- English

Help and support

Popular FAQs

You can also:

1. Clear the cache and cookies of your browser

2. Connect from an incognito tab, different device and browser

3. Ensure that the time of your Device is properly synced.

4. Ensure that you are choosing the correct login method. If you have registered using Apple or Google sign on, then you need to log in using this method.

5. Make sure browser third-party cookies are enabled:

a. In the Chrome browser window, click the More icon (usually triple dot vertical), then click Settings.

b. Click Privacy and security in the left-side navigation (this is not found in the window that pops up)

c. Click Site settings

d. Under Content, click Cookies and site data.

e. Unselect Block third-party cookies.

6. Check your Antivirus, you can try disabling your antivirus temporarily and then access your Secure Client Area again.

If none of the above helps to solve the problem, contact our support with details of the issue and our team will be happy to assist. We are available 24/7! If you need to urgently deposit or address live trades, please contact our service immediately via call or live chat.

To deposit, simply follow the steps below :

- Log in to your Secure Client Area.

- Navigate to the “Funds” section from the left-hand menu.

- Select the trading account you’d like to fund.

- Choose your preferred deposit method.

- Enter the amount you wish to deposit.

- Confirm your transaction — and that’s it!

To request withdrawal, simply follow the steps below:

- Log in to your Secure Client Area.

- Go to the “Funds” section from the left-hand navigation panel.

- Click on the “Withdraw Funds” tab to view all available withdrawal options.

- Submit your withdrawal request.

- Approve the request via the confirmation email sent to your registered address.

- If you have Two-Factor Authentication (2FA) enabled, enter the code from your Authenticator app to confirm the withdrawal.

Absolutely! Simply get in touch with our support team, and we’ll assist you in changing your trading account type. Please keep in mind that only Razor accounts are compatible with TradingView.

Reactivation of live trading accounts is available only for generating trading statements upon request. We cannot reactivate any demo trading accounts.

Funding and withdrawals

To Transfer Funds Between Accounts, follow these simple steps:

- Log in to your Secure Client Area.

- Navigate to the “Funds” section from the left-hand navigation panel.

- Click on the “Transfer Funds” tab to view all your trading accounts.

- Select the trading account you wish to transfer funds from.

- Choose the trading account you wish to transfer funds to.

- Enter the amount to transfer. Transfers below 0.99 units of currency cannot be processed.

- Confirm the transfer — funds will be instantly reflected in the selected account.

Log in to your Secure Client Area

Click on the “Funds” section on the Left side navigation panel. Head to the “History” tab to find all your deposit and withdrawal requests and their status.

We offer a wide range of funding options depending on your region. Pepperstone does not apply any fees on any deposit method, while we also offer fee-free withdrawal options! You can find all your funding and withdrawal options available for your country in your Secure Client Area “Funds” section.

Pepperstone does not charge any fees on deposits of any method! For withdrawal requests, a fee of $25 applies only for international bank wires. Keep in mind that we do not hold any control over fees that are applied by card issuers, payment providers and intermediary banks.

It may take us up to 3 business days to process your withdrawal request. Please note that after a withdrawal request is successfully processed from our end, it depends on your bank/payment provider how quickly the funds will reflect to your account. For instance, after we successfully process a withdrawal made with credit/debit card, it can take up to 5 business days, depending on your card issuer for the funds to reflect in the account.

New to trading

A pip is a unit of measurement used to convey the change in value of a currency pair. For FX pairs with 5 decimal places, a pip is the 4th decimal place, and for pairs with 3 decimal places it is the 2nd. You can calculate the value of a pip using the PIP Calculator in your Secure Client Area. Tip: A pip is always the second last number on any instrument.

Leverage is the ability to control a large amount of money in the forex markets. In our CMA jurisdiction, we offer leverage of up to 1:400 for retail clients. This means for every $1 that you have in your trading account, you can trade $400 as a retail client. Leverage can exponentially increase your profits as well as your losses so it's crucial that traders take care when using leverage. The larger your position size, the larger your pip value will be and therefore, the greater the impact on your profit/loss (P/L).

Margin is the amount of capital required to open a trading position. It determines how much of your funds are needed to maintain a trade, and directly affects your ability to enter and manage positions. The required margin varies depending on the asset and your account type.

For easy reference, a margin calculator is available in your Secure Client Area under the “Trading Tools” section on the left-hand menu.You can calculate margin using this formula:Margin Required={LeverageCurrent Market Quote × Volume}

Your Stop Loss or Take Profit may have been triggered. If you no longer have enough equity in your account to support the trade's margin requirements, the automated stop-out system will start to close out your trades. If you are using an Expert Advisor, it may have sent an order to close your trade.

Absolutely! You can set a Stop Loss or Take Profit on any order to manage risk or lock in profit. Just note that these levels act as triggers, not guaranteed execution prices. The actual fill may differ—this is called slippage, an inherent part of trading—since the closing market order executes at the next best available or fair market price. Find out more here.

Absolutely! We offer Buy and Sell Stop and Limit orders, which trigger market orders at the next best available price. Find out more here.

A currency pair contract is based on spot contracts, which are equivalent to 2-day futures. Without rollover, you would need to close your current contract and open a new one every two days. To make trading seamless, banks handle this process for you and charge a swap fee to cover the interest costs of buying and selling the same currency for different value dates. Forex brokers pass this cost on to clients. Swap rates are updated weekly and provided by our liquidity providers.

Opening an account

Our Razor and Standard accounts offer pricing from some of the world’s biggest liquidity providers. Information on these account types can be found directly from our website

A Razor account offers our clients Interbank spreads straight from our liquidity providers. However, you will pay a commission on each FX trade. You pay no commissions on a Standard account, but instead receive a 1 pip mark-up (round-trip) on FX pricing. This means that the Bid price will be 5 points lower, and the Ask price 5 points higher, on a Standard account than on a Razor account. The Razor account is popular with scalpers, while the Standard account is popular for those wanting a more simple account and for beginners.

There is no difference between Standard and Razor accounts when you are trading Commodities, Energy, Metals, Indices, Thematics or Cryptocurrencies. You simply pay the spread and any relevant overnight funding costs if you intend to hold a trade over the rollover period. For a comprehensive list of differences check this page out: Trading Accounts

We do not change any account keeping or inactivity fees. We charge commissions or a Markup only when you trade. Note that a swap fee may apply for positions running after the market closure. You can find out more about our pricing here.

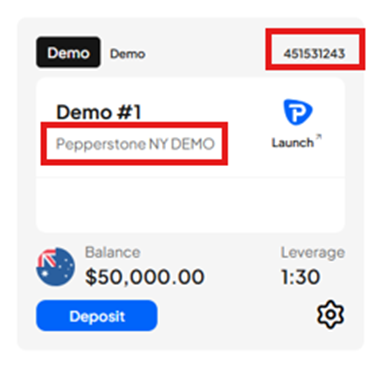

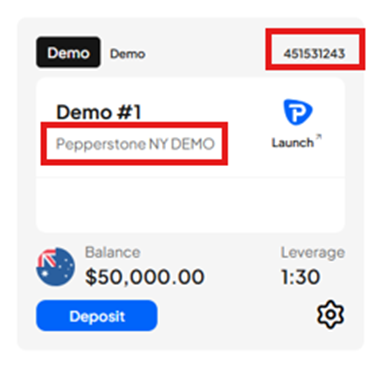

Simply log in to your Secure Client Area.

- Go to the “Trading Accounts” section from the left-hand navigation panel.

- Make sure to click on the "Live" or "Demo" section accordingly.

The trading account number and server will display for each trading account there.

You can download the trading platform you wish from the Secure Client Area “Platforms” page located at the left side navigation panel. Steps of the process can be found here.

Absolutely! As part of our Pepperstone Partners program, we offer MAM and PAMM to qualified and experienced fund managers with relevant licences or industry experience. You can find all the relevant information at our website here.

Managing my account

Simply log in to your Secure Client Area.

- Go to the “Trading Accounts” section from the left-hand navigation panel.

- Make sure to click on the "Live" or "Demo" section accordingly.

The trading account number and server will display for each trading account there.

If you trade on a Razor account, you'll pay a commission on each FX trade. For MT4/5, these commissions are based on your chosen account currency and the lot size of your trade. Trading commissions for Razor accounts on the MT4 and MT5 platform are listed here.

Keep in mind that cTrader commissions are calculated as 6 USD roundtrip fixed per unit, TradingView commissions are calculated as 7 USD roundtrip fixed per unit. If your trading account is not USD, it will be converted at spot rate in your account currency. Commissions on trades lower than 1 lot will be proportionally adjusted.

We don't charge commissions on FX trades made on our Standard account, there's a 1 pip markup on FX pairs.For single stock equities CFDs we charge a commission which is dependent on the market traded these are listed here.

Simply log in to your Secure Client Area.

- Go to the “Trading Accounts” section from the left-hand navigation panel.

- Choose "Demo" and click on "+Add a trading account"

Steps of the process can be found here.

Once your trading account has been created the currency cannot be changed. However, you can request an additional trading account with the currency of your preference! How to request additional trading account.

Simply log in to your Secure Client Area.

- Find the trading account you wish to change in the "Trading Accounts" section.

- Click on the settings icon

- Change your nickname and then "submit"

To see the steps of the process, click here.

Simply log in to your Secure Client Area.

- Go to the “Trading Accounts” section from the left-hand navigation panel.

- Choose "live" and click on "+Add a trading account"

Steps of the process can be found here.

Please note that you can have up to 10 live trading accounts.

Simply log in to your Secure Client Area.

- Find the trading account you wish to change in the "Trading Accounts" section.

- Click on the settings icon

- Change your nickname and then "submit"

To see the steps of the process, click here.

Each trading account is linked to a specific trading platform. For example, an MT4 trading account can only be connected to MT4. However, you can have multiple trading accounts across different platforms at the same time.

Please note that since TradingView is powered by cTrader, TradingView accounts can also be connected to cTrader. However, the reverse is not possible.

Absolutely! You can. Simply contact our support agents and we will change the trading account type for you. Please note that TradingView supports only razor trading accounts.

A lot of factors can affect your connection to the Secure Client Area. Please ensure that you have a stable internet connection.

You can also:

1. Clear the cache and cookies of your browser

2. Connect from an incognito tab, different device and browser

3. Ensure that the time of your Device is properly synced.

4. Ensure that you are choosing the correct login method. If you have registered using Apple or Google sign on, then you need to log in using this method.

5. Make sure browser third-party cookies are enabled:

a. In the Chrome browser window, click the More icon (usually triple dot vertical), then click Settings.

b. Click Privacy and security in the left-side navigation (this is not found in the window that pops up)

c. Click Site settings

d. Under Content, click Cookies and site data.

e. Unselect Block third-party cookies.

6. Check your Antivirus, you can try disabling your antivirus temporarily and then access your Secure Client Area again.

If none of the above helps to solve the problem, contact our support with details of the issue and our team will be happy to assist!You can contact our support team at any time and provide the trading account number of the account you wish to disable. Please note that MT4 and MT5 demo accounts cannot be disabled, as they automatically expire 60 days after creation.

We are only able to reactivate live trading account for generating a trading statement only.

Accounts with a balance of less than 10 units of currency that have been inactive for more than three months are archived to help optimize our server performance. This allows us to maintain the best possible trading conditions for all clients. In such cases, you’ll need to create a new trading account through your Secure Client Area.

This indicates that your demo trading account has expired. Please note that MT4 and MT5 demo accounts remain active for 60 days from the date of creation. Once a demo account expires, you’ll need to create a new one through your Secure Client Area.

If you have a live funded account, you can request that your new demo account be set to non-expiry. In this case, the demo account will remain active as long as you use it at least once every 90 days. To make this request, simply contact our support team at any time.

Platforms and tools

Simply right click on any pair in the 'Market Watch' window of your MT4/5 platform, and click 'Show All'. This will enable all symbols on your platform, and you can scroll through the symbols to find the pair you wish to trade.

You can find and download all our available smart trader tools for MT4/MT5 here.

In order to retrieve your journal logs in MT4/5, simply go to File, Open Data Folder, then open 'Logs' folder. Steps of the process can be found here.

For your convenience, we offer a selection of calculator located in your Secure Client Area. To access them, simply log in, click on “Trading Tools” on the left navigation panel and click on the calculator you wish to use.

MetaTrader 4/MetaTrader 5

First ensure that you have a MT4 trading account in your Secure Client Area. If you don’t, you can check How do I open another live account?

To login to your account on your computer, please try the following:

- in MT4, go to File > Login to Trade Account

- enter your trading account number and associated account password

- do not select anything from the drop-down in the server field and instead, type exactly with your keyboard: edgeXX.pepperstone.com

To login via the MT4 mobile app; please try the following;

- In MT4 app, go to Settings

- Select "New Account" and then select "Login to an existing account"

- Tap on the server search field and type: pepperstone-edgeXX.

- Enter your trade account number and associated account password

First ensure that you have a MT5 trading account in your Secure Client Area. If you don’t, you can check How do I open another live account?

To login to your account on your computer, please try the following:

- in MT5, go to File > Login to Trade Account

- enter your trading account number and associated account password

- do not select anything from the drop-down in the server field and instead, type exactly with your keyboard: “mt5-1.pepperstone.com” for a live account or “mt5-demo01.pepperstone.com”

for a demo trading account. To login via the MT5 mobile app; please try the following;

- In MT5 app, go to Settings

- Select "New Account"

- Tap on the server search field and type: Pepperstone

- Select the appropriate Pepperstone server (Pepperstone Group Limited)

- Enter your trade account number and associated account password.

- Log in to your Secure Client Area.

- Find the trading account you wish to change in the "Trading Accounts" section.

- Click on the settings icon

- Change your nickname and then "submit"

To see the steps of the process, click here.

To open a position on MT4/5:

-Click the "New Order" button from the Toolbar section at the top of the platform. You can also right-click anywhere within the Trade tab of the MT4/5 terminal and select "New Order" from the options that appear.

-In the Order window enter the details of the trade and click on the red Sell by Market button to open a short position, or the blue Buy by Market button to open a long position.

You can check the full process here.

To close a position on MT4/MT5, simply click on the “x” mark at the end of the order or right-click on the order and then select “close order”.

You can simply right-click on the position you wish and then select “modify position”.

To generate a trading statement using MT4/MT5, follow the below steps:

Step 1 - Open your MT4/5 platform

Step 2 - Click Account History tab near the bottom of the platform

Step 3 - Right click on any historical trade

Step 4 - Select your time frame of; All history, 3 months, last month or select custom to enter your dates manually and click OK

Step 5 - Right click again on any historical trade

Step 6 - Click 'Save As' report and save in your desired location

Ensure that the trading server is correct and that you manually type it. If you receive the “Authorization failed” error message it means that the server name or password is incorrect. If the server you are using is correct, please change your trading account password and try again. As a final troubleshooting step, you can delete and re-install the trading platform.

If you can successfully log in to the trading platform, it is highly possible that you have logged in with an Investor password. Logging in with an investor password sets the trading account in a “read only” mode. Please change your password and try to log in again. You should then be able to trade successfully. If you receive the error message “No Money” it means that the required margin for the position is not met. For your convenience, we have a margin calculator available in your Secure Client Area, which you can access via the “Trading Tools” section on the left navigation panel.

TradingView

First ensure that you have a TradingView account, if you don’t have, you can create one in your Secure Client Area. How do I open another live account?

Then, it is really simple to log in to TradingView!

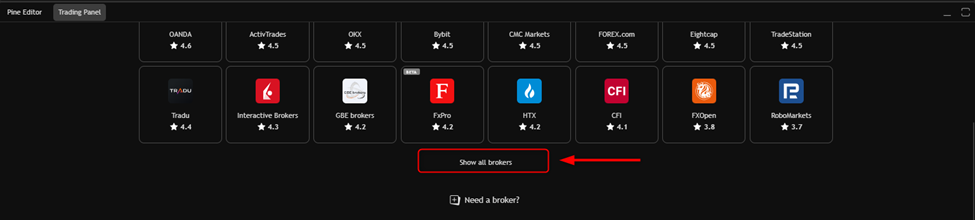

1: Log into the TradingView platform at https://www.tradingview.com/chart

2: Select "Trading Panel"and ensure that the Trading Panel is selected.

3: Find Pepperstone, click "Connect" and then you will be redirected to the Secure Client Area.

4: Log into your Pepperstone account and click on "Approve Access".

Done! You are now logged! Video for the progress can by found here

If it is the first time you are logging in, please make sure that you sign in TradingView first by clicking "Sign in" in the Top right Profile Icon. The TradingView email is the same as the one you use in your Secure Client Area.

To disconnect your Pepperstone account in TradingView navigate to Trading Panel > Click the Pepperstone logo > Click “Log Out Pepperstone"

Signing up to TradingView is Free! As Pepperstones TradingView accounts are Razor accounts commission is charged on every trade you make. Find out more about our razor commissions on TradingView here.

The TradingView website has a wide range of FAQs and tips on how to use the site here.

Please click at “Show all brokers”, find Peppertsone and start the connection!

Ensure that you have a stable internet connection and you can successfully log in to your Secure Client Area. Clear your cache and cookies or/and try to proceed from an incognito window.

You can also hard refresh the platform page by clicking ctrl + R. Ensure that you can successfully connect to your Secure Client Area and if you use an Antivirus, make sure that it does not have any marketing blocks.

In case of a 403 error, please refresh the page with ctrl + R or check your VPN/VPS settings. If you experience the issue in your mobile app, clear the cache and cookies of the application or delete and re-install it.

If the issue persists, you can always log in to the cTrader platform and manage your positions!

Ensure that you have enough margin to open the desired position. If you are receiving a “Not enough Funds” error message it means that the required margin is not met. For your convenience, we have a margin calculator available in your Secure Client Area, which you can access via the “Trading Tools” section on the left navigation panel.

Ensure that the Symbol you are trying to trade has “Pepperstone” tagged at the end. Certain instruments may have different symbols between brokers. You can also click on the “switch symbol” if you receive error message “Non-tradable symbol”.

Since Trading View is powered by cTrader, you will need to login to cTrader with your Trading View logins - in order to download the platform please login to your Secure Client Area.

If you prefer you can also generate a statement from the web version of cTrader.

Once you are logged in to cTrader you may use the steps below to generate a trading statement:

Step 1 - Open your cTrader platform

Step 2 - Click History Tab

Step 3 - Select your desired time period

Step 4 - Left Click on the green Statement button on the right-hand side

Step 5 - Click 'Save As' report and save in your desired location

To open a position in TradingView:

- Search for the symbol you wish to trade

-Right click anywhere on the chart and then add an order on the symbol. Alternatively, you can click on “Trade” next to the trading panel on the bottom menu. You can also use the one-click trading option.

You can simply click on the “x” mark at the end of the position or right-click on the order end then select “Close position”.

To modify a position in TradingView, simply click on the pen icon at the end of the order or right-click on the position and then select “modify position”.

If you experience any issues with TradingView, you can always manage your positions via the cTrader platform.

Please note that only the trades that were placed in the last 48 hours are displayed on the history tab of TradingView. In order to view any trades that were places passed that timeframe, you need to generate a trading statement via the cTrader platform.

cTrader Platform

Please be sure to be on the correct Platform: Pepperstone Group Limited cTrader. If you are using the incorrect platform, please go to your Secure Client Area and redownload the platform.

Please login with your cTrader ID which is your email address and the password you have set previously for this account. If you've forgotten your password; at the login screen, use your email and click on the 'forgot password' button to reset the password.

On cTrader, you can select the 'New Order' button from the top of the platform or from the 'Positions and Orders' window. Finally, enter the details of the position and select 'Place Order' at the bottom of the 'Create Order' window to open the position.

You can simply click on the “x” mark at the end of the position or right-click on the order end then select “Close position”.

Step 1 - Open your cTrader platform

Step 2 - Click History Tab

Step 3 - Select your desired time period

Step 4 - Left Click on the green Statement button on the right-hand side

Step 5 - Click 'Save As' report and save in your desired location

Pepperstone Webtrader

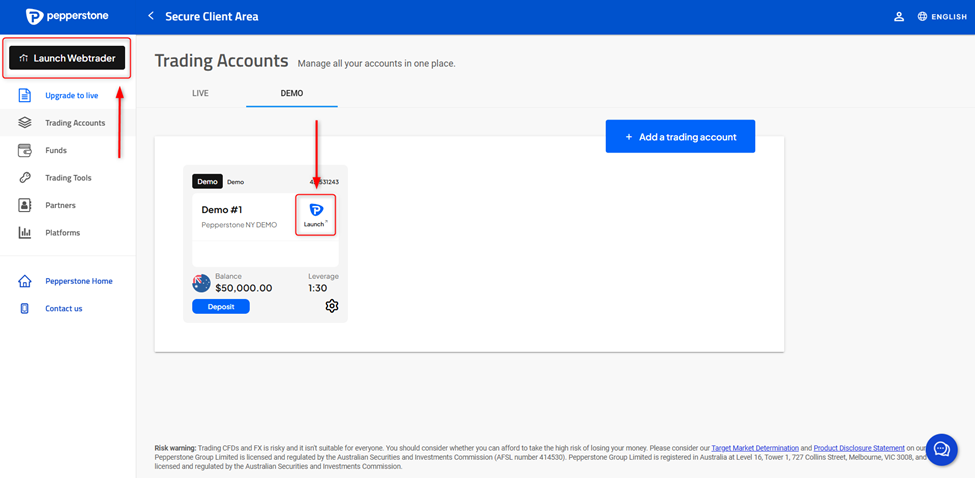

Simply Log in to your Secure Client Area and find your trading account, you can then click on “Launch” and you will be redirected to the Webtrader platform! You can also use the “Launch Webtrader” button on the left side navigation panel.

Personal watchlists and charts have a search field at the right of their title. This field will either be filled with “Symbol” or with the symbol of the instrument currently displayed. Steps of the process can be found here.

-Search for the symbol you wish to trade in the search bar menu under your Watch List.

-After clicking on the Symbol’s name, it should appear in your Watch List.

-You can then right-click on the symbol to place a position. Alternatively, you can right-click on the chart of the symbol and place a trade.

-To close a trade, select the “Positions tab” to view your open trades, select close and confirm your decision to close the trade.

You can display positions in a panel of its own or in a panel shared with other data. To display positions in a panel of its own, click Positions on the main menu bar or by clicking Portfolio on the main menu bar and selecting Positions.

You can display a watchlist in a separate panel or from a tab added to a currently displayed panel (where the panel can be of any type, such as Positions, Orders etc.). You can also display a watchlist in list view or tiles view.

To display a watchlist as a separate panel click on Watchlist at the top left of your screen, click the arrow to the right of All Products at the top left of the panel. Then select My Lists from the menu that appears and choose the watchlist you want to display.

To display a watchlist from another panel click the + sign at the right side of the currency name displayed on that panel. Then select Watchlists > My Lists > Select the name of the watchlist you want to display. A tab with the name of the selected watchlist appears on the header row of the panel. Click that tab to display the watchlist.You can display positions in a panel of its own or in a panel shared with other data. To display positions in a panel of its own, click Positions on the main menu bar or by clicking Portfolio on the main menu bar and selecting Positions.

In order to generate a trading account statement:

-click "Portfolio" near the top left of the window.

-Select "Account Statements" from the menu that appears and select the period of interest.

-Then click "Generate Statement".

Note: The swaps shown on the lower section of your statement reflect the swaps from the trades that were opened during the selected timeframe of your statement. Swaps that applied on all trades during the same period are shown in the top section.

To modify a Stop Loss or Take Profit display your positions and double-click on the relevant position. Then make your changes and click Modify.

Pepperstone Trading App

The way you submit a trade depends on whether you are using the standard multi-step approach or One-click trading. Note that One-click trading can only execute at-market trades.

To place a trade on the mobile app using the multi-step approach, display the instrument you want to trade and tap the Sell or Buy button at the bottom of the screen. Select the order type, enter the lot size you want to trade. If you are making a Limit or a Stop trade, ensure you enter a price in the relevant field.

For Limit or Stop orders, the order lifetime defaults to Good till cancel. To change the default, tap and select either Good till day or Good to date. If you select Good to date, you will also need to specify the date. To complete your order, tap Buy or Sell at the bottom of the screen. Depending on your notification settings, you may receive a notification when a Limit or Stop order is executed. To place a trade using One-click trading follow the steps below:

- With One-click trading enabled, display the instrument you want to buy or sell.

- Tap in the Lots field at the bottom left of the screen and enter the number of lots you want to trade.

- Tap Sell or Buy.

One-click trading can be enabled only after accepting a particular set of terms and conditions. Note that ‘One-click trading’ is a general term referring to a simplified way of placing an order. The Pepperstone app does require more than one step, although fewer than the default multi-step mode. To enable or disable One-click trading tap on the profile icon at the top right of your screen and select Settings. Slide the One Click Trading slider right (to enable it) or left (to disable it). Ensure you read the disclaimer notice that appears before accepting it. One-click trading can be enabled only after accepting a particular set of terms and conditions.

Method 1: You can click on Portfolio and select Positions. Then to close all open positions you can tap Close All and again select Close All on the confirmation message.

Method 2: To close one or more positions, with positions listed individually tap the trash icon beside the position/s you want to close and tap Close All.

Method 3: To close one or more positions, with positions listed individually, tap the positions you want to close and tap Close at the top right of the screen and select Close All.

Understanding trading conditions

Yes, we proactively monitor our exposure, hedging internally when we can but also using multiple external providers to hedge with when the market risk goes beyond certain limits. This model allows our clients to enjoy seamless execution speeds, as orders being matched internally will result in extremely fast execution, with low levels of slippage regardless of the trading session or time of day. More information about our hedging policies can be found in our Legal Documents.

We do offer negative balance protection to all retail clients! You can find more information here.

Please keep in mind that a Stop Loss, Take Profit, or pending Stop/Limit order is only ever a trigger level rather than a guaranteed entry or exit point for your trade. At Pepperstone we do not provide guaranteed pricing, rather we provide price feeds directly from our Liquidity Providers and your orders are executed as market orders at the best available price depending on liquidity in the market at the time. During periods of high volatility, rapid price movements are common, and price levels can change in milliseconds. You may receive a price that positively or negatively impacts your trade, and this is known as 'slippage'. It's an inherent aspect of trading, as the market order that's sent to close your trade will be executed at the next best available price or the fair market value.

We're here to help

Pepperstone's Customer Support is available 24 hours on weekdays and 18 hours on weekends.

Our advisors are only an email, call or message away from assisting you on your trading journey.

Local call: 1300 033 375 | International: +61 3 9020 0155

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.