- English

- 中文版

To anyone interested in systematic or algorithmic strategies, both Nick and Rob have some truly invaluable information. Take a look.

- Nick Radge – Achieving a positive expectancy in trading

- Rob Carver – The classic mistakes traders make in system design

A clear risk-off tone playing through broad markets and the narrative has been hit with a series of reasons for funds to de-risk and rush for portfolio hedges – the idea of leveraged players dumping risk, trend-following funds adding to short positions in Treasury futures and options market makers hedging delta is all there, largely unseen to the retail traders’ eye - it's positioning and flow that drive markets.

Of course, we can pick one of many narratives – an unfolding energy crisis, with Europe shaping up for what could be a brutal winter. A Chinese growth slowdown, extenuated by self-imposed power consumption cuts now in 20 Chinese provinces, which could cut another 1ppt off Chinese growth in Q4 – this coming at a time when the world watches to see the fallout from Evergrande’s international bondholders seeing the prospect of the interest owed fall away and the HK central bank asking banks to report their exposure to Evergrande.

There are fears of a more intense debt ceiling battle in the US and as I wrote yesterday, mid-October is the date where we start to look over the edge and ask whether the US could really make a political misstep this time around. Thursday’s vote in the Senate on infrastructure will be watched by market participants, and we look to see if the US government can avoid a shutdown on Friday.

All the while central banks are normalising – the Fed are hell-bent on tapering its QE program in November and the ‘dots’ are indicating a faster path of raising rates – all into rising stagflation fears. We are once again debating whether Jay Powell will indeed be replaced as Fed chair – with the front runner being Lael Brainard – uncertainty reigns.

Brent crude moving into $80.72 and US crude into $76.65 lifted global inflation expectations – Despite this, US real rates have moved higher, where the move in US Treasury yields has been extreme – the cost of capital has therefore risen sharply, the equity risk premium has dropped and the discount factor used to understand a businesses present value has increased to the point that companies that act as bond proxies or pay limited dividends (long-duration assets) have been sold aggressively.

US 10yr Treasury

(Source: Tradingview - Past performance is not indicative of future performance)

It’s not just the fact that US bond yields are rising, but it’s the sheer pace of the move that has caught the market out – we’ve seen 10-year Treasuries move from 1.29% to 1.54% - 25bp in 4 days. That’s the highest rate of change since January and it’s not been driven by wholly positive factors, but by supply-side constraints and a realisation that central banks are normalising policy.

Gold finds few friends in a dynamic of USD strength and rising real rates, and we see better sellers of crude, and both SpotBrent and SpotCrude have put in ominous daily candles that need monitoring for follow-through, although it’s the daily chart of natural gas that really draws attention.

Daily chart of Nat Gas

(Source: Tradingview - Past performance is not indicative of future performance)

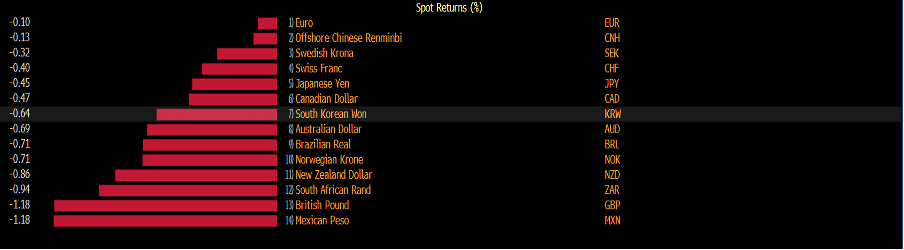

The USD has found form in this backdrop – it has the double tailwind of slowing growth expectations and a normalising Fed – for anyone following the USD ‘smile’ framework, you’d see the USD is fulfilling both the left and right side of this philosophy. A 0.3% on the USDX, that threatens a breakout of the 20 August swing high will negatively impact EM FX, and we see good selling in the MXN, While in G10 FX there’s been heavy selling in GBP, although our clients are now 68% net long GBP and looking for a bounce from 1.3536 after the break of the range lows.

(Source: Bloomberg - Past performance is not indicative of future performance)

In equities, its mainly tech sellers, but comm services and discretionary are underperforming – the NAS100 has closed -2.9%, a punchy liquidation, printing a lower low. The S&P 500 is -2% and pushing the 100-day MA – a level is bounced off last week and we see 90% of stocks lower, where volumes were 22% above the 30-day average. EU equities have also closed down over 2%. Volatility has picked up, with the VIX now at 23.25% and the VIXY ETF +10.7% on the day (trade the VIXY ETF on MT5), with traders buying volatility as a hedge, and again this would feed full circle into equity selling as funds that target vol would be raising cash levels.

It pays to be cautious here as it's unclear what causes a snapback in risk – but as always, price sets the narrative and we respect the tape.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.