- English

- 中文版

The consensus view that US Q4 GDP may print 4% (annualised) may be a touch optimistic given the COVID-19 news flow coming out of the US, with hospitalisation rates rapidly on the rise and fiscal stimulus a hurdle in the near-term.

Oil is perhaps a better proxy here, but equity investors seem unconcerned and trade the 2021 bull story. With further rotation into value and momentum taking over as the central factor to trade – buy strong, sell weak they trade – a great place to start in any market when we’re focused on the short-term.

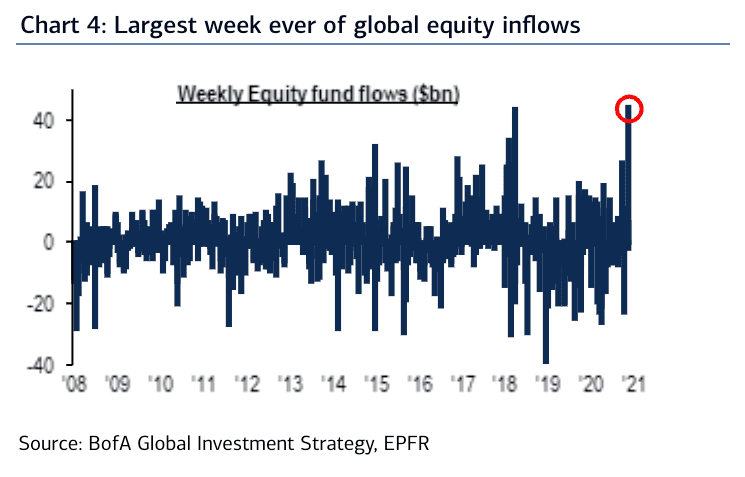

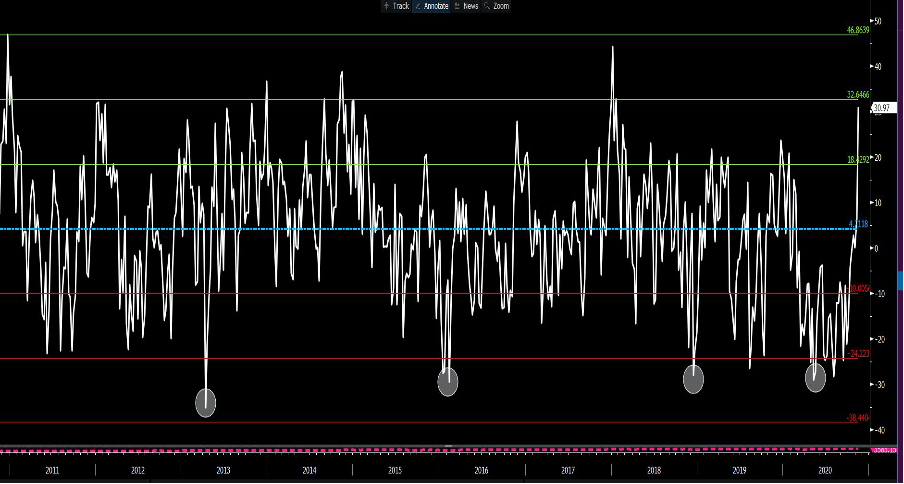

Inflows into equity funds printed $44.5b last week (source: EPFR) which is a record and corresponds well with record highs seen in the US500, US30, US2000 and Dow Transports. it’s hard to get a more bullish scenario than a market that trades at an all-time high.

There's certainly elevated chatter that potential shutdowns in the US will weigh more in the near-term and maybe so, but investor sentiment (source: AAII) is the most elevated since 2017 – two standard deviations of the mean of past 10 years. Market internals are strong in the S&P 500 (if we use this as a proxy) with 87% of share CFDs above the 200-day MA and 85% above the 20-day MA. Some will say this is a contrarian indicator and perhaps there's too much love for share CFDs, especially when we’ve seen rising insider selling from corporate executives.

AAII bullish - bearish sentiment

(Source: AAll)

Judging by the NYSE advance-decline line, we also see solid breadth and participation in the move with small caps outpacing large caps and cyclicals having outperformed defensives on the week. if the market is to respond to the US COVID-19 news in any meaningful way the internals (or price itself) are not aligned and neither are vols, with implied vol falling too and we see the VIX index closing at 23.1%.

As suggested, the oil market is looking less optimistic than equities here and price action suggests a risk of a further range-bound trade this week. That's true of the US bond market which will offer a clear vantage point on sentiment this week, especially with some many Fed speakers due out. Treasury yields were unchanged on Friday closing the week +8bp at 89.6bp (using the 10-year as a guide), but off the highs of 97.3bp. The reflation trade that can be seen in the equity market isn't being expressed in the bond market and yield curves have been subdued.

(Source: Bloomberg)

We also see global equities (ex-US) outperforming US equities of late and subsequently it seems that capital is being redistributed notably to EU equities which are on fire. With the Spanish IBEX gaining 13.3% in EUR terms and 13% in US terms last week alone. The EU Stoxx 50 outperformed the S&P 500 by 464bp in USD terms and perhaps this is a key reason why EURUSD remains steady and eyeing the double-bottom neckline at 1.1880 – a break here takes the move into 1.2000 which becomes interesting given the number of times ECB president Lagarde speaks this week.

The weekly implied move derived from options prices takes EURUSD into 1.1931 (with a 68.2% level of confidence), although any rallies into 1.2000 would be overdone this week and suggest countertrend and mean-reverting exposures.

GBPUSD also gets close attention this week post the departure of Dominic Cummings from his post, which raises the prospect of a trade deal with the EU at the margin. GBPUSD 1-week implied vol sits at 10.31% which is not elevated and the market is certainly not on edge for a big sudden move (in either direction). Chief negotiator Lord Frost, has warned that “we may not succeed” (source: the Telegraph) and this has lowered expectations ahead of this Thursday’s EU 27 leaders meeting. Trading a trade deal is tough, as you’re hoping for headlines that give confidence of at least some substance to debate into the EU summit and hope is never a great strategy. That said, if a deal is forged then cable could be re-testing the 11 November spike high of 1.3312 quite readily.

Keep an eye on AUDUSD exposures too with consolidation seen between 0.7330 and 0.7220. There’s an elevated level of event risk this week for traders to navigate, with RBA governor Lowe speaking today in Sydney at 19:40 AED, Guy Debelle following on tomorrow at 17:00 AEDT. We see the November RBA meeting minutes tomorrow, with October payrolls released Thursday with expectations that 30,000 jobs will be lost, the unemployment rate due to rise 20bp to 7.1% and the participation rate to stay at 64.8%. AUDUSD 1-week implied volatility sits at 9.57% and eyeing a drop into multi-month lows. For context, this implies a range of 0.7348 to 0.7194 (with a 68.2% degree of confidence). Keep an eye on the Hang Seng for guidance where the 20-day rolling correlation between the two variables sits at the highest since May.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.