Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

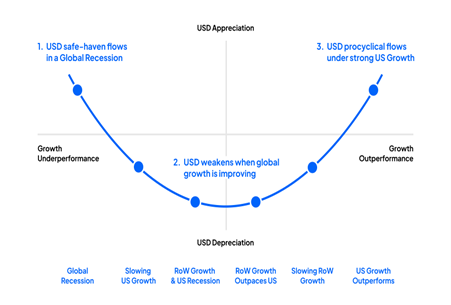

The basic principle is we can think more strategically about the regime that drives the USD, and this has consequences for price, and by extension commodities and other second-order derivatives of the USD.

- Left-hand side – the focus here is risk aversion across broad financial markets – this could be driven by several factors, including an increased recession risk and geopolitics – but increased market stress and the USD will typically attract buyers. Conversely, a risk rally will see capital flow out of the USD

- Right-hand side – the US exceptionalism story – in some capacity the idea of TINA rings true here – that being, ‘There is No Alternative - where investors see the US as having the most resilient economy and considered to be the most attractive investment destination

- The middle section sets a focus on a regime of synchronized global growth/contraction – essentially in a synchronized global growth upturn, perhaps with rising liquidity, we typically see bearish trends in the USD and clear outperformance in cyclical currencies, such as the AUD, NZD, and NOK

USD drivers into October ‘22

As we see on the daily, the USD rallied throughout 2022 peaking in September and October, with both the left- and right-hand sides of the ‘Smile’ working concurrently for the USD. This is a rarity, but can be a potent force, especially given this time around we went through a regime shift from zero interest rates and QE to rapid rate hikes.

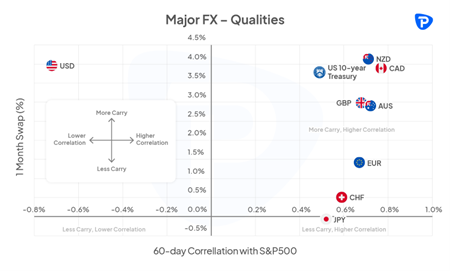

A deeper dive as to the left-hand drivers, we saw fears of a global slowdown and economic contraction driving capital into the safety of the USD – as we see in chart below (“Major FX – Qualities), the USD was unequivocally negatively correlated with the S&P500, providing a strong and unrivalled hedge against equity drawdown – the fact that cash-like assets (I’ve used 1-month swaps) in the US pay some of the highest rates meant traders achieved compelling levels of ‘carry’ or income – in effect, funds are still paid to play defence.

On the right-hand side, fears of a deeper economic contraction in China, Europe, and the UK, certainly on a relative basis, again saw the USD outperform. We can also see that while inflation rose aggressively in most DM countries, we also seen dovish pivots from the BoE, ECB, and RBA, and yet the Fed have kept a consistent tone – well, at least Jay Powell has.

A USD decline

After the US CPI report (10 Nov) we saw the USD take a dive, stopping just shy of the 200-day MA – on one hand, the right side of the ‘Smile’ becoming less USD positive – where rate hikes were priced out and the terminal expectation of the fed funds rate fell to 4.87% (from north of 5%).

We can also see the mid-part of the ‘Smile’ worked against the USD - We saw China looking less bad, with its plans to allow property developers easier access to capital, amid a multi-step guide to unwind its Covid zero policy, presumably after the ‘Two Sessions’ sitting in March 2023.

There has been a less bad feel towards Europe, with EU Nat Gas prices falling from €342 to €100 – EU data, more broadly, held up and Italian BTP spreads were contained vs German bunds.

A USD turn – but can it last?

Since the lows in the USD (I’ve used the USD index / USDX as my proxy) on 15 Nov we’ve seen a reasonable counter-rally back above 107 – the technicians will argue the USD was oversold and due a bounce anyhow. However, if we think about the news flow and how it relates to the ‘smile’ theory, we’ve seen the emergence of increased uncertainty on China’s Covid plans – Korean 20-day exports fell 16.7%, while Taiwanese exports fell 6.3% YoY. Crude and copper have shown us the way, but traders are expressing a view of a global growth slowdown, which of course favours USD strength.

The news flows may change as we head into what will be a big December by way of event risk– bad US data will impact the right-hand side of the smile and weaken the USD, especially if the US labour market shows real signs of cooling and core CPI undershoots again. Should US data hold up, but Chinese and EU data deteriorates, well that’s USD positive, especially if we see an equity drawdown.

I’ve not seen a momentum USD buy signal on the longer-time frames yet – however, with terminal fed funds pricing above 5%, which we consider that to be fair, it feels like global growth is probably the factor that will drive the USD into year-end. The smile could be a good guide to think about the USD direction.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.