Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Trader thoughts - a sinister close in US equities but bullish moves in copper, AUD, and NZD

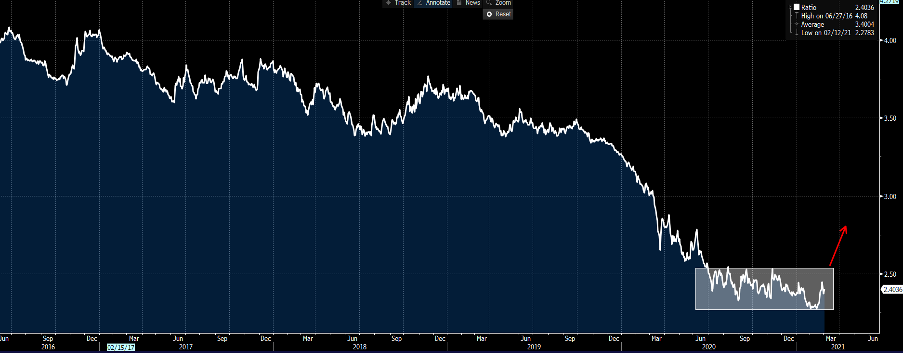

To start, sentiment in equities has soured into the cash close, with small caps (US2000) closing -1.9% and tech finding supply (NAS100 - 1.7%) – this despite a 7bp decline in US real yields, amid rising speculation the Fed will look to roll out a re-run of its ‘Operation Twist’ program. Despite what many say, in my view this is not Yield Curve Control (YCC), but more aimed at issues in ultra-short-term rates (collateral scarcity) and re-aligns policy with other central banks. Long US30 and short NAS100 may be worth a look.

(Dow/NAS ratio)

(Source: Bloomberg)

Crude is 1.7% lower with all eyes on the full narrative from the OPEC meeting, with the group now expected to increase production - the $58.50 19 Feb swing low will be closely watched – we’ve just seen the weekly API inventory report showing a massive build of 7.4m barrels. Considering as today’s DoE inventory report (02:30 AEDT) is expected to show a drawer of 735k barrels and one suspects consensus needs to be adjusted.

Crude aside, commodities look interesting notably copper. After pulling back from $4.37 to $4.04, copper has seen buyers all through US trade, printing a solid bullish outside day reversal. On the 4-hour, we saw a failed breakthrough of $4.07 and price has reversed and built on that. Watch Chinese equities today as the tape was poor yesterday amid comments from China’s bank regulator of being “very worried” about risks from the domestic property sector. However, the fact we’ve seen copper regain composer is interesting and if this kicks on through trade today, then it could suggest we go back to test the recent highs.

The bears will point to extreme and almost record bullish positioning in LME and Comex. However, positioning aside the price action we’ve seen in copper and industrial metals more broadly suggest growing conviction the commodity bull market morphs into something far more prolonged and thematic of a multi-year supercycle.

By way of inspiration, the market sees continued growth in housing, with lumber more than doubling since October portray this eloquently. EV will only evolve and an ever-greater move to renewables-related consumption will boost the demand outlook for certain industrial metals, such as copper. Do consider that the recent fall in mined production and significant draw in inventories that the copper market will be in a massive deficit this year and perhaps 2022 too.

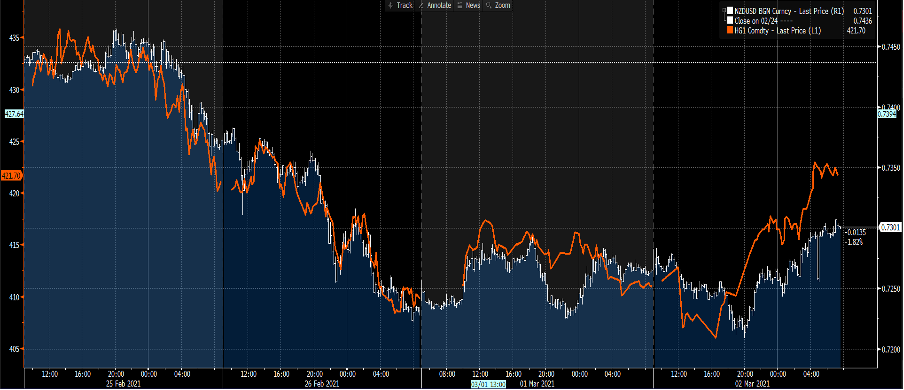

(Orange – copper, white – NZDUSD)

NZDUSD has basically tracked copper prices as the Bloomberg chart portrays, so it won’t surprise to also see a bullish outside day in this pair. The 50-day SMA has contained the selloffs of late and despite the moves in equities the flow in the pair looks solid. A close through the 5-day EMA and I’ll be taking the timeframe down and looking at buying strength for a test of 0.7430/40 (Jan 2018 high).

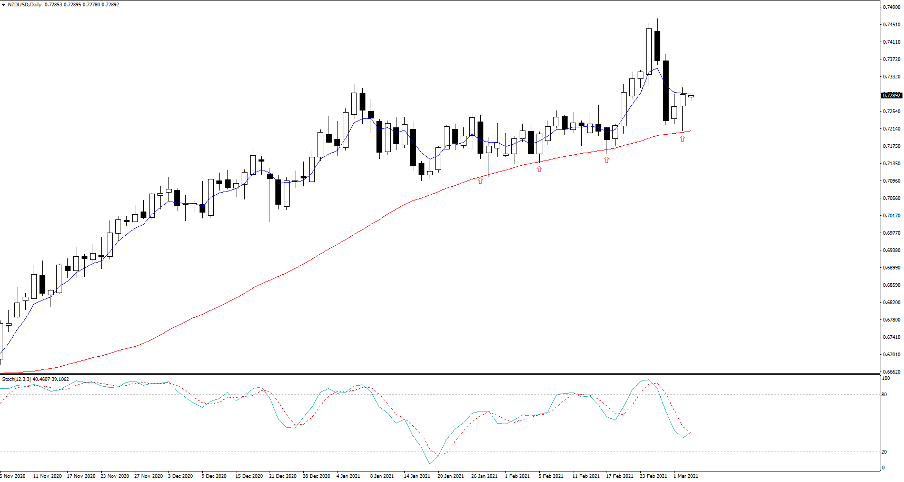

(NZDUSD daily)

The AUD is also making a charge higher and despite the negative equity backdrop, with price rallying from 0.7736 in EU trade into 0.7838. I was keen on buying weakness yesterday, but the limit was a touch aggressive and it was a case of chasing price from there. Judging by the move higher in Aussie 10-year bonds from 1.66% into 1.74% the actions of the RBA were not dovish enough relative to expectations. The bank has said they’d do more QE if needed and one suspects they'll need to increase the ‘envelope’ of capital. We get Aussie Q4 GDP at 11:30 AEDT, although I’m not expecting this to move markets.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.