Analysis

BoE and Scottish Elections Preview

.jpg)

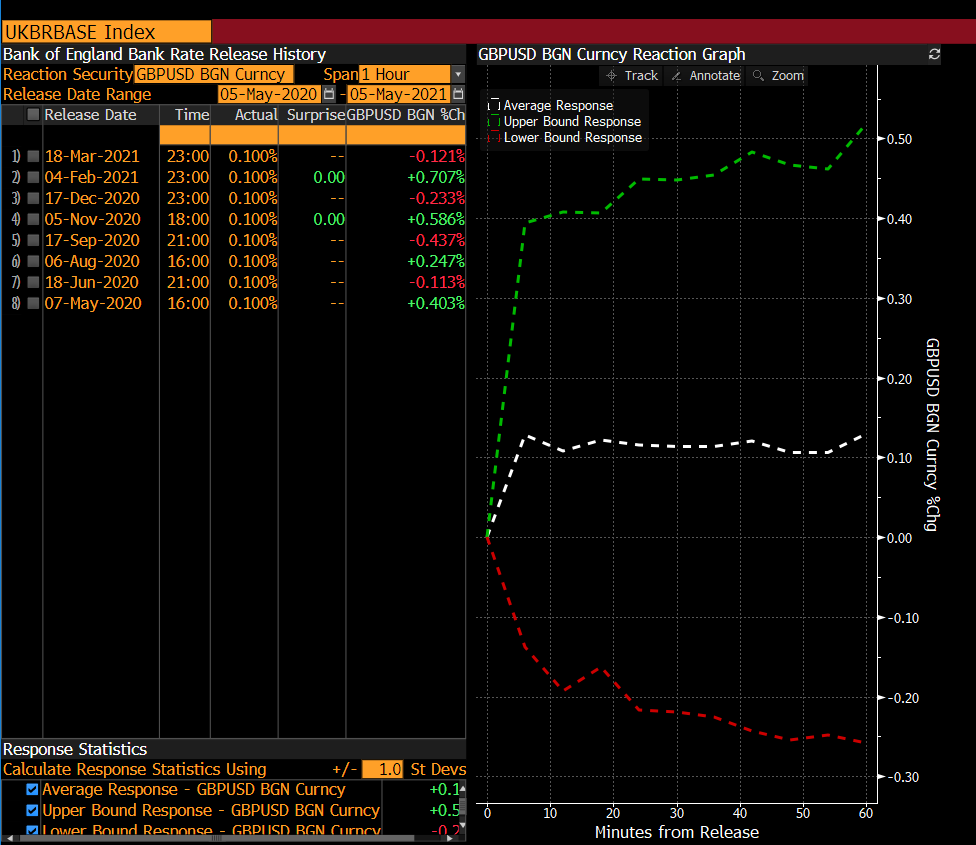

The below chart indicates how GBPUSD has reacted over the last 8 BoE meetings from just before the interest rate decision to an hour after. As we can see the average is about a 0.12/0.13% gain, with the lion's share of that gain coming in the first 10 minute window.

Source: Bloomberg

This BoE meeting will provide us with the bank’s updated quarterly economic projections. The big question mark the market is trying to get to grips with is – will the BoE taper at the May meeting or hold off until June? This is a tough call to make and clearly the market is uncertain about this as indicated by the many differing views amongst the major financial institutions. Will the BoE stand pat like the Fed and ECB or will the tapering baton be passed from the Bank of Canada to their commonwealth cousins here in the UK. At the November 2020 meeting when the BoE expanded their QE programme to £875 bln, they also gave their expectations on when asset purchases would conclude – circa end of 2021. At their current purchase pace of £4.4 bln a week, this timeline would be reached well before the end of the year. In my opinion, the BoE will want to avoid the liquidity taps being completely turned off in early H2. Which means they’re left with two options – 1) Implement a gentle taper in May and switch the pace to £3.25-3.5 bln a week 2) Hold off till June and make a larger cut to purchases, taking the weekly number to around £2.5-2.75 bln. Although a taper at this meeting may be construed as Hawkish (small bid in GBP crosses), it would be mild in the grand scheme of things and the market should be able to handle the small drop off. If they choose option 2, any concerns regarding financial conditions tightening should be brushed off as the economic recovery should be in full swing. Higher Gilt yields will be far more palatable as the economy will be in a much healthier position by the end of June. I think the BoE would like to avoid being placed in the hawkish basket next to Bank of Canada. The wiser strategy, would be to take a wait and see approach to observe how the full reopening progresses – both on the economic and virus front.

Speaking briefly about the new economic projections we will receive, the recent spate of economic data coming out of the UK has been robust as the economy emerges from the pandemic and has successfully hit the milestone of having over half their adult population vaccinated - keeping Covid at bay. Additionally, a faster than expected lifting of mobility restrictions, fiscal policy support announced at the Spring Budget, much smaller impact from Brexit and spillover effects from the significant US stimulus package have all been positive tailwinds for the UK. Taking all of these factors in combination we will see the BoE upgrade their economic forecasts. With a lower than anticipated hit in Q1 and faster normalization in Q2, full year estimates for 2021 could get quite a chunky upward revision. Goldman Sachs recently upped its UK growth forecast to 7.8% for 2021, outpacing the US. Also, in a recent interview with the Telegraph the deputy governor Ben Broadbent stated that the U.K. economy will see “very rapid growth at least over the next couple of quarters.” Could the UK economy reach pre-covid levels by the end of this year? Shifting to the labour market, the extension of the furlough scheme till September will undoubtedly see the peak in unemployment revised lower from the near 8% it was previously. I also think we could get a small tweak to inflation for 2021 above the 2% target. The real question is whether it stays there or pops higher and slides lower due to transitory factors.

Moving onto the other risk event - the Scottish Elections. I am certain a pro-independence majority will be achieved when combining support for the SNP, Greens and Alba party. What is not certain is whether the SNP will achieve a majority. A poll of polls from the Financial Times indicates they may struggle to get that majority, but it really is too close to call. Well respected poll guru, Sir John Curtice, recently opined that he believes there is less than a 1/3 chance the SNP secures a majority. Additionally, the latest polling data shows support for independence has been declining and Nicola Sturgeon’s approval rating has slid slightly. This could boil down to the UK’s superb vaccination rollout when compared to Europe and the very recent public spat between Alex Salmond and Nicola Sturgeon. However, the recent “cash for curtains” controversy which Boris Johnson seems to have found himself in could raise negative sentiment towards Westminster through a vote for the SNP. Another factor which may throw a curveball in this election is the very strong support for independence amongst the younger demographic in Scotland. Whether they choose to give their vote to the SNP or the Greens we will have to wait and see as results are released. Exit polls should be out on Thursday night around 10pm, giving us a good indication of the final results (due out Friday, but may be delayed due to covid). In terms of how this would affect the pound, if the SNP fails to secure a majority we could see a bid in sterling crosses as some anxieties are unwound in the currency market. However, if she does secure a majority we could see a knee-jerk reaction lower in the pound as the algos and systematic traders trade the initial headline news flow. I see the drop being quite short lived though as another referendum would be years away if it ever happened. Furthermore, Boris Johnson has explicitly stated he against granting another referendum. Morgan Stanley and Citi see the probability of independence from the UK at 15% and 35% respectively.

Price just can’t seem to overcome the 1.40 handle at the moment. Could tomorrow’s twin events be the catalyst to see this sticky zone eventually negotiated? The RSI recently had a go at piercing through the key 53 level, but has now rolled over and is moving sideways as of writing. Price is just above the 21-day EMA & 50-day SMA with the 50-day SMA just crossing below the 21-day EMA. In terms of chart patterns we have a small triangle pattern which has emerged, signifying a breakout in either direction is becoming increasingly likely. I’d like to see a move above the 1.40 level and back into the ascending channel to feel more confident on longs. From a seasonality perspective, the dollar is historically strong during the month of May, which could see Cable struggle to move higher throughout this month.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.