Summer Of Easing To Support Risk And The Greenback

The ‘summer of easing’ is something discussed at length recently in these pages, though in the central banking world summer appears to have arrived early, with the Swiss National Bank (SNB) having become the first G10 central bank to deliver a rate cut this cycle at their March meeting, as domestic inflation settles towards the bottom of the SNB’s target range.

Nevertheless, although the SNB may have won the ‘race’ to deliver the first cut, other G10 central banks remain highly likely to follow in relatively short order.

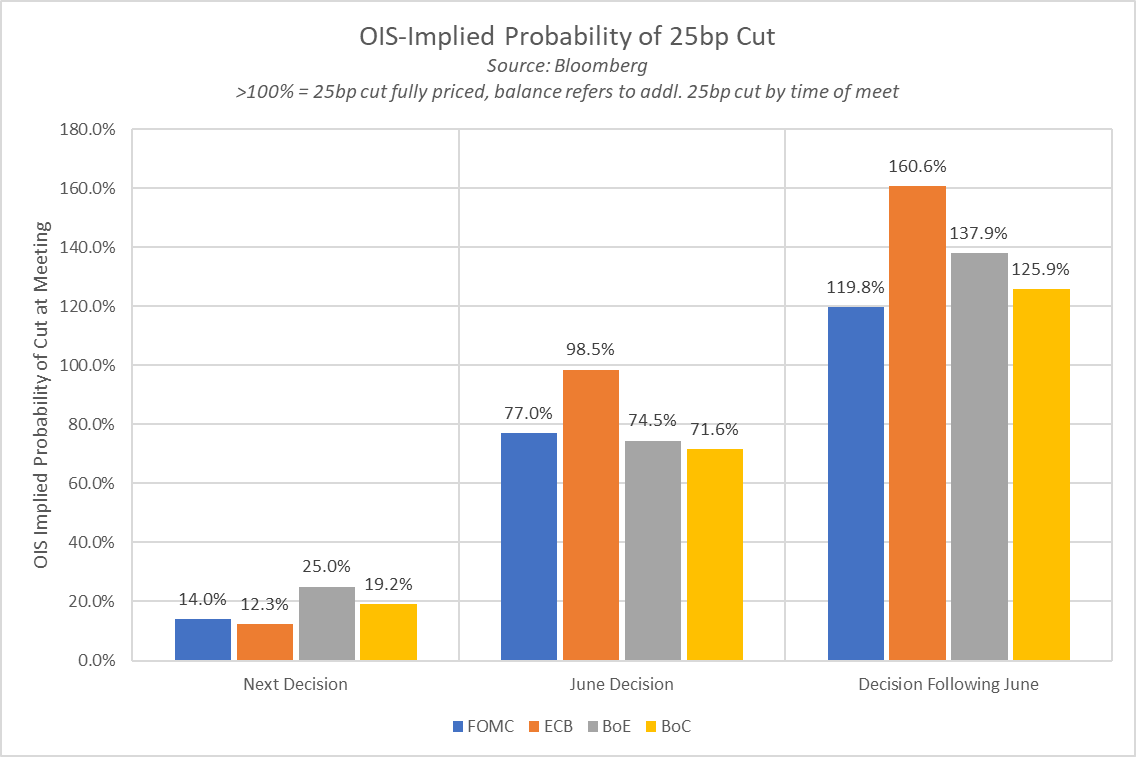

The ECB, for instance, have all but pre-committed to a rate cut in June, despite retaining a data-dependent pretence; the BoE seem likely to cut in June, with Governor Bailey having noted that rate cuts are now “in play” at future meetings; while the FOMC are also likely to kick-off the easing cycle in early-summer, having appeared somewhat desperate to begin policy normalisation last week, with the latest SEP pointing to unchanged rate expectations (75bp cuts this year), despite an upwardly revised inflation outlook.

As discussed previously, with the policy backdrop set to become increasingly supportive, equity volatility should remain relatively limited.

This is not to say that there are no risks present – clearly, there are, both from a geopolitical standpoint, and an economic one, particularly as services inflation remains sticky. Instead, it is to say that looser monetary policy (via both rate cuts and an end to quantitative tightening) should, to a significant degree, work to insulate risk assets from significant adverse shocks.

Furthermore, one must recall the central bank put that is once more in place, with inflation back at, or within touching distance of, the 2% target in most DM economies. This means that, if such an adverse shock were to eventuate, policymakers possess the ability to cut significantly, and deliver liquidity injections if necessary, to further insulate both the economy and markets.

In short, while dips, or even deeper pullbacks, cannot be ruled out, and would in fact be healthy to remove potential froth from the market, they should remain short-lived, and relatively shallow in nature. Hence, the path of least resistance for the broader market should continue to lead to the upside, with vol subdued.

The same, however, cannot be said for the FX market. Some signs of renewed life have already begun to emerge, with JPM’s G7 FX vol index spiking to a 6-week high – though, it must be said, much of this move was driven by higher JPY vol over the BoJ, and has since subsided.

This may, however, prove to be a small taste of things to come as the ‘summer of easing’ progresses.

While the direction of travel for all G10 central banks, bar the BoJ (whose 10bp hike is insignificant), is one towards easier policy, and rates moving back to their neutral level, said policy normalisation will take place at differing speeds, and to differing magnitudes, opening natural policy divergences for traders to take advantage of.

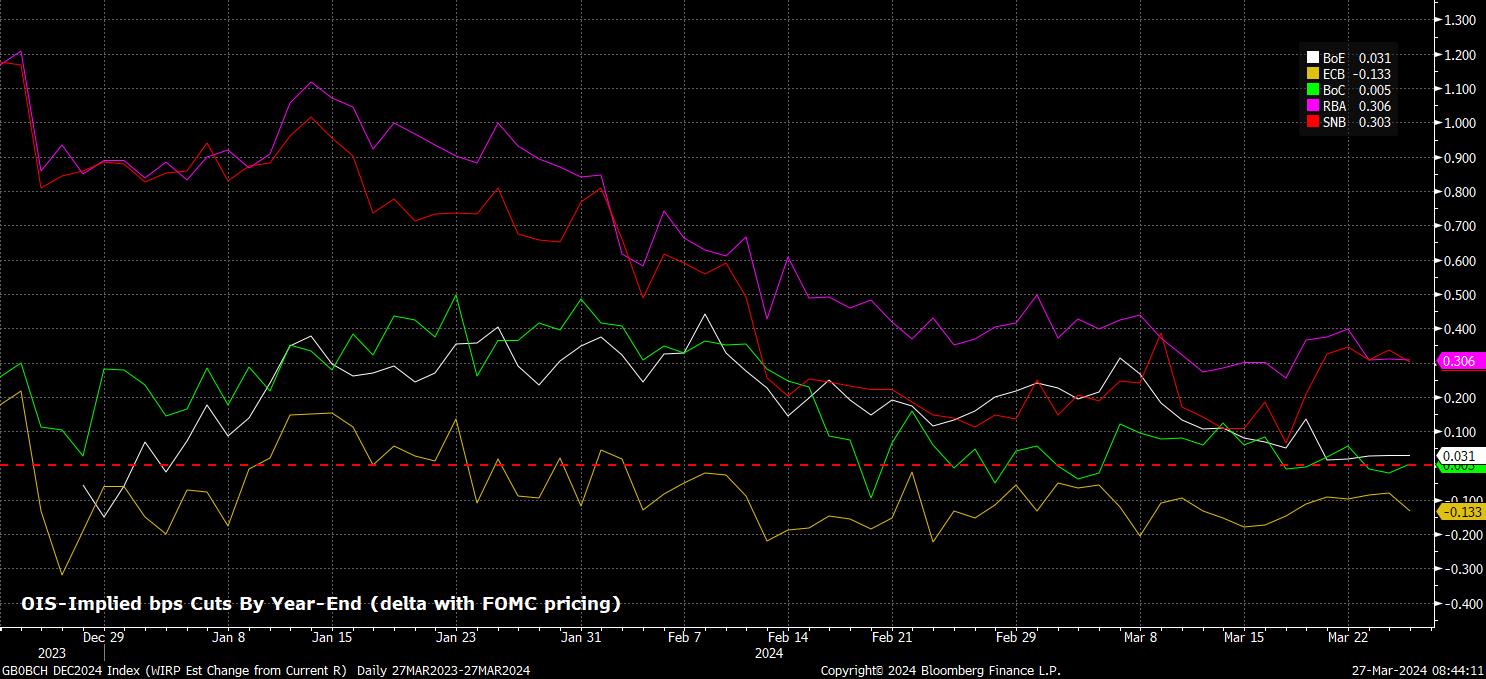

Comparing the market-implied pace of easing for various G10 central banks to that implied for the FOMC helps to illustrate that point; though, interestingly, OIS currently implies that only the ECB, and the BoC, will ease to a greater degree than Powell & Co. over the remainder of 2024.

This pricing, however, should not be taken as gospel alone.

One must also consider the direction in which risks to the policy path tilt. On this note, one would argue that for the FOMC, risks to the market-implied path are biased in a more hawkish direction, with services inflation remaining sticky, CPI continuing to print hotter-than-expected, and with just one FOMC member now pinning their ‘dot’ below the median expectation, compared to five last time around.

In contrast, elsewhere, risks appear biased in a substantially more dovish direction. This is especially true of the ECB where, although the first cut remains likely to be delivered in line with that of the FOMC in June, dovish overtures from Governing Council members are growing increasingly loud. The same can be said of G10 central banks elsewhere – fragile domestic property sectors raise dovish risks for the BoC and RBNZ, along with the BoE, while the Riksbank have already flagged that it is “likely” a cut can be delivered as soon as May if the inflation outlook remains favourable.

Logically, one would therefore expect yield spreads to move back in the greenback’s favour as the ‘summer of easing’ gets underway, helping to support the next leg higher in the dollar’s recent run, as the FOMC become something of a hawkish outlier among G10 peers. While the USD and equities rallying together is unusual, such a scenario remains the base case for now.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.