Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

August 2025 UK Inflation: Underlying Pressures Ease But Worries Remain

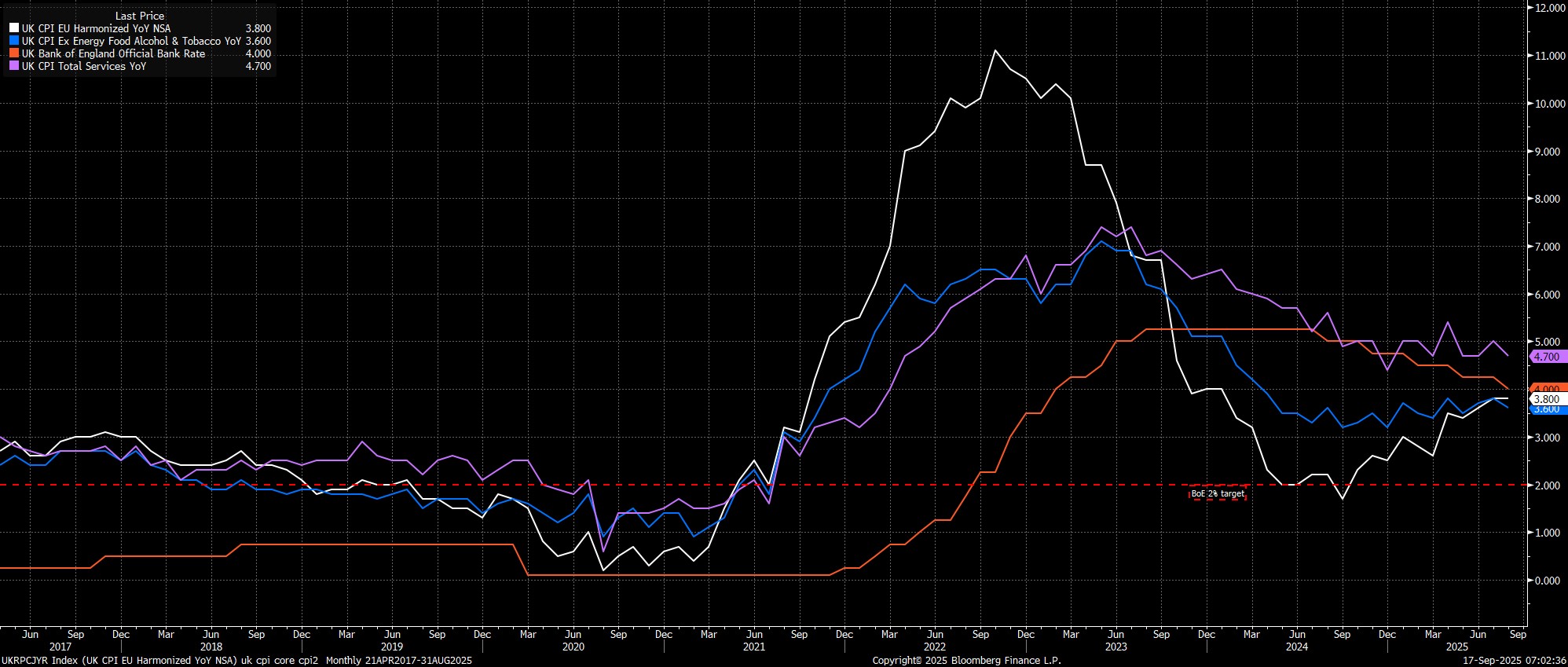

Headline CPI rose 3.8% YoY in August, unchanged from the pace seen in July, and bang in line with the Bank of England's forecast.

Meanwhile, measures of underlying inflation did show some, tentative signs of price pressures beginning to fade. Core CPI rose 3.6% YoY last month, the first easing in the metric since May, while services CPI rose 4.7% YoY, cooler than the Bank's expectation for a 4.8% increase, and an 0.3pp cooling from the pace seen in July.

The modest easing in underlying price metrics came after a number of 'hot' areas of the July print unwound, most notably airfares which eased considerably after a +30% MoM jump last time out. Food inflation, though, at 5.1% YoY, remains worryingly high after climbing for the fifth month running, particularly given the significant risk it poses in terms of broader consumer inflation expectations becoming un-anchored.

On the whole, though, this morning's data - which the MPC will have had advance sight of - is highly unlikely to be a gamechanger for the Bank's September decision, with Bank Rate set to remain at 4.00% tomorrow, likely via a 7-2 vote among Committee members.

November remains the next 'live' MPC meeting, where for the time being, and providing the 'gradual and careful' guidance is maintained tomorrow, a 25bp cut remains my base case. The September CPI report, due 22nd Oct, will be crucial here, though, as a rise in headline inflation north of the Bank's current 4% expected peak likely kills the possibility of another Bank Rate reduction this year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.