- English

- 中文版

Overall, it seems unlikely that the Budget will substantially move the needle in terms of the UK economic outlook. While tax cuts were delivered, namely via a second straight 2pp cut to employee national insurance, and some tweaks to the child benefit regime, such moves seem unlikely to substantially shift the balance of risks facing the economy, which continues to display relatively anaemic growth, even if the recession into which UK Plc. fell at the end of 2023 is likely already over. Naturally, fuel duty was also frozen, as it has been every year since 2011, while many will also cheer the freeze in alcohol duty for the next 11 months.

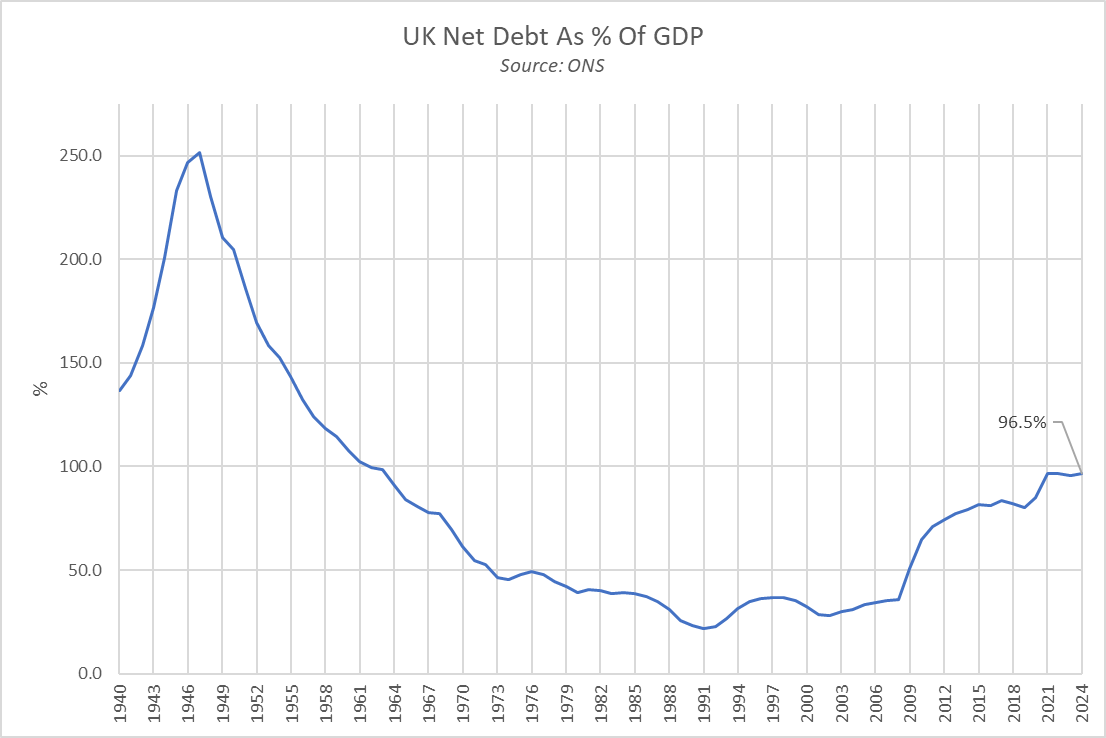

Nevertheless, in a reflection of the continued fragile state of the public purse, these modest tax cuts – which amount to a giveaway of just under £13bln in the 2024-25 fiscal year, and around £10.5bln in the following 12 months – were accompanied by an incredibly long list of tax increases. Thee include a new duty on vaping, higher tobacco duty, higher airfare duty, removal of tax relief on holiday lets, an extension of the oil & gas profits levy, and the abolition of the ‘non-dom’ tax regime.

For a ‘tax cutting’ budget, that is a very, very long list of tax hikes. Furthermore, the Budget produced no traditional ‘rabbit out of the hat’, with the UK’s rather perilous fiscal backdrop meaning that both the rabbit, and the hat, were presumably unaffordable.

The OBR’s latest economic forecasts, which as always must be taken with a healthy pinch of salt, paint a picture of why said increases were deemed necessary. When all Budget measures are considered, the OBR see the Government meetings its fiscal rules with just £9bln of headroom, far less than the historical average, and leaving little further wriggle room for any further pre-election tax cuts that the Chancellor may wish to deliver in the autumn.

Sticking with the OBR, the body produced a surprisingly upbeat economic outlook. Headline inflation, per CPI, is seen falling back below the 2% target within the next few months, broadly in line with the BoE’s expectations, with the aforementioned fuel and alcohol duty freezes both knocking around 0.2pp off headline inflation over the next year.

On growth, the OBR painted an outlook that is significantly more bullish than both the BoE, and the sell-side consensus. This year, the OBR see growth of 0.8%, double the sell-side consensus, and almost four times greater than the MPC’s forecasts indicated in February. In 2025, the OBR see a blockbuster – and, frankly, unrealistic – 1.9% pace of GDP growth, well above the sell-side median of 1.2%, and the BoE’s meagre 0.75% forecast. This is important as any downward revisions to GDP expectations will likely further limit the Chancellor’s room to manoeuvre and deliver significant further fiscal easing later in the year, before a likely Q4 general election.

As noted above, the Budget measures seem highly unlikely to materially alter the BoE policy outlook. Reduced national insurance contributions aren’t seen as inflationary, while the restrained degree of fiscal easing will further allay concerns that inflation could make a significant resurgence later in the year.

Consequently, and in keeping with recent times – bar, obviously, the ‘mini-budget’ of September 2022 – Hunt’s statement to the Commons caused relatively little by way of significant market volatility.

The pound traded ‘as flat as a pancake’ through the Budget, with little for market participants to trade off given the largely unchanged macroeconomic outlook, with cable remaining contained within the 1.26 – 1.28 range that has been, by and large, in place since the middle of last December.

_2024-03-06_14-01-56.jpg)

Gilts were similarly uninspired by Hunt’s measures, trading pretty much flat across all maturities, with any borrowing jitters also somewhat soothed by the year-ahead gilt remit being bang in line with market expectations at £265bln.

The same, unsurprisingly, can be said for UK equities. While the FTSE 100 did briefly probe new day highs as Hunt spoke, those modest gains fizzled as remarks continued, particularly as modest strength in the homebuilding, and hospitality, sectors faded as rapidly as it had come about.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.