- English

- 中文版

WHERE WE STAND – For a while, Friday was shaping up to be a calm, subdued, gentle glide into the weekend.

Then, just as London traders were starting to think about where to close out the week with a cold beverage (myself included), a bolt from the blue emerged in the form of a ‘Truth Social’ post from President Trump, and the US-China trade war suddenly flared up once again.

Trump appeared to have been riled up by earlier news that China planned to tighten export controls on various rare earths, and other materials, many of which are critical for the semiconductor industry. Said move, per Trump, was ‘very hostile’ and ‘sinister’, thus leading to the US being forced to consider ‘many countermeasures’ on China, including the possibility of increased tariffs on Chinese imports. Perhaps most importantly, Trump also noted that there now appears to be ‘no reason’ to meet President Xi, as planned, in two weeks’ time.

At least we didn’t have to wait especially long to find out what those countermeasures might look like. Trump later, just after the market close (!!) announced an additional 100% tariff on Chinese goods, as well as export controls on ‘all critical software’, both effective 1st November. I’ll say that again – both effective 1st November. Three weeks, or less, until TACO time, I guess…

I’m going to stick my neck on the line a bit here – that 100% figure is too arbitrary, too ridiculously high, and too much of a round number, for it to be something that the US would realistically consider imposing. We’re back to the whole ‘Art of the Deal’ idea where a number so large, and so outlandish, is thrown onto the table in an attempt to focus minds, and drive a quicker agreement between the two parties. I may well be wrong, but this all seems to be setting up for a climbdown, a U-turn, and claims of ‘the greatest victory for the US ever’ before too long.

Now, quite obviously, nobody was going to try to act the hero and trade that view as Friday’s session came to a close – capital preservation very, very quickly became the focus for all market participants, resulting in a decidedly risk-off, and defensive end to the week. Frankly, it was all a bit of a ‘perfect storm’ with a big chunk of surprising news flow hitting a somewhat complacent market that’s been trending in one direction for months, with super low implied and realised vol to boot.

That perfect storm, predictably, saw stocks slump across the board, with both the S&P 500 and Nasdaq 100 enduring their biggest one-day declines since the aftermath of ‘Liberation Day’ in mid-April. Meanwhile, the buck softened against all peers with the JPY and CHF becoming the havens of choice for market participants, with traders also seeking shelter in gold and silver, which closed north of $4,000/oz and $50/oz respectively. Treasuries caught a bid too, with benchmarks rallying about 10bp across the curve, while crude swooned to its lowest level since May, as front WTI cracked below $60bbl.

Of course, the question now is what comes next. That is, of course, impossible to say with any certainty, however it essentially comes down to whether this is the start of a return to the ‘bad old days’ of early-April, and an end to the US-China trade truce; or, whether this is yet another negotiating gambit to which the market has over-reacted in knee-jerk fashion, and it’ll be a case of ‘all’s well that ends well’ in short order.

As alluded to above, my working assumption for the time being is that this will probably end up being a sequel to the moving that we all saw earlier in the year, in Q2, where Trump uses the ‘escalate to de-escalate’ ploy in order to force concessions, and a faster dealmaking process, from the other party involved. If that does indeed prove to be the case, then this is an equity dip that offers a buying opportunity, and a development that doesn’t derail the overall bull case for risk assets.

That said, it may take some time for participants to come round to that view, particularly when one considers that long risk positioning had likely become rather stretched in recent weeks, and that the risk of a trade re-escalation was (in hindsight) clearly underpriced. Consequently, higher vol and choppy trading conditions are likely to prevail for the time being, as we all attempt to gauge whether another U-turn is around the corner, or whether ‘this time is different’.

This time isn’t usually different though, is it?! And weekend comments from both President Trump & Vice President Vance indicate that another about-face could come sooner rather than later.

A week of CRAB (China Retreats And Backs-off) TACOs (Trump Always Chickens Out) could be ahead, resulting in BTFD ruling the roost once again.

LOOK AHEAD – Quite clearly, trade developments are set to dominate the upcoming week, especially as the continuing US government shutdown means that markets will continue to operate in a data vacuum.

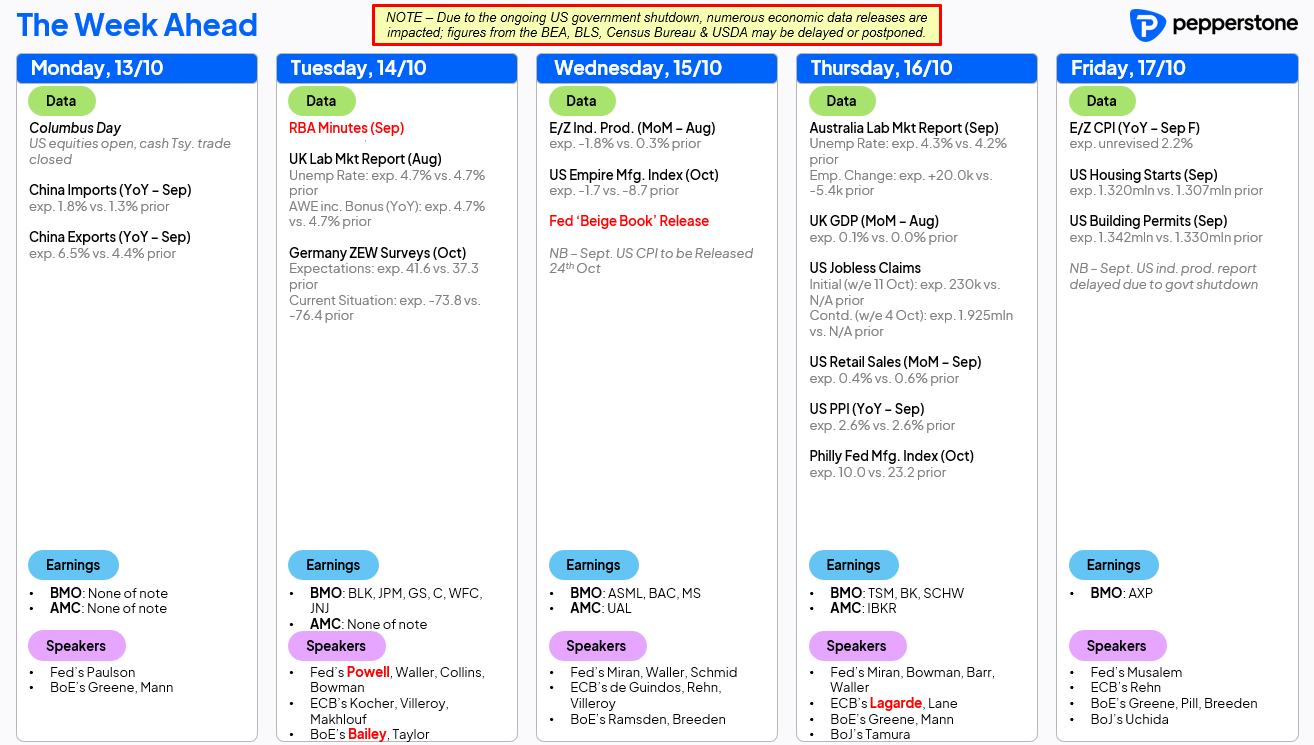

While stateside data may be lacking, there are plenty of central bank speakers to make up for things, including the ‘big three’ of Fed Chair Powell, ECB President Lagarde, and BoE Governor Bailey, though explicit guidance as to the policy outlook is unlikely.

As well as that, this week marks the start of Q3 earnings season, with the banks kicking things off tomorrow. Per Factset, overall S&P 500 earnings growth is expected at 8.0% YoY in Q3, an outturn which would mark the ninth consecutive quarter of growth for the index.

As usual, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.