- English

- عربي

Cautious Tone as Prices Turn Choppy, All Eyes on U.S.-China Talks

.jpg)

After a sharp 5.3% drop last Tuesday, gold found support around $4,000 and entered a consolidation phase. Softening US inflation and market bets on two more rate cuts before year-end have capped further declines, while positive signals from US-China trade talks have weighed on safe-haven demand, limiting gold’s upside.

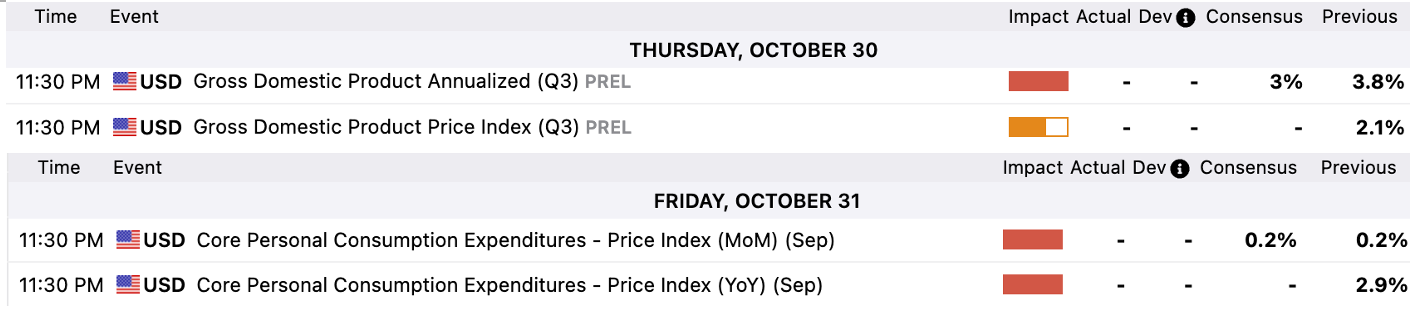

Looking ahead, the FOMC decision, U.S. Q3 GDP and core PCE data, along with the highly anticipated meeting between Trump and Xi, will be key risk events for gold prices this week.

Technical Observation: Tug-of-War Between Bulls and Bears, Awaiting Direction

On the XAUUSD daily chart, gold snapped its nine-week winning streak last week, with heavy profit-taking on Tuesday contributing to a weekly decline of over 3%, though the retreat found support near $4,000.

Since then, bulls and bears have been evenly matched, with long upper and lower wicks reflecting a tug-of-war and no clear directional bias. Near-term upside remains capped by the 5-day EMA, while support comes from the lower boundary of the late-August ascending channel, around the 20-day MA.

If buying pressure strengthens and gold closes back above $4,100, the consolidation high at $4,150 since last Wednesday would be the next resistance level before challenging $4,200.

Conversely, if prices continue to retreat, support at the late-August channel bottom and the $4,000 round number will be key. A breach of these levels could push gold toward the 61.8% Fibonacci retracement of the recent rally, around $3,980.

Mixed Signals: Long-Term Support Holds, Short-Term Pressure Remains

Despite ongoing US government shutdown risks, elevated fiscal deficits, and persistent geopolitical tensions providing a supportive backdrop, gold’s latest boost comes from September US inflation data. Last Friday, core CPI rose 3.0% YoY, below the 3.1% forecast, while core services inflation fell to a cycle low of 3.5%. This cooling trend reinforces market expectations for two more rate cuts this year, supporting non-yielding assets like gold.

At the same time, US-China trade talks in Kuala Lumpur have eased risk sentiment. Bessent confirmed that a “successful framework for leaders” was reached, broadly matching market expectations: China may moderately ease rare earth export controls, while the Trump administration could extend the 90-day tariff pause and withdraw the threat of a 100% additional tariff.

This development lifted sentiment, prompting safe-haven flows to exit gold and shift into risk assets. CME’s recent 5.2% increase in gold and silver margins has further restrained short-term buying momentum.

Overall, after dropping from the all-time high of $4,381, gold found temporary support around $4,000 and entered a consolidation phase. While technical profit-taking and easing trade tensions caused short-term volatility, the key drivers for gold’s medium- to long-term outlook—Fed rate cut expectations, central bank purchases, and geopolitical safe-haven demand—remain intact.

In my view, near-term upside appears constrained, with gold likely to trade within a neutral to slightly bearish range this week, depending on risk sentiment and key economic developments.

Focus on US Risk Events and US-China Talks

This week features a dense schedule of central bank meetings and key economic data. For gold, the Fed meeting, Powell’s speech, Q3 US GDP, and September core PCE data are the main highlights.

With an October rate cut largely priced in, attention will focus on Powell’s tone and forward guidance. If he acknowledges the cooling inflation and signals a potential end to balance sheet runoff in the coming months again, expectations for a 25bp cut in December would be reinforced, supporting gold. Conversely, if he emphasizes that tariff effects are still working through the economy and uncertainty remains in policy direction, gold may face pressure.

Although GDP and PCE data will be released after the Fed meeting, traders should still watch closely. The consensus is for Q3 US GDP annualized growth to slow to 3.0% (from 3.8%), while September core PCE is expected to remain at 2.9% YoY. Data confirming slowing growth and moderate inflation would further reinforce rate cut expectations, supporting gold.

Beyond short-term data-driven swings, the US-China leaders’ meeting at the APEC summit could be a key catalyst for gold’s next move. With positive signals already sent from the Kuala Lumpur talks, markets expect the meeting to focus on confirming concession details. As long as both sides avoid escalating tensions, any level of concession will reduce safe-haven demand, posing a short-term headwind for gold.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.