- English

- عربي

July 2025 UK Jobs Report: Tentative Signs Of Stability

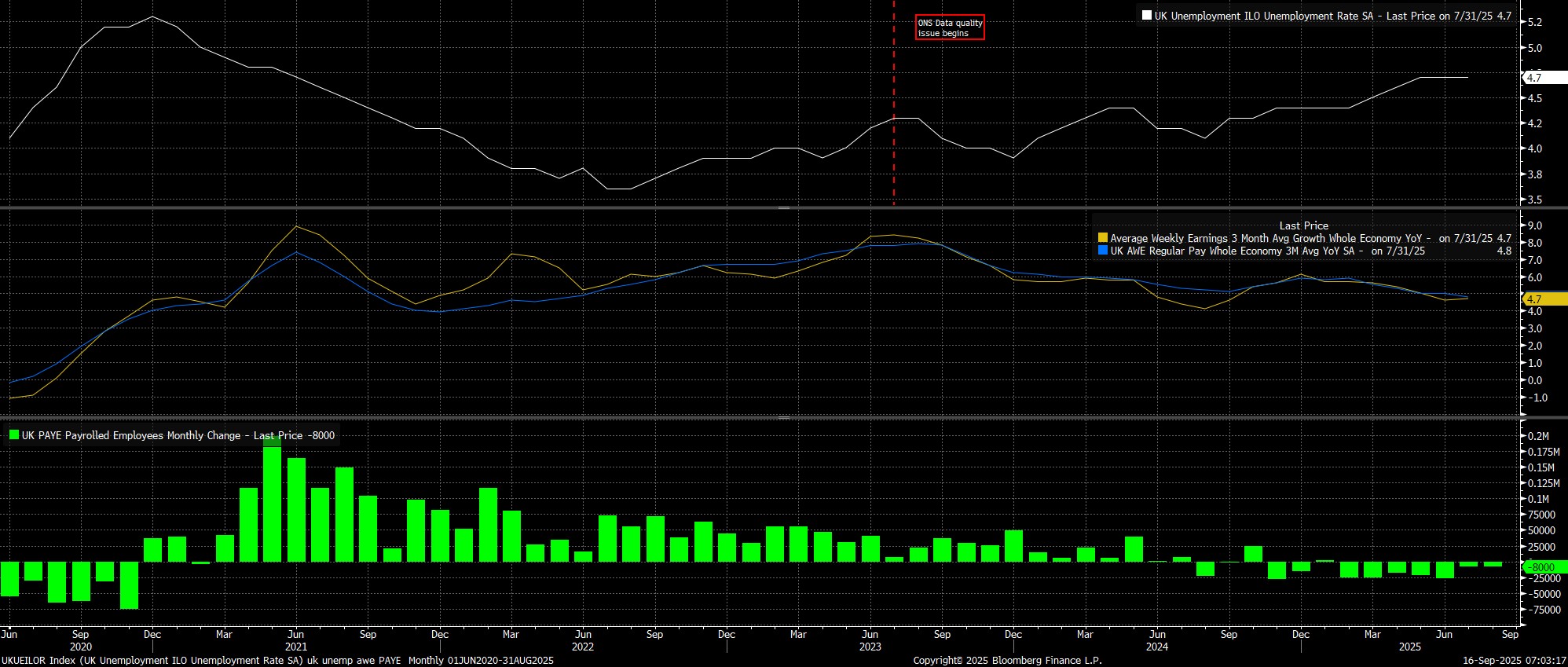

Unemployment held steady at 4.7% in the three months to July, for the third month running, though one must continue to interpret the figures with some degree of caution, as the data remains plagued by numerous quality issues.

Earnings growth, meanwhile, remains at a pace incompatible with a sustainable return to the 2% inflation target. Overall pay rose 4.7% YoY in July, while regular pay rose 4.8%, the latter metric dipping below 5% for the first time since the middle of 2022

Turning to the more timely PAYE payrolls metric, data pointed to payrolled employment having fallen by a relatively modest 8k in August, though this still marks the 7th straight monthly decline in payrolls, while also meaning that payrolled employment has now fallen in every month, bar one, since the Budget last year.

Taking a step back, while the employment backdrop looks to have stabilised a touch, risks overall remain tilted to the downside, not only as broader economic momentum remains anaemic at best, but also as the 26th November Budget looms, with uncertainty in the run up to Chancellor Reeves's announcement likely to keep a lid on business activity for the time being.

The figures are also unlikely to meaningfully alter the near-term Bank of England policy outlook, with Bank Rate set to be maintained at 4.00% in a 7-2 vote this Thursday; the MPC will have had advanced sight of today's data in any case. The next 'live' MPC meeting shan't come until November where, providing the current 'gradual and careful' guidance is maintained this week as expected, a 25bp cut remains the base case. That, though, hinges almost entirely on the inflation outlook, most importantly the September CPI print due 22nd October, where a print at, or below, the BoE's current peak 4% forecast will be required in order for further easing to remain on the cards this year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.