CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren.72.6% der Kleinanlegerkonten verlieren Geld beim CFD-Handel mit diesem Anbieter. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

Trader talk - the stage is set for the Fed to start a taper process

The stage is in place for the Fed to start the process towards cutting its own pace from $80b a month of US Treasury purchases. This should start tomorrow (the FOMC meeting starts at 4:00am AEST), with the Fed altering its statement to acknowledge the improvement in economics, but shying away from hinting too intently that they’re seeing the “substantial progress” in economics needed to start the tapering process sooner.

Joe Biden is also expected to speak, although there is no set time. Biden should offer more colour around his “American Families Plan” – the full size of the fiscal package will likely garner the reaction in markets, while we should get additional headlines on personal taxes, which should frame our understanding of the prospect of passing the Senate.

If I look at overnight implied volatility in FX pairs like USDJPY (now 6.2%) it sits at the bottom percentile of the 12-month range, but I’d expect this to gravitate higher into the London trade – either way, for risk management purposes the market is not seeing the FOMC meeting as a vol event, but more of a stage setter for a markedly different statement in June. I expect markets to wear a far higher volatility into and around this period.

Near-term though, do not underestimate the resolve of the Fed. The US data is improving, we’ve seen that in the PMI series, last month’s payrolls, retail sales and consumer confidence smashed expectations at 121.7. We look for a May NFP print potentially north of 1m jobs and that should take the broad unemployment rate to 7.3% and closer towards the Fed’s target of 4%. Clearly progress is being made, but there's far more to be done and the Fed will hold off from reducing accommodation as long as possible.

Inflation expectations are making a renewed push again, with 10-yr breakeven rates breaking out to 2.40% and we’ve all seen the moves in commodities.

(5yr UST)

(Source: Tradingview)

Bond markets have responded into the FOMC, with all parts of the Treasury curve moving +5bp higher on the day. The 5yr Treasury fascinates (see above), as we see this has seen a sharp move up from 77bp into 88bp in the past few days, with Eurodollar rates markets pricing in a few more basis points of hikes by 2023. Technically, the set-up suggests a further push higher in yield and this may weigh again on the NAS100, with Microsoft – the second biggest stock by market cap – doing a good job of acting as a headwind (-2.7% in post-market), with the focus on Azure which has disappointed relative to incredibly lofty expectations.

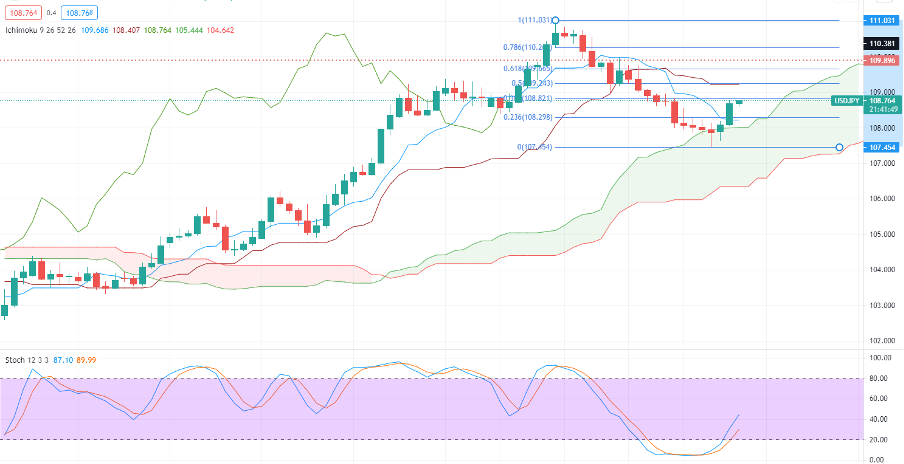

I've been looking for a turnaround in US Treasuries and that is playing out – US financials are in a solid uptrend, and we’ll likely see Macquarie (MQG) breaking to new highs in Australia today. The USD has found a better bid, with USDJPY the natural beneficiary. The USDX has seen indecision in the price action, a reflection that traders still see near-term attractions of the EUR, but USDJPY is the proxy of US rates and is moving in close correlation. A break of 108.21 (the 38.2% Fibo) takes the pair into 109.22.

(Source: Tradingview)

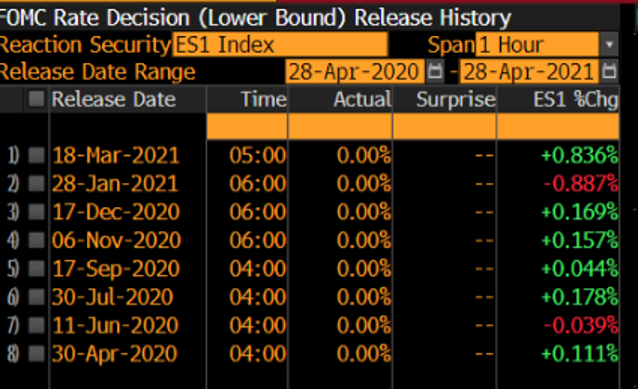

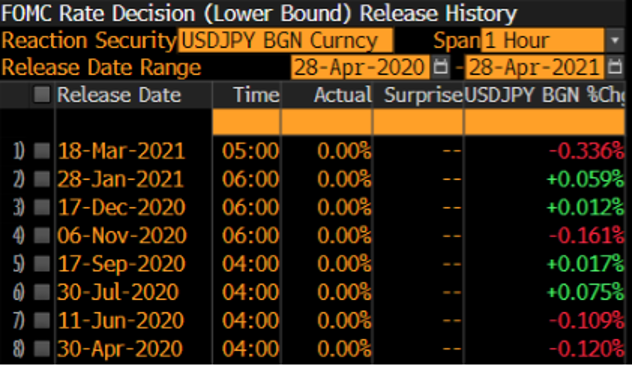

Will the FOMC meeting be the catalyst? Let’s look at the pedigree in the hour after the statement drops.

S&P 500 futures – the equity market typically likes what they hear from Powell.

(Source: Bloomberg)

USDJPY – No clear pedigree – a mixed reaction.

(Source: Bloomberg)

Gold has typically reacted positively to the Fed narrative.

(Source: Bloomberg)

Related articles

Bereit zu traden?

Es ist einfach, ein Pepperstone-Konto zu eröffnen. Stellen Sie Ihren Antrag innerhalb von Minuten, auch mit einer geringen Einzahlung. Beginnen Sie Ihre Reise mit Pepperstone noch heute.

Bei diesem Artikel handelt es sich um eine Werbemitteilung. Diese Information wurde von Pepperstone GmbH bereitgestellt. CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. Zwischen 74 % und 89 % der Kleinanlegerkonten verlieren beim Handel mit CFD Geld. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren. Zusätzlich zum untenstehenden Haftungsausschluss enthält das auf dieser Seite enthaltene Informationsmaterial weder eine Auflistung unserer Handelspreise noch ein Angebot oder eine Aufforderung zu einer Transaktion in ein Finanzinstrument. Pepperstone übernimmt keine Verantwortung für die Verwendung dieser Kommentare und die daraus resultierenden Folgen. Es wird keine Zusicherung oder Gewähr für die Richtigkeit oder Vollständigkeit dieser Informationen gegeben. Folglich trägt der Anleger alleinverantwortlich das Risiko für einzelne Anlageentscheidungen. Jede angebotene Studie berücksichtigt nicht das Investment spezifischer Ziele, die finanzielle Situation und die Bedürfnisse einer bestimmten Person, die sie empfangen kann. Sie wurde nicht in Übereinstimmung mit den gesetzlichen Vorschriften zur Erstellung von Finanzanalysen erstellt und gilt daher als Werbemitteilung im Sinne des Wertpapierhandelsgesetzes (WpHG).