- English

- 中文版

For example, the equity bulls see good support below 3920 on the US500 and a further push through 4039 takes the index to 4081. We see the NAS100 eyeing a bullish breakout on a close above 12,800 puts real credence to the bull flag.

A bull flag on the NAS100

Granted, the rally in the US500 has been built on a rotation into tech and defensive sectors – utilities, REITS, and staples - but we’re not yet seeing a rush to simply dump equity and the demand for equity volatility (as a hedge) isn’t overly high. Gold continues to bang into supply at $2000, while crypto consolidates but a closing break (in Bitcoin) above 28,500 and we should see 30k soon after.

Rotation aside, the combo of the market pricing 95bp of cuts from the Fed this year – perhaps optimistically – a falling discount rate, a lack of major conviction to see a standout currency and the Fed expanding its balance sheet (even if it is just temporary credit lines), are all reasons touted for the flow. Resilience in equity is the call.

The US and EU banks remain the central focus and we continue to watch data around weekly deposit flows, demand for credit from the Fed’s weekly liquidity operations (released Thursday) and importantly inflows into money market (MM) funds. Bank deposits continue to leave smaller banks and into MM funds, so the market will want to see signs these flows are abating to justify a real equity rally. Conversely, should we see further deposit outflows and see credit markets, specifically high-yield corporate credit, really deteriorate (everyone has been focused on commercial mortgage-backed securities) and equity could roll over and the USD will find its mojo.

Certainly, we see FX markets very sensitive to the price action in the banks and when EU banks underperform, we see EURUSD sellers and when EU banks work, we see EURUSD rally. We see interest rate expectations (priced between May and December 2023) increase whenever US banks sell off and gold and the USD are reactive to that. We also see rotation within the indices CFD and tech continues to work well and support the NAS100 and US500 – Nvidia, Microsoft and Meta are all working well and seeing solid momentum.

EU banks / US banks (via ETFs) vs EURUSD

Month and quarter-end and dealer hedging could play a big part this week too. looking at the calendar and the potential landmines for traders to navigate, how influential this data proves to be when the market is watching the tape of the banks is yet to be seen. I see benefit from reacting to moves in the KRE and XLF ETF, and the EU Stoxx 50 banks. We hear from a raft of ECB, BoE, and Fed officials and while everyone is doing the numbers around rising recession risk (caused by a higher cost of credit and a tighter supply of credit) the market is waiting for the economic trigger to justify the degree of cuts now priced in.

We've just heard from mega hawk Fed member Neel Kashkari, who has detailed the bank turmoil does raise recession risk, but will other Fed speaker open the door to share this view?

What’s on the event risk calendar?

Monday

Germany – IFO survey (19:00 AEDT) – the consensus eyes the ‘expectations’ survey to decline modestly to 88.3 (from 88.5), while the ‘current assessment’ survey is expected at 94.1 (from 93.9). Hard to see this impacting the EUR in any great capacity, with the EUR closely tracking the EU Stoxx bank index.

EU - M3 Money Supply and private sector credit (19:00 AEDT) – Not typically one I would look at too closely, but any intel on deposit and credit flows will get a stronger look in given the intense focus on EU and US banks.

Tuesday

EU – ECB Schnabel speaks (02:00 AEDT) – one of the more insightful members on the ECB, Schnabel may offer insights into the recently released money supply and credit data and any insights into financial instability risk could move the EU banks, and by extension the EUR.

UK – BoE gov Bailey speaks (04:00 AEDT) – UK rates price 16bp of hikes from the 11 May BoE meeting (64% chance of a hike), with 29bp priced to peak expectation of 4.45% in August. Let’s see if Bailey moves the dial here – GBPUSD has a 1.2300 – 1.2200 range in play, and happy to be guided by a break.

Aus – Feb retail sales (11:30 AEDT) – the consensus sees Aussie retail sales at 0.1% (from 1.9% in Jan), so a decline in the pace of growth is expected. With just 1bp of hikes priced for the May RBA meeting the market is confident a pause in the hiking cycle is upon us - I see this data point as a non-event and the AUD has other factors to consider this week and will take its lead from equity moves and broad risk sentiment.

Aus – RBA Connolly speaks (16:15 AEDT)

US – Fed member Jefferson speaks on monetary policy (08:00 AEDT) – US swaps price 4bp of hikes for the May FOMC meeting, so the market – perhaps prematurely - is confident the Fed is done hiking and may soon embark on an easing cycle. Unlikely the market alters its pricing on Jefferson’s speech, but any clear insights into his framework for easing could impact the USD. Conversely should Jefferson play up the inflation risk and say the Fed have more to do could see the yield curve bear flatten, USD strength and US banks under pressure.

UK – BoE gov Bailey testifies on SVB Financial (19:45 AEDT) – will get some attention, although having just recently spoken to the markets new insights may be lacking.

Wednesday

US – CB Consumer Confidence (01:00 AEDT) – the market expects the confidence print to drop to 101 (from 102.9) – there will be an increased focus on consumer trends moving forward and this survey is one that could be influential, but for now, unless this is a big beat/miss I am sceptical this proves to be a vol event.

US – Vice-chair of Supervision Michael Barr testifies to the Senate Banking Panel (01:00 AEDT) – there will be an ongoing focus on deposit insurance so any comments here could move the market, as will further colour on how he sees the recent credit channel offered to US banks.

AUS – Feb (monthly) CPI (11:30 AEDT) – the market eyes the monthly inflation at 7.2% (from 7.4%) which would add confidence to the market pricing, where we start to price cuts from June and see a full 25bp cut priced by October. This monthly CPI read would essentially cover c.80% of the quarterly Q1 CPI basket (released 26 April)

Thursday –Fedrelease factors affecting reserve balances (H.4.1 report) and take up from banks of liquidity from the BTFP, and the discount window.

Germany – CPI (23:00 AEDT) – the market eyes headline CPI at 7.3% (from 8.7%), and EU harmonised at 7.5% (9.3%) - both metrics are expected to head lower, and the outcome could influence the EU CPI print seen on Friday. We currently see 16bp of hikes priced for the May ECB meeting, so this could influence that pricing and by extension the EUR.

Friday- Month and quarter end

US - core PCE inflation (23:30 AEDT) – the market is eyeing 0.4% MoM / 4.7% YoY (the economist’s range is seen between 4.9% and 4.7%) – while this is an important data point for the Fed, with inflation temporarily superseded by bank credit data, deposit, and money market flows, unless this core PCE is a big beat/miss then the influence on markets may be limited. US core CPI is seen on 12 April and that be influential on markets - one for the diary.

Japan – Tokyo CPI (10:30 AEDT) – the market expects inflation at 3.2% YoY (from 3.4%) and core CPI at 3.1% (3.3%) – so more signs that inflation in Japan has peaked, validating Kuroda’s dovish stance. USDJPY has good support between 130.60 to 130.00 and keeps a strong focus on US v Japan yield differentials, but I will keep an eye on both Japan's 10yr JGB and 10yr swap rates.

China – Manufacturing and services PMI (12:30 AEDT) – the market eyes the manufacturing index at 51.8 (from 52.6) and services index at 54.3 (56.3) – some heat coming out of the data flow which will disappoint those hoping for more from the reopening. Have limited concern holding positions over this data point.

EU – CPI estimate (20:00 AEDT) – the market expects inflation to fall to 7.1% (from 8.5%), with core at 5.7% (5.6%) – one of the marquee data points for the week. While the tone will be set from Spain and German CPI, the EU aggregate CPI print could influence the EUR, although price action in the EU banks could get a bigger look in. We see 16bp of hikes priced for the 4 May ECB meeting.

EU – ECB president Lagarde speaks (02:00 AEDT)

Mexico – Mexican central bank meeting (Sat 06:00 AEDT) – consensus expects the overnight rate to increase 25bp to 11.25% - all 11 economists surveyed by Bloomberg calling for the 25bp hike. While a hike is priced, I still like USDMXN lower from here.

US – Fed members Williams (Sat 06:05 AEDT), Waller (7 am AEDT) and Cook (08:45 AEDT) speak.

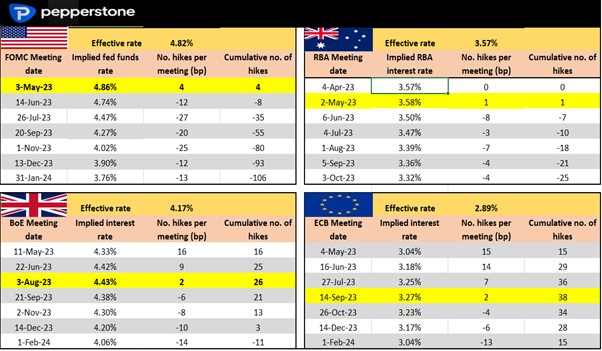

Rates Review – we see what’s priced into markets for the upcoming meeting, and the step up per meeting (in basis points) going forward.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.