- English

- 中文版

That means pitting monetary policy alongside fiscal to create a red-hot economy and nominal levels of GDP north of 6%. The real optimists would hope that we get such compelling levels of aggregate demand and a reduction in the output gap that wages, low and behold, increase. That would get the inflation hawks talking.

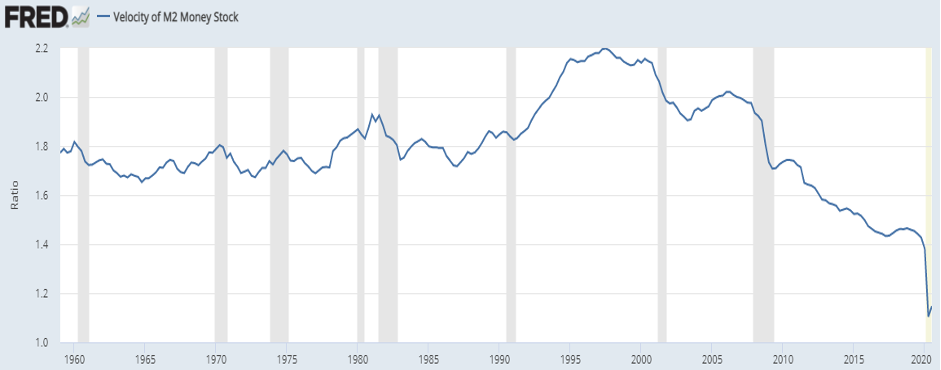

Another variable that would get the inflation hawks excited would be a pickup in the year-over-year rate of change in the velocity of money. We may have to wait until March or April to see a positive reversal and that will predominantly be because of base effects. However, should the market sense that the velocity of money is reversing as the US economy opens up and pent-up demand kicks in, and more USDs will be turned over more frequently, then that would be a huge development.

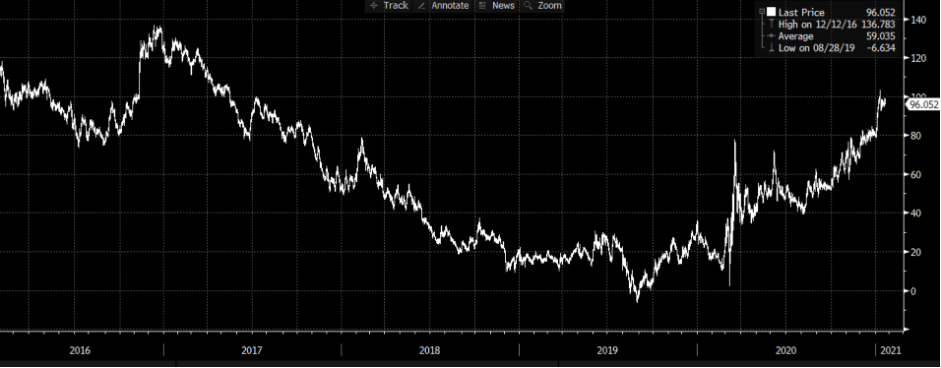

The risk of being long US Treasuries if the market sees the velocity of money turning higher is clear and this is where funds pile on short-duration positions and we see yields in 10s moving towards 1.50% by Q3/Q4. It’s here we see Treasury curves steepen, real rates rise and the debate more actively turns to whether the Fed look to impose measures to cap levels of the curve. Either through increased levels of bond purchases (QE) or yield curve control.

Yield curve control (YCC) has certainly been actively debated of late, notably after Janet Yellen’s comments that the level of US debt is high, but it's not an issue given interest rates are low. If yields subsequently rise and the pace of change picks up, then that debt may be an issue and the Fed may have to do more. If the market forms a consensus view that YCC is coming then I’ll be a seller of USDs or buyer of gold in size, as the market looks at the next leg higher in the Fed’s balance sheet.

Yield curve control, or bank profitability?

That said, the counter to that and a view I’m sympathetic too is that yield curve control hurts the banks. If you want to get the banks firing up and making money other than through managing financial markets flow then incentivize them to make loans – that means accepting a stepper curve which boosts their net interest margin.

So, the Fed seem stuck between a rock and a hard place.

Now, this is all well and good and something that will become a major macro consideration from March-April, which is when base effects kick in and the YoY change in inflation and velocity of money pushes higher. It's also when we should see the proposed Covid-19 relief fiscal stimulus passed through the Senate, although it’s unlikely to pass in its current form and we'll either see the size taken down to c.$1t or the DEMs will need to force a budget resolution. Either way, the inflation hawks would argue that $1t of fiscal stimulus will add an additional 5% to GDP. Again, a reason to think that we could be staring at a strong second half to 2021.

Yield spread between 10yr and 2-year US Treasuries

(Source: Bloomberg)

Short-term uncertainty needs to be managed.

Near-term, as fiscal expectations get walked back, the vaccine roll-out in the US is slower than anticipated and with the core of the Fed also push back on the notion of tapering its QE program, we’ve seen a better bid emerge in bond markets. US 10-year Treasury yields coming in from 1.185% to 1.085%, 10-year breakeven rates have pulled back to 2.08% and could possibly pull back to the 2% level as real-time economic data starts to moderate. We’re seeing a heavy tone in commodities which have been the poster child on inflation.

However, once we get past this stage though and the vaccine effort improves then things get interesting. Let’s not forget that the Fed are the biggest buyers of both US Treasuries and TIPS (Treasury Inflation-Protected Securities) and the difference between the two is the breakeven inflation rate – so in essence, one of the key measures for expected inflation is largely controlled by the Fed. Then recall that inflation expectations typically lead to actual inflation.

So big change is coming, but as part of a macro framework and we need to consider the trigger points for when the Fed’s language changes. One factor to recall is that the Fed’s reaction function has slowed under its new regime of average Inflation targeting. They are more evidence-based and want to see it before they believe it. Whereas, in prior cycles such as late 2018, their pro-active stance caused them to hike earlier. It’s for this reason why this week’s FOMC meeting will be an extension of the recent dovish narrative that they are in no rush to move policy.

My best guess is the Fed’s language will not materially change until April once we see fiscal stimulus, the economy starts to heat up and the vaccine efforts are more efficient.

It’s at this point that I see a real risk that US Treasuries sell-off, yields curves steepen and inflation expectations rise. Although topping out at 2.25%, subsequently real yields also rise at a gradual pace. ‘Gradual’ is fine for risky assets, it’s in a scenario that bond yields rise too quickly that would cause growth equities to be hit hard, as would gold with a rising USD becoming a major headwind for global financial conditions.

This seems unlikely as the Fed need stability in real rates and they need accommodative financial conditions. Therefore, an aggressive rise in real yields would need to be dealt with swiftly by the Fed or the market would take them to task.

Exuberance in equity markets

The froth in markets is there for all to see – the recent news flow may have been about inflation and growth (specifically in the second half of 2021), but the number of charts highlighting the sheer exuberance in equity markets has been incredible. Whether we’re talking ballooning margin debt, extreme market internals, exponential moves in non-profitable tech stocks or extreme holdings of call options from retail traders – there seems a concerted view that downside is limited and that the Fed has the markets back.

So, what causes a 15-20% correction in risky assets? For me, one consideration would be a renewed downturn in the US (and global economy), which seems unlikely as we’re talking a strong second half. Another would be a policy mistake from the Fed and inflation that causes real rates to rise too quickly. Again, something that can be managed but it would need to be done with precision.

While we could be in for a short-term period of uncertainty, which could lead to a higher USD, the road for the year ahead screams of growth and inflation and that’s the camp that I sit in. How the Fed deal with the bond market will be key.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.