- English

Constraints on Shorting CFD Single Stocks

Lack of Short Interest

One reason some CFD single stocks are only available for buying and not shorting is the unavailability of short liquidity provided by Liquidity providers. In order for a Liquidity provider to allow shorts they must have available liquidity in the specific stock in which they can borrow, sell at market and facilitate the short. Where this option is not available a broker will move an instrument to long or increasing only and disable short selling.

Regulatory Restrictions on Short Selling

Another significant factor that limits the ability to short CFD single stocks is regulatory intervention. Governments and financial authorities may impose restrictions on short selling to maintain market integrity, protect investors, and ensure the smooth functioning of financial markets.

Example: Regulatory Measures during the COVID-19 Era

Amid the economic uncertainties caused by the COVID-19 pandemic, several countries implemented temporary restrictions on short selling. For instance, the European Securities and Markets Authority (ESMA) imposed a ban on short selling in certain European markets to prevent potential market abuse and disorderly trading conditions. This move was aimed at stabilizing financial markets during a period of heightened volatility.

Market Liquidity and Operational Constraints

In some cases, stocks may be restricted from shorting due to liquidity concerns or other limitations. Illiquid markets can pose challenges for short sellers, as it may be difficult to find counterparties willing to lend the shares needed for short positions.

Example: Illiquidity in Specific Stocks

Imagine a scenario where a relatively small-cap stock experiences low trading volumes. In such cases, brokers may hesitate to enable short selling due to the limited availability of shares for borrowing. This precautionary measure is taken to avoid creating a situation where the demand for borrowed shares significantly outweighs the available supply, potentially leading to extreme market volatility.

Conclusion

Understanding why some CFD single stocks are only available for buying and not shorting involves considering various factors, from the lack of short interest to regulatory interventions and liquidity concerns. Traders navigating the complexities of the financial markets must be aware of these constraints to make informed decisions and adapt their strategies accordingly. As the financial landscape continues to evolve, staying abreast of market dynamics and regulatory developments is crucial for successfully navigating the world of CFD trading.

Q and A:

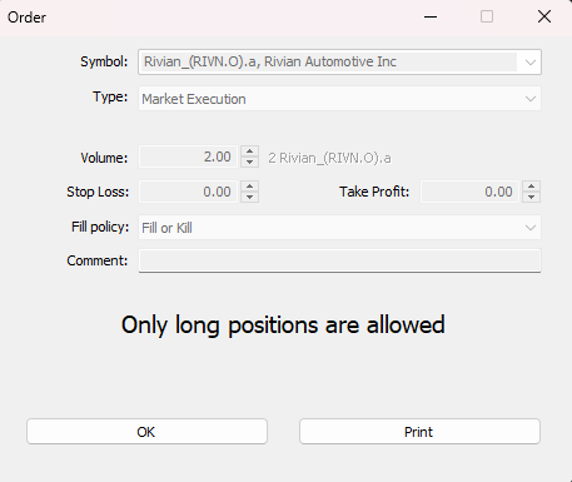

What does it mean when the “Sell” option is greyed out on MT5?

When a stock is long only the sell option on a deal ticket will be grayed out with the long/buy option being the only selectable one.

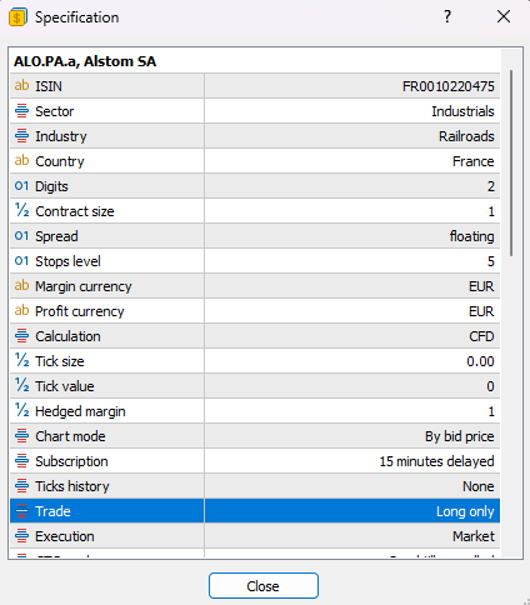

How to determine if an instrument is on Long Only?

Under the instrument specifications on MT5/cTrader you will see “Long Only” as per the images below

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.