- English

- عربي

Over the past week, gold has seen alternating bullish and bearish pressure, maintaining a high-level range. Moderately soft U.S. inflation data, confirmation of a September Fed rate cut, and persistent geopolitical tensions have supported the bulls. However, since April, rate cut expectations have largely been priced in, limiting further upside.

This week, U.S. retail sales data and the FOMC meeting are the clear focus, with their outcomes and guidance likely determining whether gold can restart a trend move.

Looking at the XAUUSD daily chart, since gold peaked at $3,674, bulls and bears have been in a tug-of-war. In the absence of a clear single-sided trend, prices have mainly consolidated between $3,610 and $3,675.

If bulls return after the Fed’s rate decision and break above the $3,650 resistance, potentially reaching a new all-time high, it could signal the start of a fresh upward trend. Conversely, if bears dominate and push prices lower, attention should focus on the $3,600 level. A break below this key support would confirm a bearish trend, possibly driving prices toward $3,450.

Rate Cut Expectations and Geopolitical Risks Support Bulls

Gold’s recent high-level consolidation is driven by multiple positive factors: weak U.S. employment, moderate inflation, strengthening market expectations of a rate cut, and geopolitical risks acting as a catalyst.

On the data front, over the past year through March 2025, U.S. nonfarm payrolls were revised down by 911,000, highlighting labor market weakness. This further underpins traders’ demand for gold as a hedge against economic downturns.

Meanwhile, although August U.S. CPI recorded its largest month-on-month gain in seven months, with annual growth rising from 2.7% in July to 2.9%, the results broadly matched market expectations.

The more notable development was the unexpected decline in PPI, largely due to a slowdown in services. This reflects companies facing cost pressures from tariffs while contending with weak demand. Some firms absorbed costs internally rather than passing them fully to consumers, tempering inflationary pressure.

These data reinforce expectations that the Fed will resume rate cuts this week. A 25bp cut is almost fully priced in, with three cuts for the year largely anticipated. Against this backdrop, the 10-year U.S. Treasury yield briefly fell below 4%, marking a five-month low. For a non-yielding asset like gold, this is a clear positive.

Geopolitical tensions have also attracted buying interest. Poland shooting down the drone sparked concerns that NATO might be drawn more directly into the Russia-Ukraine conflict. Meanwhile, Trump’s threats of sanctions on Russian energy and banks, combined with potential escalation in the Middle East, could quickly boost risk-aversion flows into gold.

Watch for Exhaustion of Upside Momentum

Yet gold remains range-bound at high levels, indicating continued resistance. Inflation data is mixed: while the PPI decline supports rate-cut expectations, the CPI rise and the University of Michigan survey showing higher long-term inflation expectations highlight sticky inflation, making post-September policy paths uncertain.

At the same time, the market is taking profits on priced-in rate cuts, and easing concerns over Fed independence provide temporary dollar support, all limiting further gains.

Overall, gold is in a consolidation pattern. Rate-cut expectations and rising geopolitical tensions favor gold, but uncertainty over future rates and a lack of fresh market catalysts cap upside. In my view, gold is likely to maintain a high-level range with a bullish bias in the near term, though technical pullbacks remain a risk.

Focus on US Retail Sales and the FOMC Meeting

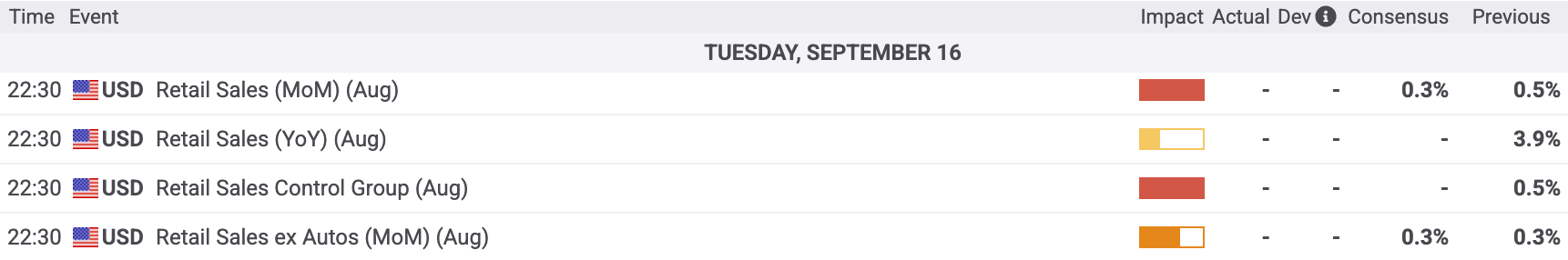

For the remainder of this week, Tuesday’s U.S. retail sales and Wednesday’s FOMC meeting warrant close attention.

Market expectations for August retail sales are for a modest slowdown from 0.5% to 0.3% month-on-month. If results, particularly the control group, fall short, it could reinforce expectations for further easing this year, depressing Treasury yields and the dollar while supporting gold.

Regarding the Fed meeting, a 25bp cut is widely expected. Traders will closely watch the statement wording, dot plot updates, and Powell’s press conference guidance. If the dot plot suggests a more aggressive future rate cut path, or more officials back a 50bp cut at once, it could boost bullish sentiment and increase the chances of gold breaking above the current consolidation range. Conversely, if the statement emphasizes sticky inflation or slower easing, the dollar and Treasury yields could rebound, weighing on gold.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)