- English

- عربي

Preview For The September 2025 US Jobs Report: Take Two

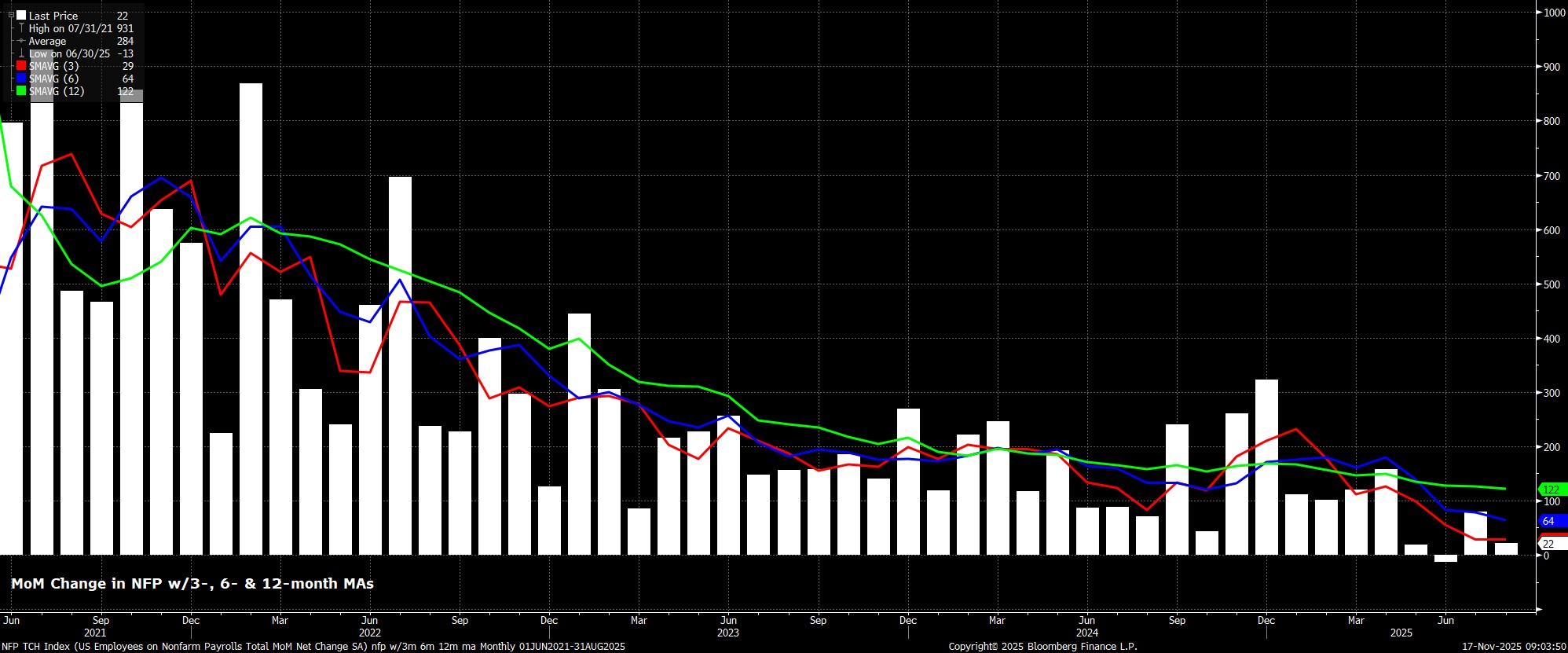

Payrolls Growth To Rebound From August

Headline nonfarm payrolls are set to have risen by +50k in September, a pace that would be a fair uptick from the +22k seen in August, while also being one broadly in line with the breakeven pace of jobs growth, though considerable uncertainty remains as to exactly where that lies, given the rapidly changing composition of the labour force.

In any case, the range of estimates for the jobs print is as wide as ever, from -20k to the downside, to +105k to the upside, per forecasts submitted prior to the originally scheduled early-October release date. Furthermore, revisions to the prior two months of data will also be closely watched, especially with the August survey response rate having been the lowest seen for the month in 25 years.

No Shutdown Impact Yet

It’s worth noting here, before examining leading indicators for the payrolls print, that the record-long government shutdown almost certainly had no impact whatsoever on the data that we’ll be getting later this week. While the shutdown will negatively impact the October, and possibly November, reports, the September survey was conducted long before federal government operations ceased.

That said, any negative impact on the aforementioned reports, both of which will likely be released in early-December, should prove short-lived, with those workers who were furloughed during the shutdown returning to their prior roles, and being entitled to receive full back-pay.

Leading Indicators Tilt Positively

An odd quirk of the September report being so delayed is that we have a considerably greater number of leading indicators for the payrolls print than would usually be available. Only time will tell whether that makes anyone’s ‘guesstimates’ any more accurate, mind!

September’s ISM surveys were relatively positive, from a payrolls perspective at least, with the manufacturing employment sub-index rising to its highest since May at 46.0, and the equivalent services gauge hitting its highest since June at 48.2. Meanwhile, initial jobless claims fell a modest 2k between the August and September survey weeks, while continuing claims fell by a more sizeable 18k. Only the ADP metric of private payrolls points in a negative direction, having indicated a decline of 32k private sector jobs in the month, though this was skewed by the ADP’s annual re-benchmarking exercise, which subtracted 43k jobs from the print, thus over-stating the extent of any employment decline that might’ve been seen.

Finally, the NFIB’s metric of hiring intentions, which has been a useful leading indicator for much of the cycle, points to a private payrolls gain of around +75k, which we can also use as a proxy for the overall nonfarm payrolls print, given there was likely zero net government hiring, with state & local job gains offset by a further decline in federal payrolls, though the impact of any DOGE-related deferred layoffs is unlikely to become clear until the October report.

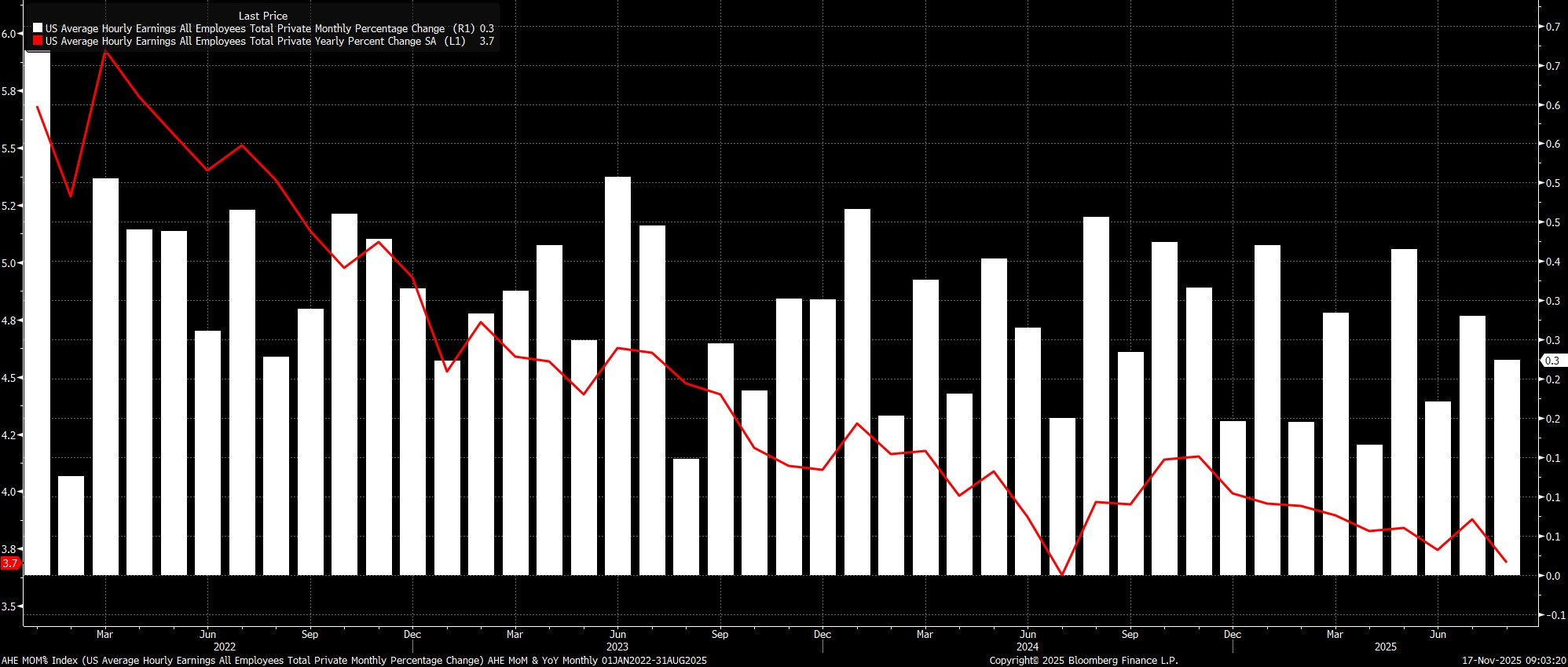

Earnings Pressures To Remain Contained

Sticking with the establishment survey, the September report is likely to again point to earnings pressures remaining relatively contained, as they have done for some time now. Average hourly earnings are set to have risen by 0.3% MoM, unchanged from the pace seen a month prior, which would in turn see the annual rate hold steady at 3.7% YoY.

Data of this ilk would confirm the continued trend of moderating pay growth seen over the last year or so, while also helping to reinforce the view of many FOMC members that the labour market is not, at present, a source of significant upside inflation risk.

Household Survey

Consensus expects headline unemployment to have held steady at 4.3% in September, remaining at the cycle highs seen in August. That said, the bar for the September figure to tick higher to a fresh high at 4.4%, with unemployment having printed 4.3237% on an unrounded basis last time out.

On the other hand, labour force participation is set to remain at 62.3%, though this still represents a relatively subdued level, being just 0.1pp above the cycle lows printed during the summer. One must, though, continue to interpret the whole of the household survey with a significant degree of caution, given both the sharp decline in survey response rates, and the rapidly-changing composition of the labour force, owing largely to heightened immigration enforcement which continues to be seen across the US.

FOMC Impact

While the September jobs report is, undoubtedly, stale by this stage, the figures are still likely to have a key bearing on the FOMC’s near-term policy trajectory, not least with the data being the first official read on US labour market conditions that policymakers will have received for two and a half months.

Furthermore, the October confab marked a notable hawkish shift from the Committee, not only considering the 3-way vote split, but also with Chair Powell himself flagging the divided nature of policymakers, and noting that a rate cut in December is ‘far from’ being a foregone conclusion. Recent Fedspeak, albeit largely from regional presidents as opposed to Governors, has also tended to lean in a much more hawkish direction, amid concern over elevated services inflation.

Taking that into account, the bar for another 25bp cut before year-end is, clearly, a higher one than at the time the September report was originally due for release, especially with the USD OIS curve now discounting just a 50/50 chance of such a move. Though those odds, of course, are liable to swing around over the upcoming print, it remains highly likely, although not certain, that we will still get another two (Oct & Nov) jobs reports before the final FOMC meeting of the year. For the time being, the ‘path of least regret’ does likely lead policymakers towards another rate cut before the year is out, with a 25bp cut in December remaining my base case, providing that job growth continues to stall, even if such a move is likely to come with even more hawkish dissent than seen in October.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.