Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

I, for one, would have liked more from the Fed. To really challenge behaviours and drive animal spirits. But, as detailed in my prior note if the Fed didn’t win the credibility battle then they would see a tighter financial backdrop. Which is the case, where we’ve seen a steeper yield curve, a slightly stronger USD and equities have been sold.

I have put more detailed thoughts into this video (see above), which I hope best portrays what's a big subject but needless to say, I'm left with a number of questions. Consider the overriding statement that the Fed will maintain the current policy target range “until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

I, like many, want to understand:

- What constitutes a “moderate” overshoot? 2.5% perhaps

- How will the Fed assess the duration of ‘sometime'? 3 months, 6 months... longer?

- Why, when the Fed is pro-actively driving inflation above 2% do the inflation projections (in the set of forecasts) not reflect this?

- Could we not have had more colour on future asset purchases (QE) – size, scope and composition are important to bond traders, which could be why we saw 10-year Treasuries sell-off and subsequently the NAS100 finding sellers.

- This policy regime is an outcomes-based approach, but how flexible are they on their outcomes?

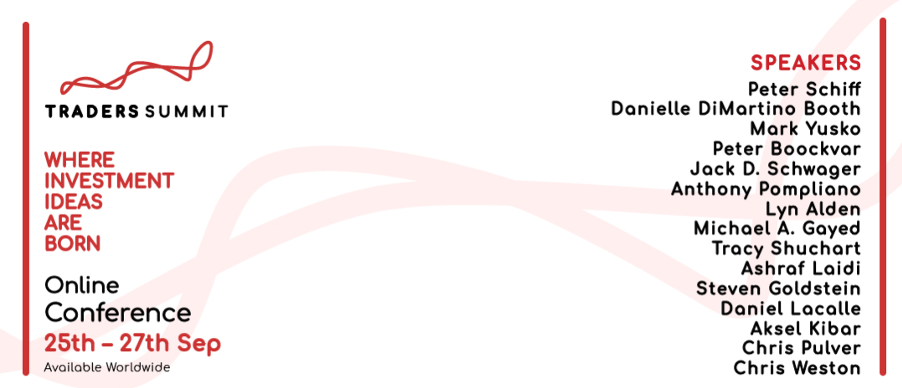

I also want to give you the heads up on Trader Summit, an event I will be speaking on the 27th on the Fed’s new policy regime and how to trade it. The line-up (perhaps yours excluded) is as good as you will see in any event and promises to be an incredible event. Get involved, it's free.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.