- English

- عربي

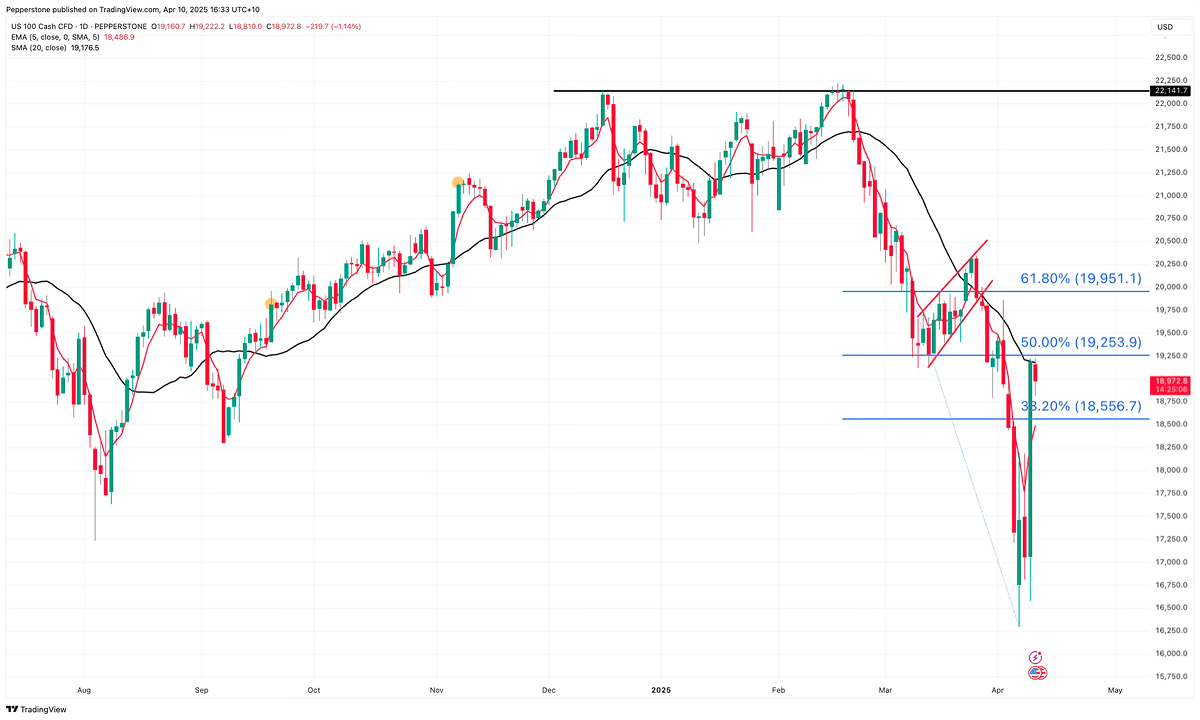

After two weeks of steady declines, the Nasdaq shot up 12.5% yesterday—its biggest one-day jump since October 2008.

This sharp rebound is more of a technical adjustment than the start of a long-term trend reversal. Bearish positions had gotten pretty extreme, so the market was super sensitive to any positive news, sparking a quick short-covering rally.

The immediate trigger for this shift in sentiment was the latest update on U.S. tariffs. Even though the trade war between the U.S. and China keeps escalating, the White House announced a 90-day delay on tariffs for countries that haven’t retaliated against the U.S. (excluding Canada and Mexico). They’ll only charge a 10% interim tariff during this period. This helped calm fears of a full-blown trade war, settled market nerves for a bit, and got buyers back into global equities.

But after this sentiment-driven rally, the Nasdaq pulled back again today, highlighting that concerns about the economic fundamentals are still very much there. If you do the math, it turns out that 10% tariffs on everyone, plus 125% on China, equals about the same overall tariff increase we would have seen with reciprocal levies country-by-country—just with more focus on Chinese imports.

The risk of a global economic slowdown is still hanging over us, and the U.S.'s tariff tweaks just shift more pressure onto China, rather than easing the cost pressures on U.S. businesses and consumers. Inflation is still a problem, and for smaller economies, even a 10% tariff is no small deal. The global growth outlook remains pretty uncertain.

For risk assets to truly start a sustainable upward trend, I think there are two key things to watch. First, how tariff negotiations play out in the next 90 days. If the Trump administration can strike some sort of deal—or at least show they’re open to negotiating—with China and the EU, that could help restore confidence in the market and bring back risk appetite.

Second, the Federal Reserve’s stance, or if we can see the ‘Fed Put’. While stocks have bounced back in the short term, U.S. Treasury yields are still on the rise. This could be signaling early bets on a recession or forced unwinding of trades. With the April 15 tax deadline putting a squeeze on bank cash, if markets start worrying about a liquidity crunch, the Fed might have to dial up the dovish talk—or even hint at rate cuts—which could give stocks a pretty solid boost.

Until we get more clarity on either of these fronts, I’m staying cautious on the Nasdaq and global stock markets. The risk of further pullbacks in the short term is still very real.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)