.

يقوم وسيط عقود الفروقات بزيادة رصيد حساب المتداول، مما يمكّن من التحكم في مركز أكبر في الذهب مما كان سيكون ممكنًا بخلاف ذلك.

ما هي المؤشرات الاقتصادية الرئيسية التي تؤثر على أسعار الذهب؟

يمكن أن تؤثر المؤشرات الاقتصادية الرئيسية من الاقتصادات الرائدة بشكل كبير على سعر الذهب.

تشمل هذه المؤشرات:

أرقام البطالة وخلق الوظائف: يمكن أن تؤدي البطالة المرتفعة إلى زيادة عدم اليقين الاقتصادي، مما يزيد الطلب على الأصول الملاذ الآمن مثل الذهب.

إحصاءات التضخم: تؤثر معدلات التضخم على القدرة الشرائية للنقود. مع ارتفاع التضخم، تنخفض عادةً قيمة العملة، مما يجعل الذهب استثمارًا أكثر جذبًا.

استطلاعات النشاط الصناعي (مثل مؤشرات مديري المشتريات أو PMIs): تقيس هذه الاستطلاعات صحة القطاع الصناعي. يمكن أن يشير انخفاض النشاط الصناعي إلى تباطؤ الاقتصاد، مما يزيد من الطلب على الذهب.

أسعار الفائدة والتغيرات في السياسات النقدية للبنوك المركزية الرائدة: تؤثر التغيرات في أسعار الفائدة من قبل البنوك المركزية على تكلفة الفرصة البديلة لحيازة الذهب. عمومًا، تجعل أسعار الفائدة المرتفعة الأصول غير ذات العائد مثل الذهب أقل جذبًا، بينما يمكن أن تؤدي الأسعار المنخفضة إلى تعزيز أسعار الذهب.

تساعد هذه المؤشرات المستثمرين في تقييم الاستقرار الاقتصادي واتخاذ قرارات مستنيرة بشأن الاستثمار في الذهب.

كيف يؤثر الدولار الأمريكي على أسعار الذهب؟

يُسعر الذهب بالدولار الأمريكي، لذا فإن تقلبات قيمة العملة الأمريكية في أسواق الصرف تؤثر مباشرة على أسعار الذهب.

عادةً ما تكون العلاقة بين الدولار الأمريكي وأسعار الذهب عكسية، ويمكن تلخيصها بالقاعدة التالية:

دولار أمريكي أقوى: عندما يقوى الدولار الأمريكي، تميل أسعار الذهب إلى الانخفاض. وذلك لأن الدولار الأقوى يجعل الذهب أكثر تكلفة بالعملات الأخرى، مما يقلل من الطلب.

دولار أمريكي أضعف: على العكس، عندما يضعف الدولار الأمريكي، غالبًا ما ترتفع أسعار الذهب. الدولار الأضعف يجعل الذهب أرخص بالعملات الأخرى، مما يزيد من الطلب على المعدن.

تتأثر هذه العلاقة العكسية بين الدولار الأمريكي وأسعار الذهب بعدد من العوامل، بما في ذلك التضخم، وأسعار الفائدة، واستقرار الاقتصاد العالمي.

هل يمكن أن يكون تداول عقود الفروقات على الذهب مربحًا؟

يمكن أن يكون تداول عقود الفروقات على الذهب مربحًا، لكن هذه الربحية تعتمد على عدة عوامل، بما في ذلك مهارة المتداول واستراتيجيته وانضباطه. فيما يلي بعض النقاط الرئيسية التي يجب أخذها في الاعتبار:

إمكانات الربح والخسارة: مثل جميع أشكال التداول، يقدم تداول عقود الفروقات على الذهب إمكانية تحقيق أرباح كبيرة. ومع ذلك، فإنه ينطوي أيضًا على مخاطر كبيرة، ويمكن أن تحدث الخسائر بسرعة مثل المكاسب.

أهمية الانضباط: يتطلب النجاح في تداول عقود الفروقات على الذهب اتباع نهج منضبط. يحتاج المتداولون إلى اتباع استراتيجية محددة بوضوح والالتزام بمبادئ إدارة المخاطر. يمكن أن يؤدي التداول العاطفي، أو الإفراط في التداول، أو تجاهل قواعد إدارة المخاطر إلى استنزاف رصيد حساب التداول بسرعة.

دور الرافعة المالية: تعتبر الرافعة المالية أداة قوية في تداول عقود الفروقات على الذهب، حيث تتيح للمتداولين التحكم في مراكز أكبر بمقدار أقل من رأس المال. بينما يمكن أن تضخم الرافعة المالية الأرباح، فإنها يمكن أن تضخم الخسائر بنفس القدر. لذلك، يجب استخدامها بشكل مناسب ومع فهم كامل للمخاطر المتضمنة.

إدارة المخاطر: إدارة المخاطر الفعالة أمر حاسم. يشمل ذلك تحديد أوامر وقف الخسارة لتقييد الخسائر المحتملة، والحفاظ على أحجام المراكز المناسبة بالنسبة لرصيد الحساب، وتجنب التداول ضد الاتجاهات طويلة الأمد في السوق.

يمكن أن يكون تداول عقود الفروقات على الذهب مربحًا، لكنه يتطلب نهجًا منضبطًا، وإدارة مخاطر قوية، وفهمًا شاملاً للرافعة المالية. يجب على المتداولين أن يكونوا على دراية بإمكانات المكاسب الكبيرة والخسائر الكبيرة. إدارة هذه المخاطر بشكل صحيح أمر أساسي لتحقيق النجاح على المدى الطويل في سوق الذهب.

المادة المقدمة هنا لم تُعد وفقًا للمتطلبات القانونية المصممة لتعزيز استقلالية البحث الاستثماري، وبالتالي تُعتبر بمثابة مادة تسويقية. على الرغم من أنها غير خاضعة لأي حظر على التعامل قبل نشر البحث الاستثماري، إلا أننا لن نسعى للاستفادة منها قبل تقديمها لعملائنا.

لا تمثل Pepperstone أن المادة المقدمة هنا دقيقة أو محدثة أو كاملة، ولذلك لا ينبغي الاعتماد عليها على هذا الأساس. المعلومات، سواء كانت من طرف ثالث أو غيره، لا يُعتبر أنها توصية؛ أو عرض لشراء أو بيع؛ أو دعوة لتقديم عرض لشراء أو بيع أي ورقة مالية، منتج مالي أو أداة؛ أو للمشاركة في أي استراتيجية تداول معينة. كما أنها لا تأخذ في الاعتبار الوضع المالي للقراء أو أهدافهم الاستثمارية. ننصح أي قراء لهذه المحتويات بالبحث عن مشورتهم الخاصة. بدون موافقة Pepperstone، لا يُسمح بإعادة إنتاج أو توزيع هذه المعلومات.