- English

- 中文版

What is it about Mondays that the equity market loves so much?

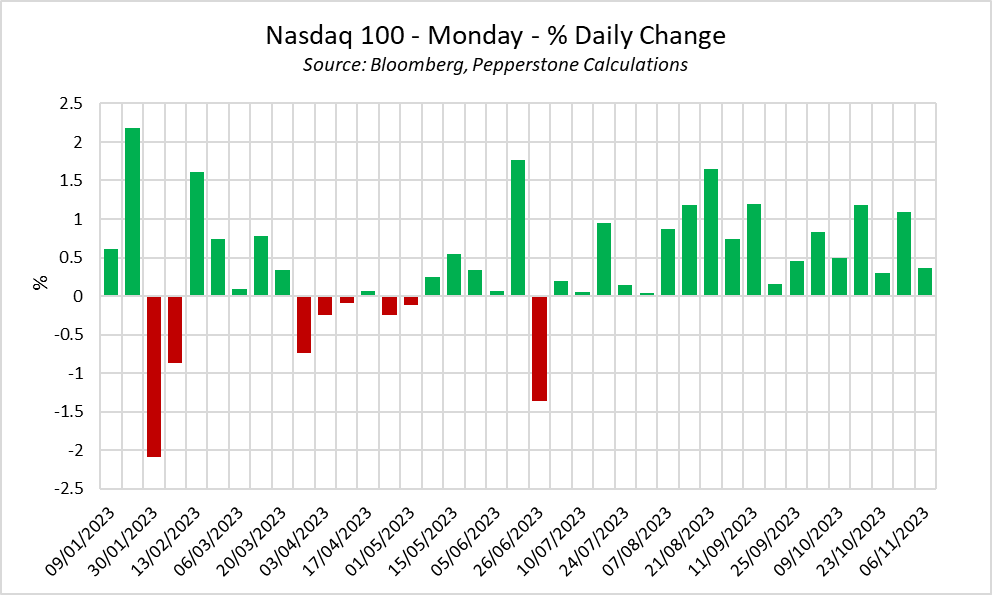

The question springs to mind given the recent strong performance seen to start the week on Wall Street. The tech-heavy Nasdaq 100, for instance, has now notched a Monday gain for 18 weeks in a row, a stretch extending back to the start of July.

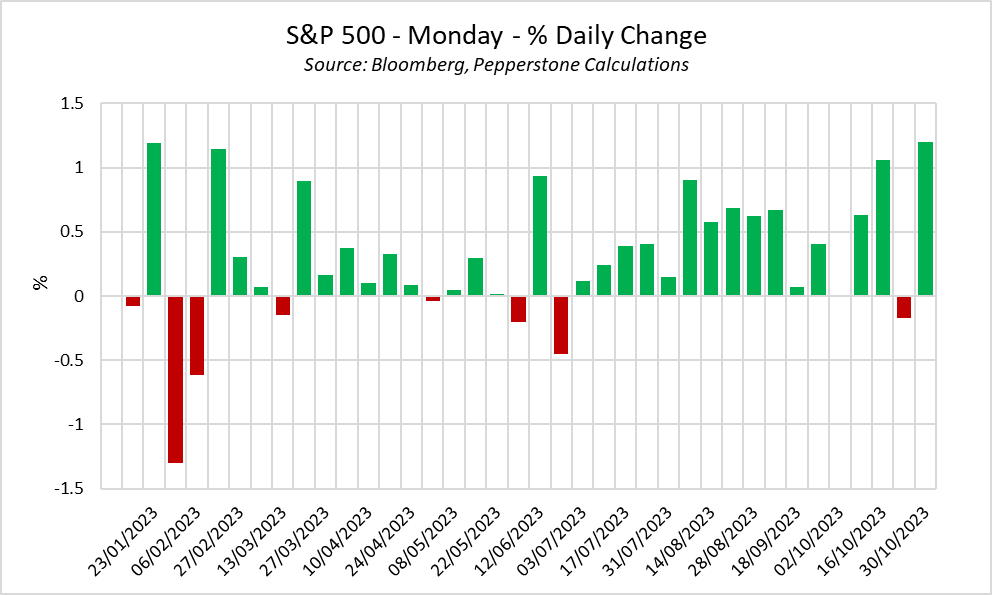

A similar trend is seen if one looks at the broader S&P 500, suggesting the phenomenon is not solely isolated to the tech sector, with 17 of the last 18 Mondays having seen a daily gain.

Logically, one then begins to ponder the reasons why such a trend may be taking place. Interestingly, it appears there is little link between performance on a Monday, and that seen on the prior Friday. For the Nasdaq, those 18 Monday gains have been preceded by 9 green, and 10 red days to end the week. It seems, then, that one can’t tie a Monday gain in with de-risking prior to the weekend; though, particularly of late, perhaps gains to start the week are a ‘relief rally’ amid, thus far, a lack of market-moving geopolitical escalation taking place over the weekend.

This leads one to think about other potential catalysts allowing riskier assets to start the week on the front foot. One could be the typically quiet economic calendar, with top-tier figures and the majority of central bank decisions tending to be released later in the week. This quiet calendar could, in the absence of other news-related catalysts, lead markets to take the ‘path of least resistance’ which, often, leads higher for equities.

Whatever the reason, it seems unlikely that such a phenomenon can last forever. Nothing is constant in financial markets and, as has been observed with events such as month- and quarter-end FX fixings in recent times, edges erode as market participants attempt to front-run expected moves.

In any case, Monday or not, the outlook is starting to look rather more constructive for risk assets, with long-end Treasuries having backed off around 50bp from the cycle highs seen in mid-October, and markets now firmly of the belief that the Fed’s hiking cycle is done & dusted. That said, futures continue to price as many as four 25bp cuts by Jan 2025, a pace that seems rather too punchy, though the probabilistic nature of rate pricing over such a duration means the signalling power of such pricing is limited.

As mentioned, though, the bulls look to have managed to wrestle back control of proceedings in the S&P 500. Price has now reclaimed both the 50- and 200-day moving averages, closing above the former for the first time in six weeks, as earnings season comes to an end, with around four-in-five of those firms to have reported beating consensus EPS expectations.

4,400 stands out as the next upside barrier through which the bulls will have to break, above which lurks the 100-day moving average around 4,430. With seasonals likely providing a favourable tail-wind into year-end, 4,500 may soon be within the market’s reach, with support stemming from the aforementioned moving averages to the downside, as well as the August 2022 highs around 4,325.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.