- English

- عربي

August 2025 BoE Review: A Farce On Threadneedle Street

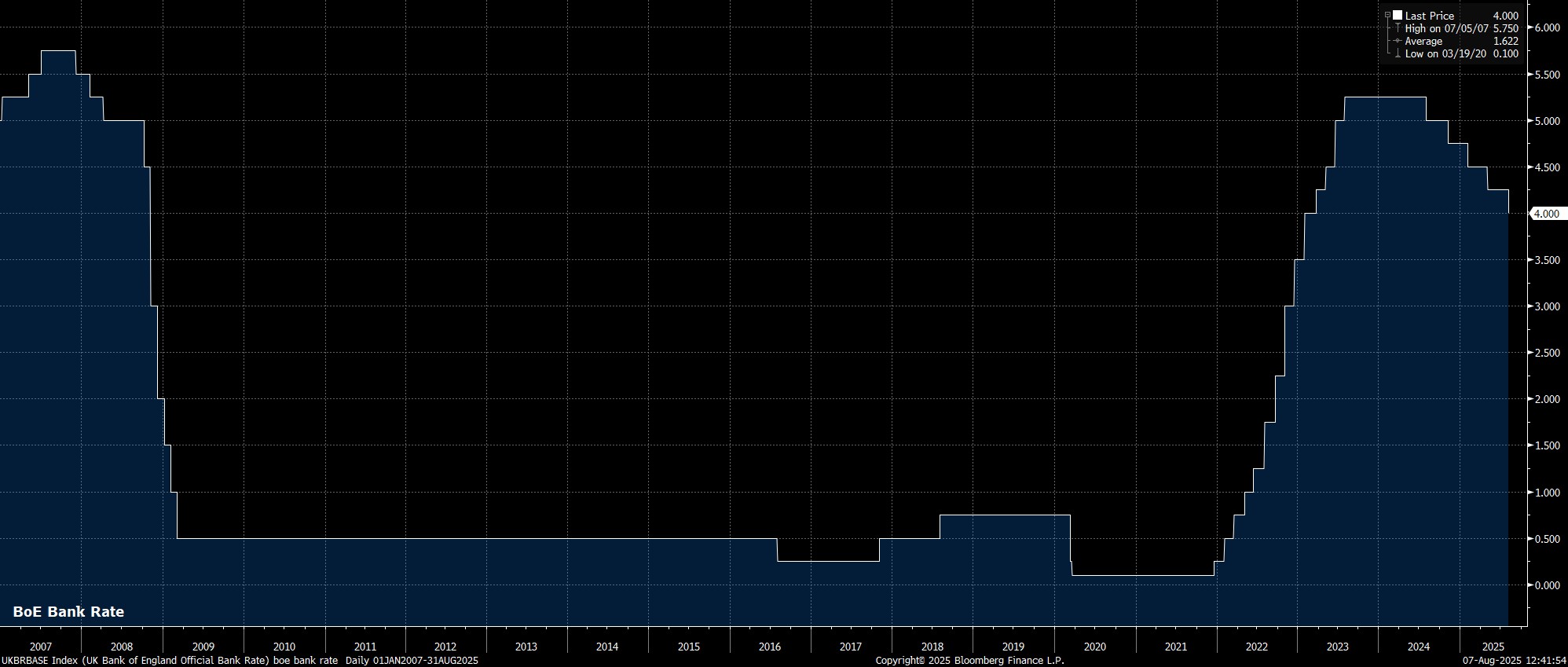

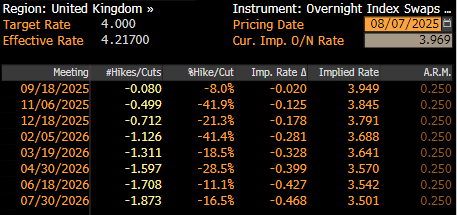

As expected, and as had been fully discounted by money markets, the Bank of England’s Monetary Policy Committee delivered a 25bp cut at the conclusion of the August meeting, lowering Bank Rate to 4.00%. Such a move marks the third rate reduction of 2025, and the fifth of this cycle, as the ‘Old Lady’ continues to slowly but surely remove policy restriction.

Accompanying that decision was the MPC’s updated policy statement. Here, although policymakers again stressed that a ‘gradual and careful’ approach to future policy easing remains appropriate, reference to policy needing to remain ‘restrictive for sufficiently long’ was removed, a notable dovish shift, and potentially also a nod towards the MPC believing that Bank Rate has already reached something akin to its neutral level.

Besides that shift, the MPC’s vote split was also in focus. Once again, this revealed bitter divisions among policymakers over not just whether a cut should be delivered at this meeting, but also as to the appropriate magnitude of such a rate reduction. In fact, those divisions were so bitter that the MPC, for the first time since inception, was forced to vote twice on the proposition that the Governor put forward, and almost ended up holding rates unchanged!

Initially, four members preferred holding Bank Rate steady, four preferred a 25bp cut, and one (external member Taylor) preferred a 50bp move. However, on a second vote, in order to avoid rates being left on hold, Taylor switched his vote to a 25bp cut, thus making the overall vote split an uber-tight 5-4 in favour of a 25bp cut.

Meanwhile, with it being ‘Super Thursday’, the Bank also released their latest Monetary Policy Report, including an updated slate of UK economic forecasts.

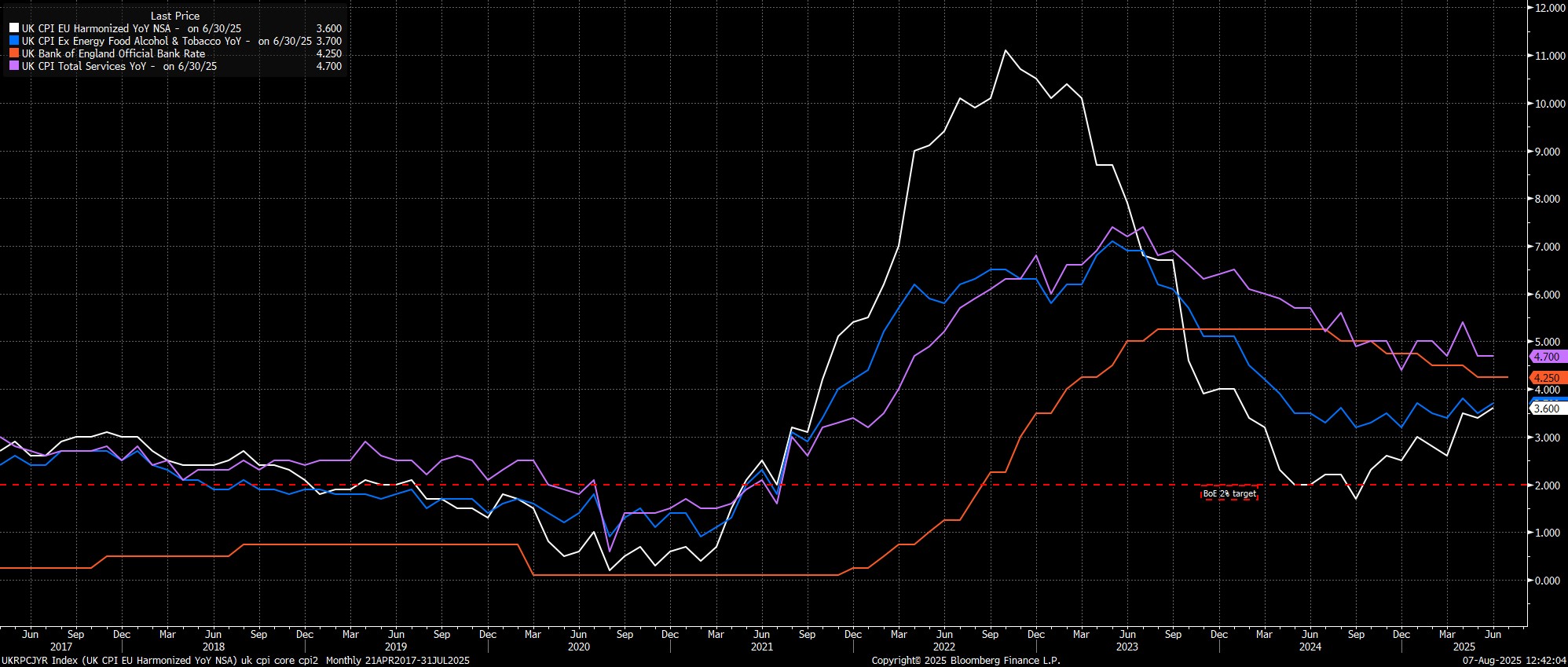

On inflation, the projections now see headline inflation peaking at 4% this quarter, up from the prior forecast of 3.7%. Price pressures, though, are then expected to continue to fade, with inflation seen returning back to the 2% target in early-2027.

As for the GDP growth outlook, the Bank actually raised their short-term growth expectations, now pencilling in growth of 1.2% this year, and 1.3% next year. Both of these figures seem rather hopeful, given mounting downside risks facing the UK economy.

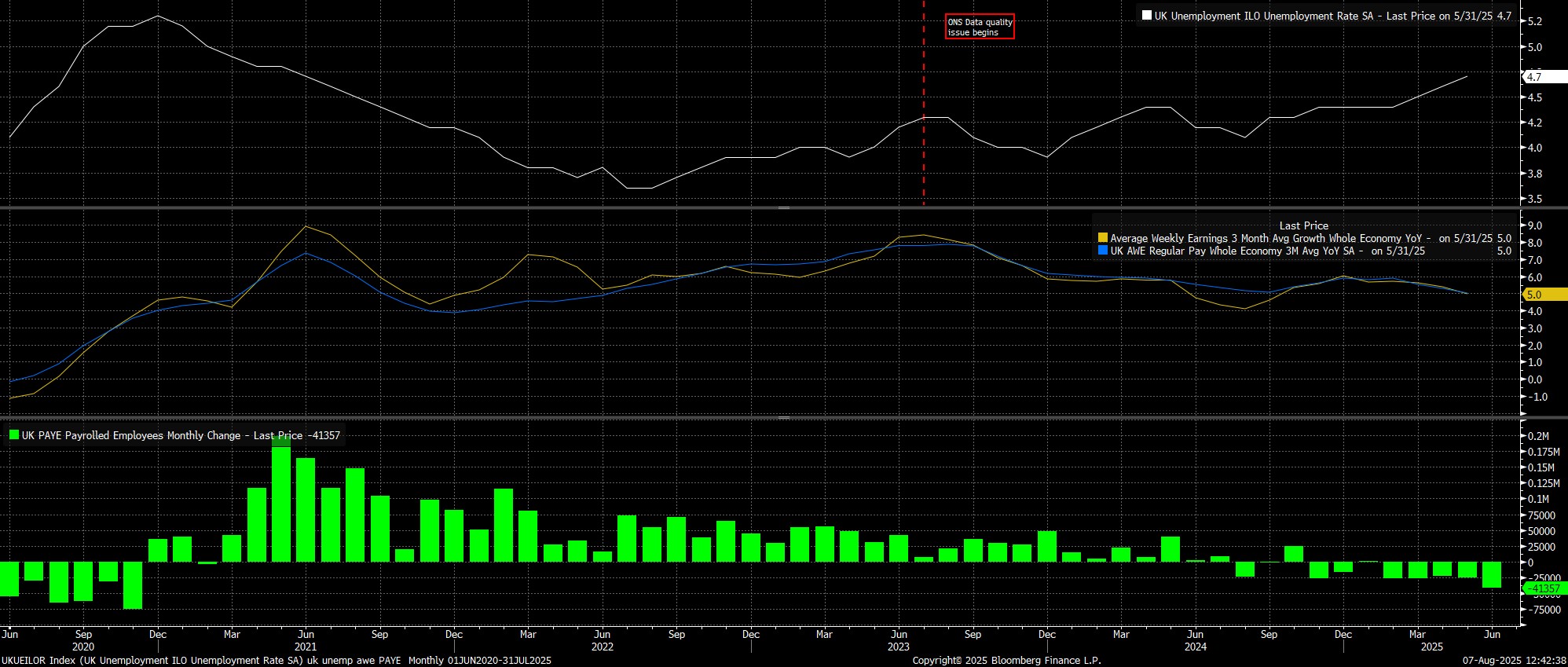

Finally, on the labour market, things are also rather perplexing, with the forecasts actually seeing a lower peak in unemployment – 4.9% vs. 5.0% prior – despite the economy having shed jobs for 8 months running.

After all that, focus turned to Governor Bailey’s post-meeting press conference. Here, Bailey reiterated that a ‘gradual and careful’ approach remains appropriate, while also flagging additional upside inflation risks, and more downside activity risks, than had previously been foreseen. In any case, Bailey again noted that the direction of travel for rates remains downwards, and that policy is still restrictive in nature.

Where does all that shake out?

Firstly, we have a hawkish vote split, accompanied by a dovish policy statement, and a hawkish set of economic forecasts. All about as clear as mud.

Secondly, cutting through some of the noise, we clearly now have a higher bar for further rate cuts, especially with Dep Gov Lombardelli & Chief Economist Pill having been in the hawkish dissent camp yesterday.

That said, the direction of travel for rates clearly remains a downwards one, while the ‘gradual and careful’ guidance implies a continuation of the present quarterly easing pace, and I remain of the view that a 25bp cut will probably be delivered in November, it’s clear that the MPC’s numerous hawks will take plenty of convincing that further loosening is indeed required.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.