- English

- عربي

Week Ahead Playbook: Path Of Least Resistance Leads Higher Ahead Of Payrolls & Powell

The Week That Was

Although the docket was on the light side, there were a handful of notable themes to take away from the ‘week that was’.

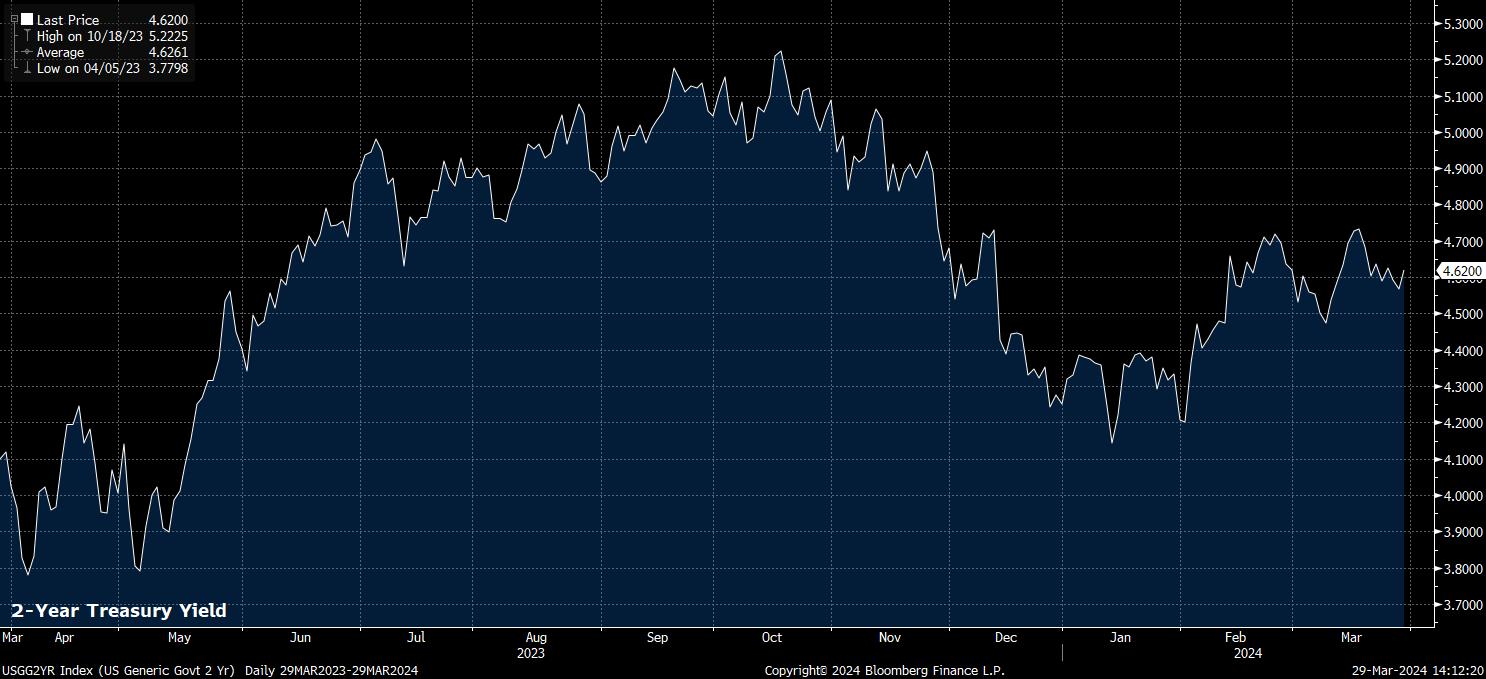

Stateside, it was remarks from Fed Governor Waller that piqued the interest of most participants, with one of the more hawkish FOMC voters offering some pushback on both market pricing, and the 2024 median dot, which both point to three 25bp rate cuts being delivered this year. Waller noted that recent hotter-than-expected inflation figure warranted “fewer cuts, or a later start to easing”, and that the risk of waiting to cut “is lower than acting too soon”.

While this, clearly, is rhetoric in line with Waller’s well-known hawkish stance, it once again speaks to a risk that is, perhaps, under-priced at present, in that the FOMC may well not join in with the ‘summer of easing’ upon which other G10 central banks are set to embark, particularly if the March CPI print (due 10th April) is also hotter-than-expected. Though Chair Powell has largely dismissed the January and February inflation reports as noise, distorted by seasonality, the longer CPI remains stubbornly high, the harder it becomes to dismiss.

This, along with there now being just one FOMC member with a dot below the media, compared to 5 in December, suggests that the risks to Fed policy are increasingly tilting in a more hawkish direction, posing downside risks to the front-end of the Treasury curve, and in turn further upside risks to the greenback.

Despite this, the latest core PCE figures – both the Fed’s preferred inflation gauge, and the week’s data highlight – were released bang in line with expectations on Good Friday.

On an MoM basis, data showed the core PCE deflator rose 0.3% in February, down from an upwardly revised 0.5% MoM a month prior, in turn seeing the annual rate slip to 2.8% YoY, from an also upwardly revised 2.9% YoY in January. While annualising the MoM figures paints a slightly less rosy picture, with the 3-month rate rising to 3.5%, and the 6-month rate to 2.9%, this is more a function of near-zero core PCE prints from last year falling out of the data, and hence is something of a statistical quirk that is unlikely to materially concern policymakers just yet.

Besides the aforementioned remarks, and PCE figures, the week provided relatively ‘slim pickings’ in terms of fresh catalysts. Cooler-than-expected French and Italian inflation figures, however, do raise the chances of a further dovish pivot from the ECB at the next meeting on 11th April, though with policymakers having, effectively, already pre-committed to a June cut, the impact of further cautious language may well be relatively limited.

Nevertheless, the trend is increasingly one of European central banks turning more dovish, as risks to the FOMC outlook become more significantly biased to the hawkish side. Last week’s Riksbank decision, for instance, flagged the likelihood of a first 25bp cut coming in May, while the Swiss National Bank have already delivered the first G10 cut this cycle, and chatter of a May BoE cut is also growing ever-louder. One would, therefore, expect European FX (EUR, SEK, CHF, GBP) to continue to trade in relatively soggy fashion against the greenback for some time to come.

_Daily_30_2024-03-29_14-11-30.jpg)

More broadly, though, the direction of travel for monetary policy over the remainder of 2024 remains unchanged across DM – rate cuts are coming, an end to quantitative tightening is coming, and the central bank put is back once more.

Altogether, this means that the backdrop for risk remains an incredibly supportive one, as the bulls remain in command of equities, not only on Wall Street, but across the globe, with the pan-European Stoxx 600, Germany’s DAX, Japan’s Nikkei 225, and Canada’s S&P/TSX 60 all notching fresh records within the last week.

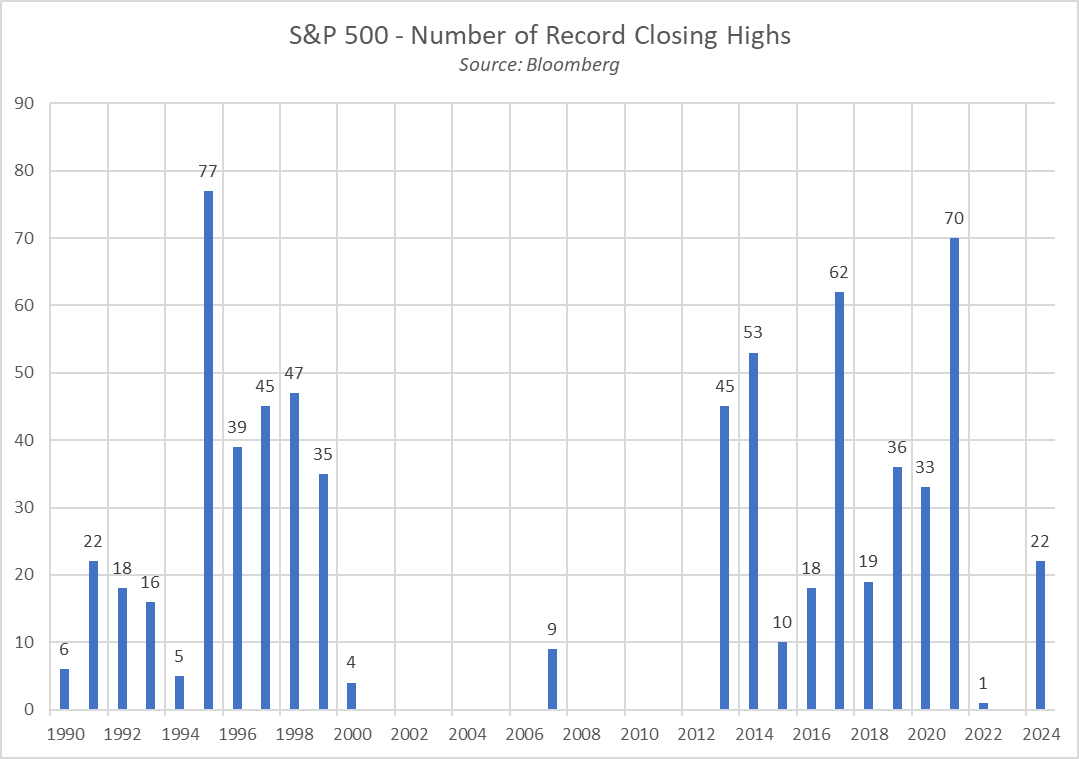

Naturally, despite marginally lagging equity performance in Europe, it remains the US where most attention is focused, with the S&P 500 having notched back-to-back gains at the end of the holiday-shortened week, while also closing at an ATH for the 22nd time this year.

This succession of record closes comes as the rally continues to show signs of broadening out, with 10 of the S&P’s 11 sectors now positive YTD, compared to 9 at the end of February, and just 5 at the end of January. At a constituent level, 73% of the index’s 503 members now trade in the green on a year-to-date basis, up from 60% at the end of February, and 45% at the end of January. Clearly, momentum behind the rally continues to build, and the bulls show little sign of relinquishing control any time soon.

On a broader basis, both the S&P 500 and Nasdaq 100 have now chalked up five straight monthly gains, with Q1 24 also marking the second straight quarterly advance for both indices. Given the aforementioned supportive policy backdrop, further gains seem likely from here, with the start of Q1 earnings season on 12th April the next significant test for the equity market at large.

The relatively quiet tone of the equity market was one that other asset classes mirrored.

Treasuries, for instance, traded unchanged across the curve, with the market comfortably absorbing supply in the belly, after solid 5- and 7-year auctions which both stopped through, further allaying some lingering concerns over surging issuance.

The FX market also mirrored this relatively subdued tone, although the USD did continue to gain broadly against peers, with the dollar index notching a third straight weekly advance, touching 6-week highs in the process. As alluded to earlier, there remains little in the G10 FX space that beats the buck on either a growth, or a yield, basis, hence momentum should remain positive, and dips in the dollar relatively shallow.

Gold, however, did display a few more signs of life, rallying around 3% over the last five working days, with the yellow metal seemingly finding its shine once more, benefitting from the relative stability in the FI space, touching fresh all-time highs in the process.

_D_2024-03-29_14-08-51.jpg)

The Week Ahead

After a quieter week last week, the data docket presents much more by way of event risk and intrigue as markets move past the Easter break.

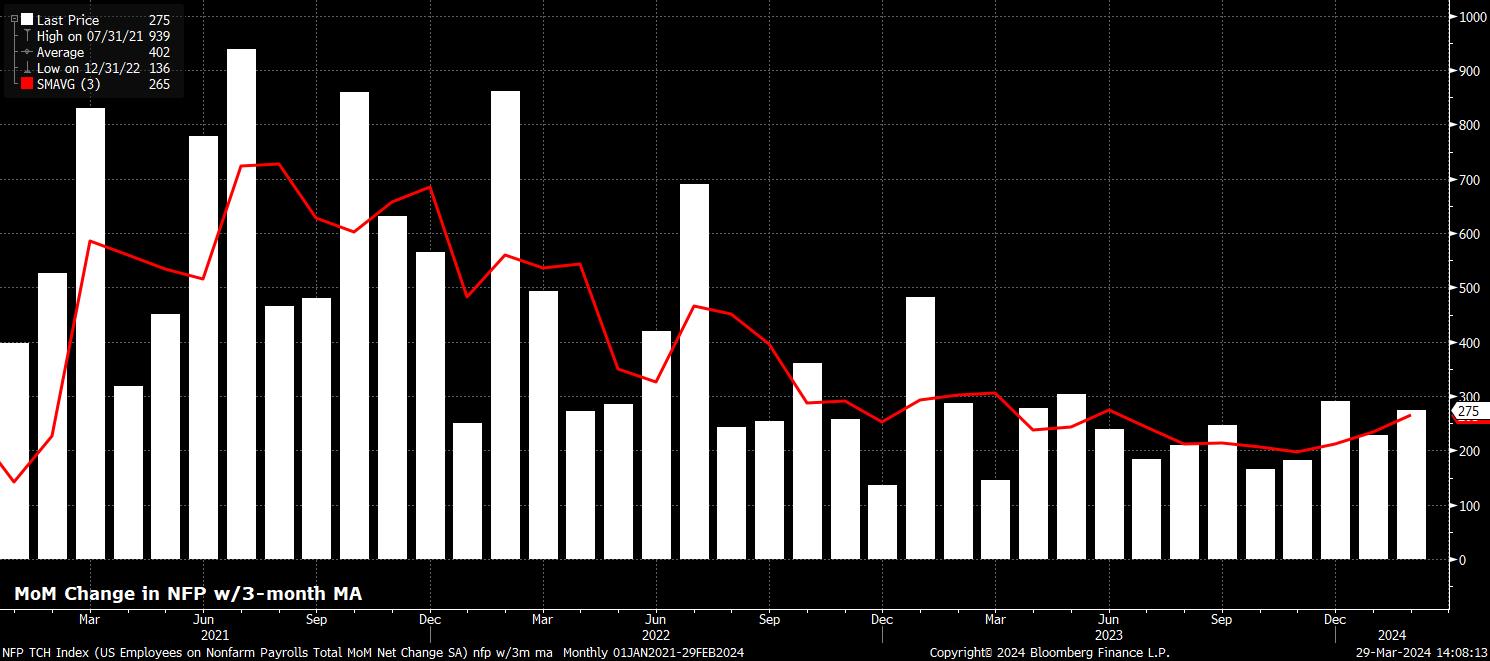

Obviously, Friday’s US jobs report, referencing March, will be the main event from a data standpoint, with consensus expecting headline nonfarm payrolls to have risen +205k on the month, and unemployment to have remained unchanged at 3.9%, while earnings growth is seen quickening to 0.3% MoM, from 0.1% prior.

It is, however, relatively difficult to envisage the March jobs report substantially moving the needle from a policy perspective, particularly with Fed Chair Powell having recently flagged how the Committee do expect unemployment to move higher over the remainder of the year, and that the risks to the FOMC’s dual mandate are coming back into “better balance”. For now, it remains the case that “confidence” in inflation returning to the 2% target will be the key determinant of the timing of the first rate cut, on which note the next CPI report – due 10th April – takes on significant importance.

Nevertheless, the week ahead is a busy one in terms of Fed speakers, with 9 separate Fed speeches due, including standout remarks from NY Fed President Williams on Tuesday, and Chair Powell himself on Wednesday. Naturally, remarks from all FOMC members will be watched closely for hints on the timing of the first cut, how much additional data the Committee will need to see before being confident enough to begin normalisation, and what individual policymakers see as an appropriate degree of easing to deliver this year.

A handful of other monetary policy events will also be on the radar, including minutes from the March RBA and ECB meetings, with the latter of particular interest as Lagarde & Co continue to move rapidly towards the first rate cut coming in June.

Sticking with the eurozone, the latest bloc-wide inflation figures are due on Wednesday, with ‘flash’ data for March set to show headline CPI slowing to 2.5% YoY, from 2.6% prior, while the core metric should nudge 0.1pp lower to 3.0% YoY. Figures in line with, or cooler than, expectations should further cement the case for a June cut, though such an outcome is already fully priced by EUR OIS.

Inflation figures are also due from Switzerland this week, where headline CPI has already settled towards the bottom of the SNB’s target band, with money markets pricing a further 50bp of easing to be delivered by year-end, including a 3-in-4 chance of a further 25bp reduction at the next meeting in June.

Inflation is not the only focus, with market participants also set to get their latest check-up on the growth side of the economy, as the latest round of PMI surveys drop from most DM economies. While many of these releases will be ‘final’ reads, the US ISM figures will be of note, especially Monday’s manufacturing index, after the February report pointed to the fastest pace of production growth in the sector in almost two years.

On the whole, however, the week ahead will likely be a ‘Powell & Payrolls’ story; providing neither springs any unpleasant surprises, the near-term balance of risks points to further equity and USD upside for now.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.