- English

- عربي

Fed on course for further cuts as labour market stagnates

Summary

- Labour market stalls: Private data show minimal change in US employment conditions amid the ongoing government shutdown, with slow hiring and limited firing.

- Payrolls near a floor: Leading indicators such as NFIB hiring intentions suggest payrolls growth may be bottoming out as the economy adjusts to prior trade shocks.

- Unemployment steady: Private-sector models point to a stable unemployment rate around 4.3%, despite temporary distortions from furloughed federal workers.

- Wage growth contained: The Atlanta Fed and Indeed data both show subdued earnings growth, reducing inflationary risks from the labour market.

- Fed outlook: With inflation easing and labour conditions soft, the FOMC remains on track for further rate cuts, potentially lowering the policy rate to around 3% as both rate and balance sheet policy turn supportive.

Has payrolls growth finally started to stabilise?

Of course, it is the headline nonfarm payrolls metric that typically ‘steals the show’ when the jobs report is released, even if there are numerous issues with simply taking that figure at face value.

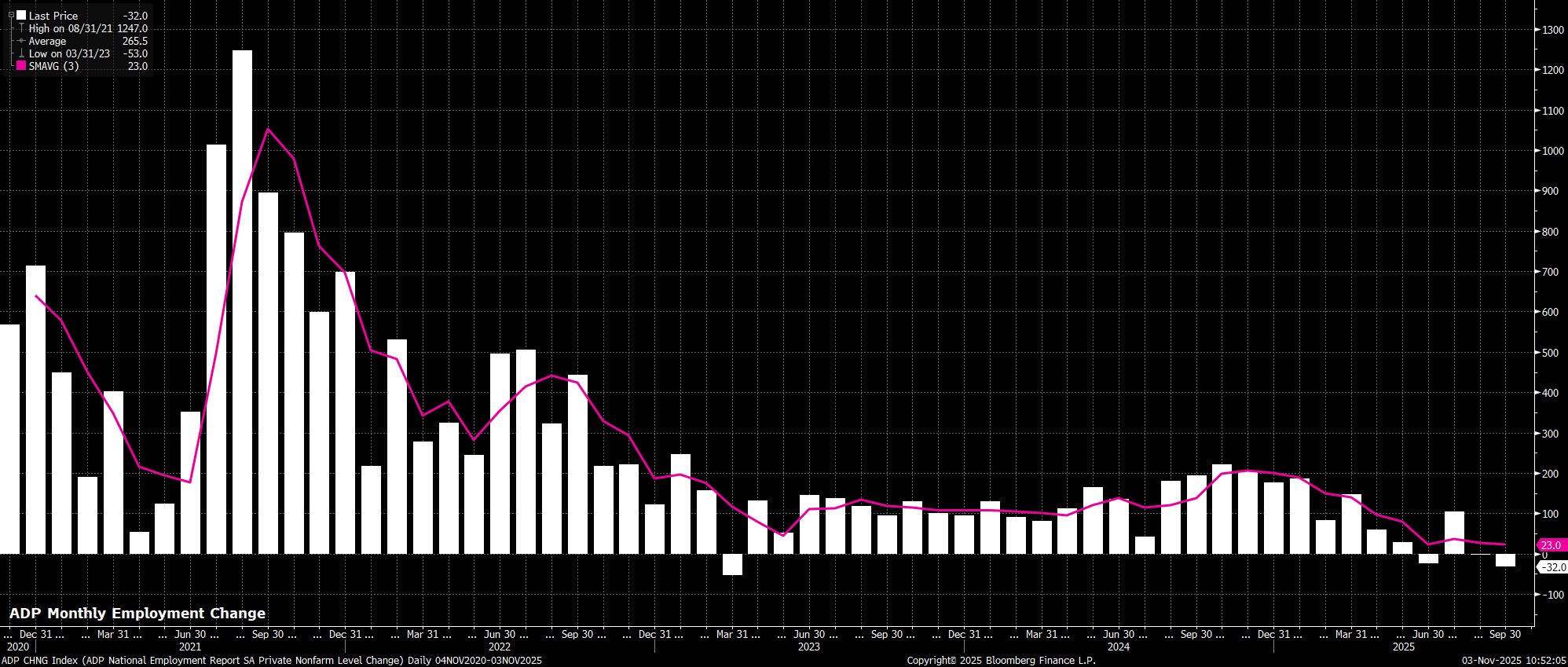

In any case, alternative data can help provide something of a steer as to how overall employment has evolved. September’s ADP employment report pointed to private sector jobs having fallen by 32k in the month, though this figure was skewed lower by a significant downward revision owing to the ADP conducting a re-benchmarking exercise based on the 2024 QCEW results. Removing this revision would’ve pointed to employment having risen by +11k on the month, while a new weekly payrolls index that ADP have begun to calculate pointed to employment having risen by +14k in the week to 10th October, the most recent period for which data is available.

Quite clearly, both of these figures point to labour market conditions having remained broadly unchanged from those on display upon release of the last BLS jobs report, with payrolls growth remaining very anaemic indeed. However, with the breakeven rate potentially now being as low as zero, such a sluggish pace of jobs growth should perhaps not be too surprising.

Have leading indicators found a floor for payrolls growth?

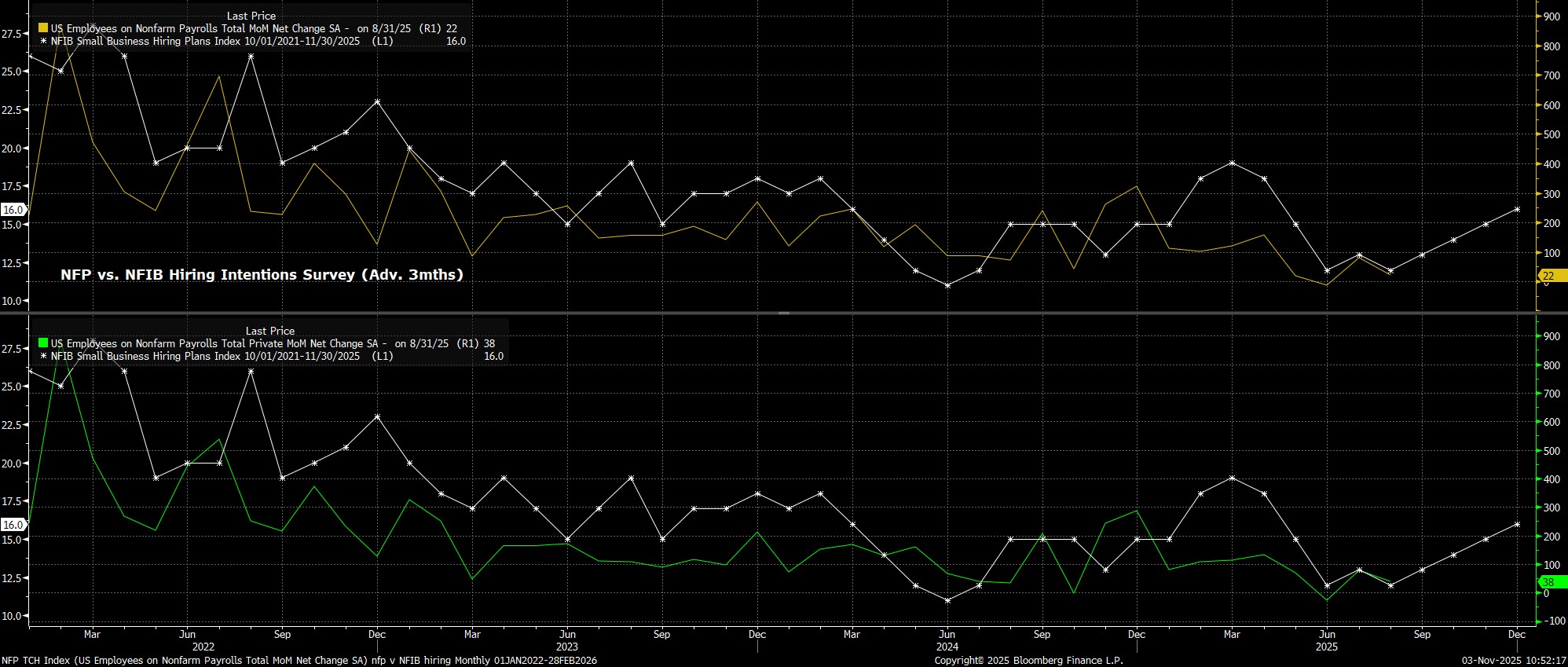

That said, while jobs growth appears to have remained anaemic over the last few weeks, there are increasing signs that things may well be starting to bottom out.

The NFIB hiring intentions survey has been a reliable leading indicator for payrolls growth for much of the cycle, typically leading payrolls growth by around three months, with the latest data supporting the idea that employment growth may be nearing a nadir, as the economy completes its adjustment to the tariff-related shock that was delivered on ‘Liberation Day’ in April, and in subsequent months. This also further supports my base case which remains that there is little by way of significant underlying structural issues with the US labour market, with employment conditions instead set to improve, and the economy at large likely to re-accelerate, as we move into 2026.

Are there mixed signals emerging on unemployment?

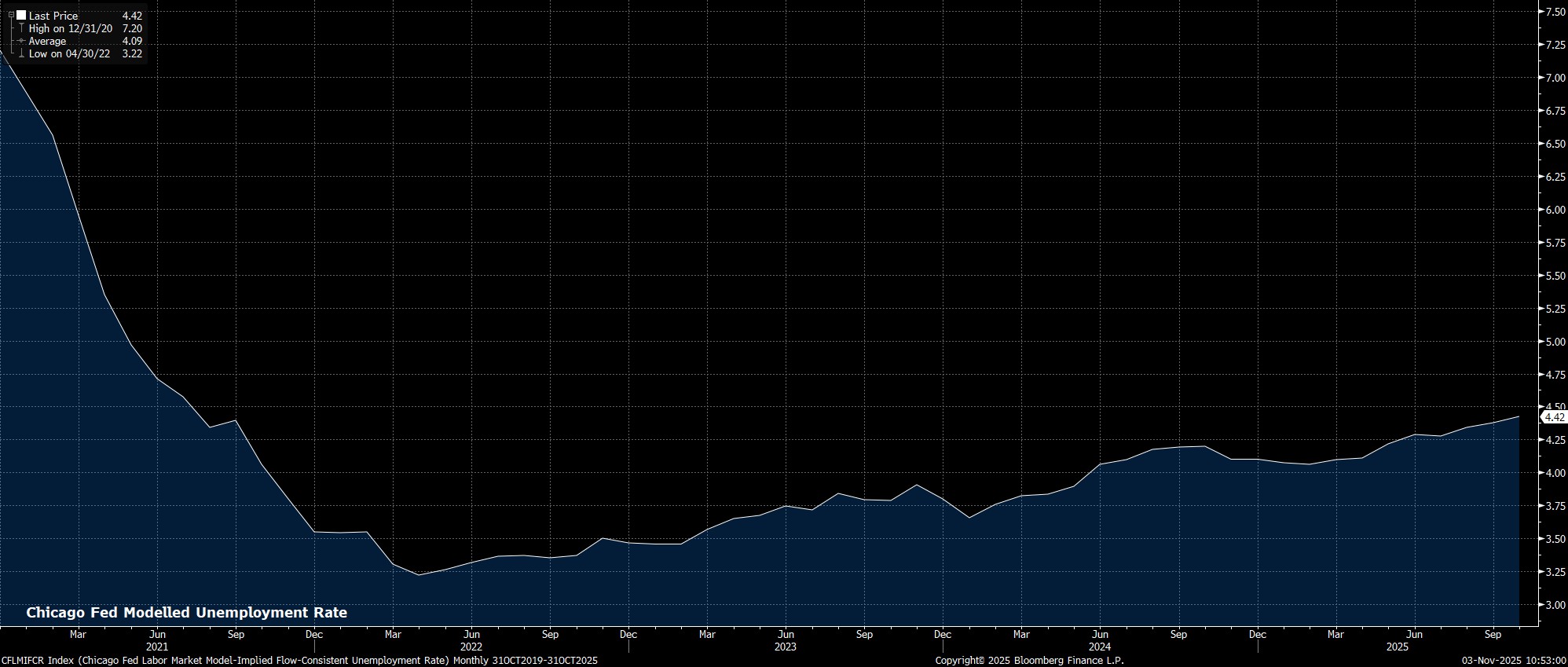

While it is, relatively, straightforward to model employment, proxying the unemployment rate is notably more difficult at the current juncture. This, primarily, stems from the classification of government workers who have been temporarily furloughed as a result of the ongoing shutdown, and who should technically be classed as unemployed as a result.

Before accounting for any other job losses since the last BLS jobs report in August, the roughly 700k government workers who have been placed on furlough would be enough to push the unemployment rate to around 4.8%, though this surge would, almost entirely, be unwound upon the resumption of normal federal funding.

Meanwhile, the Chicago Fed’s unemployment rate model, a composite of several different private sector metrics, pointed to unemployment most likely having held largely steady at 4.35% last month. Given the unavailability of government data inputs to the model, one can reasonably assume this forecast to suggest that there has been little change in private sector unemployment since the last official jobs report.

Have earnings pressures remained contained?

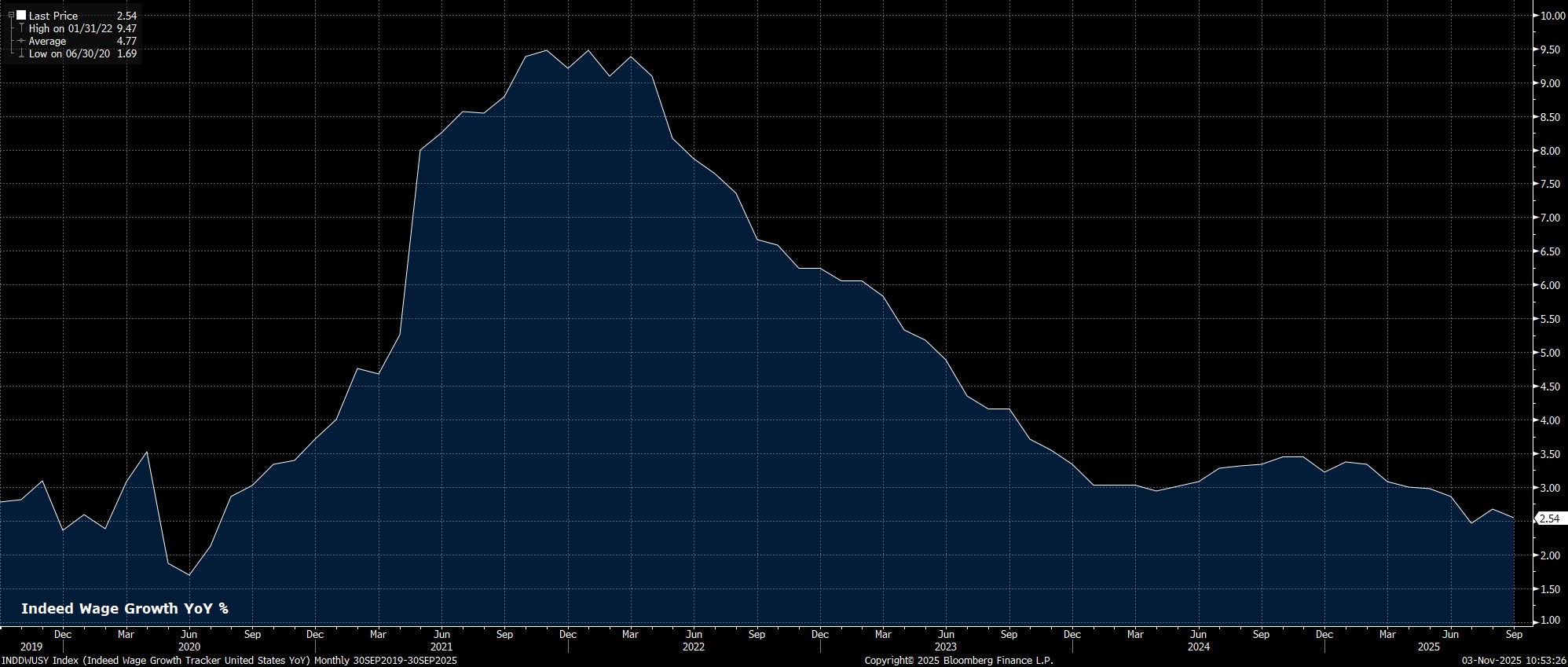

The labour market hasn’t been a significant source of upside inflation risk for some considerable time now, with the latest private data continuing to bear that out.

The Atlanta Fed’s monthly wage growth tracker pointed to earnings pressures having remained largely contained in September, at 4.2% YoY, with the bulk of this earnings growth once more coming from higher income groups, with pay growth among those in the lowest quartile continuing to stall.

On a more timely note, recruitment platform Indeed’s metric of earnings growth reinforces the idea that pay pressures remain largely contained. According to this measure, earnings rose 2.54% YoY in September, a mere rounding error away from printing fresh cycle lows.

What’s the overall message from the labour market data?

On the whole, private sector metrics point, by and large, to employment conditions in the US having changed little over the last six weeks or so, despite any prevailing uncertainty that may stem from the ongoing government shutdown.

Overall, the employment backdrop remains one of very slow hiring, but also very slow firing, with a degree of labour hoarding continuing to take place, as companies remain somewhat scarred by prior skills shortages, and difficulties in re-hiring workers when required. Consequently, this remains a labour market that continues to stall, for the time being, as opposed to one that is falling off a proverbial cliff, though also one where leading indicators point to a possible re-acceleration in the short-term, provided that no further downside trade shocks are to emerge.

Is the FOMC preparing to deliver another rate cut?

Taking into account the above-mentioned labour market backdrop, there is little to suggest that the Fed will be deterred from delivering another rate reduction before year-end, not least considering that the FOMC’s reaction now leans heavily, if not entirely, towards supporting the labour market. Further supporting this base case of another 25bp cut in December, is not only softer than expected recent inflation figures, with core CPI having risen 3.0% YoY in September, but also signs that the effects of tariff-induced price hikes may be coming to an end, after core goods prices held steady at 1.5% YoY last time out.

This rate outlook, regardless of whether or not a December cut is delivered, can be summarised as one that will see the FOMC return to a more neutral level, around 3%, in the relatively near future. Importantly, this neutral rate level will be accompanied by a balance sheet that’s set to bottom-out at a neutral level of around 20% of GDP, meaning that, for the first time in over a year, the FOMC’s two primary policy levers will now be working in tandem, with risks also tilting in a more dovish direction, thus creating a powerful ‘put’ structure to backstop the economy, and risk appetite, moving forwards.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.