- English

- 中文版

Analysis

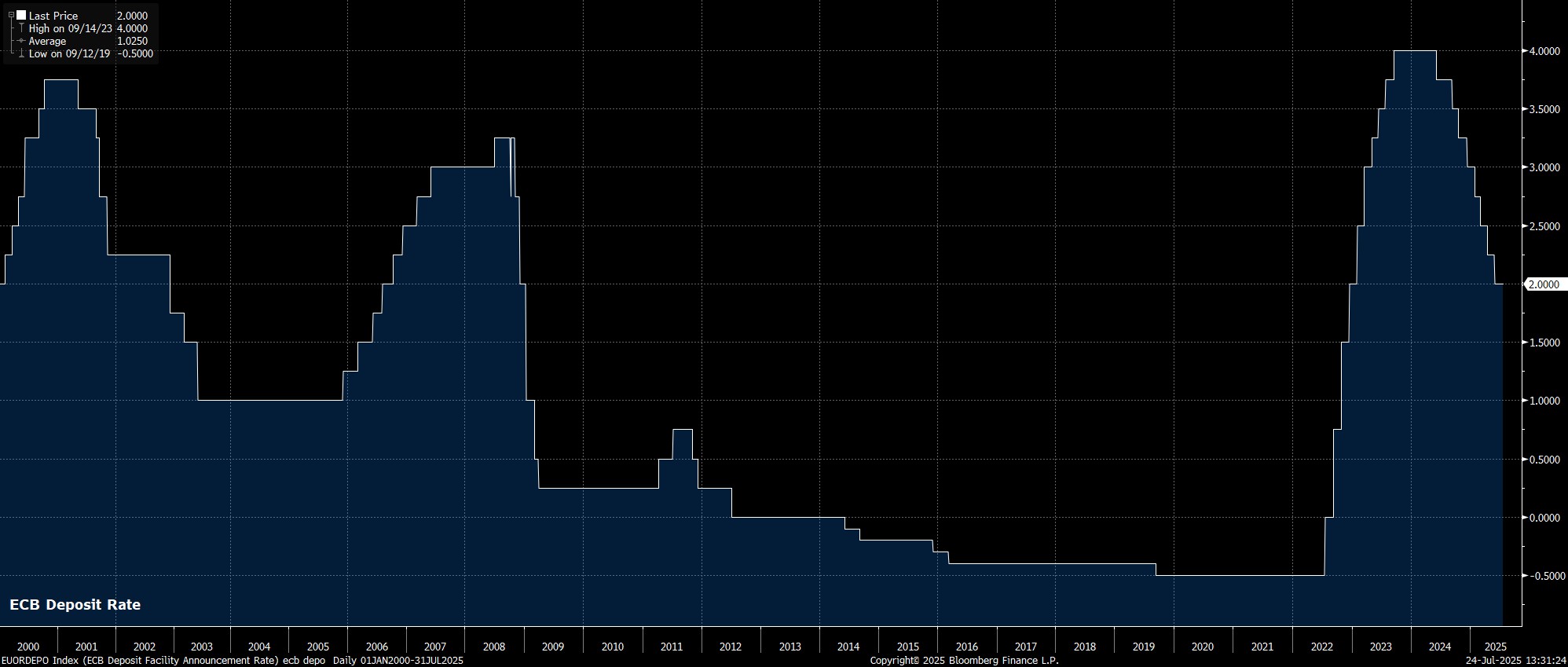

To nobody’s surprise, the ECB’s Governing Council decided to stand pat at the July meeting, holding the deposit rate at 2.00%, marking the first meeting in a year where policymakers have not taken any rate action, as the GC hit ‘pause’ on the easing cycle, having delivered eight cuts over the last 13 months.

The accompanying policy statement also brought very little by way of fresh, or surprising, information.

Once again, policymakers stressed that a ‘data-dependent’ and ‘meeting-by-meeting’ approach will continue to be followed when it comes to future policy decisions, while also reiterating there is no ‘pre-commitment’ being made to any particular rate path. Guidance of this ilk is not only incredibly familiar at this stage, but also allows the ECB to maintain as much optionality as possible, which remains a logical approach given the elevated degree of uncertainty which continues to cloud the economic outlook.

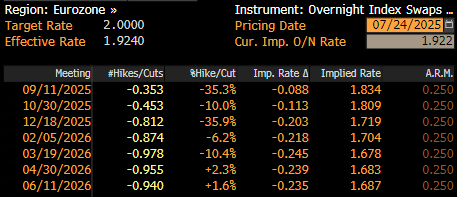

Current market pricing, which implies that just one further 25bp cut will be delivered this year, seems about right, given where risks currently lie, both in terms of trade, but also the relatively lofty valuation of the EUR.

In any case, not only were both the decision itself, and the policy statement, in line with market expectations, they were also very much in keeping with the pre-meeting ‘sources’ stories that had been doing the rounds. Again, these reports nodded towards a preference among policymakers to maintain flexibility, as well as a desire to act only on concrete information, as opposed to whatever the latest tariff threat from the Oval Office may be.

President Lagarde largely echoed these sentiments at the post-meeting presser, which was again a typically dull affair. Lagarde once again affirmed that risks to the economic outlook are tilted to the downside, while also stressing that the ECB is “not targeting” any FX rate, and that – for now – the baseline scenario outlined in June continues to hold. Consequently, Lagarde reiterated that policy remains in a “good place”.

Stepping back, the July ECB meeting will certainly go down as a dull affair, and very much as one for the purists. Frankly, we received little-to-no fresh information, and certainly nothing that changes my expectations for where policy goes from here.

In an ideal world, the Governing Council would likely wish to wrap up the easing cycle here, holding the deposit rate steady at 2.00% for the foreseeable, despite sizeable risks of a sustained inflation undershoot next year. However, risks to this ideal clearly tilt in a more dovish direction where, either a further significant strengthening in the EUR, or a ‘no deal’ outcome in EU-US trade talks, would likely force policymakers’ hands into delivering at least one more rate reduction.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.