- English

- 中文版

Gold Shines Amid Market Divergences: Bitcoin, margin FX, and Key CPI Insights

Gold breaking out of its 8-day consolidation phase

Gold stands out in this regard, with the spot price finding a strong bid through European trade, resulting in a solid low-high trend day, and pushing into $2695. The 1.2% rally on the day coming despite a modestly stronger USD and a slight uptick in US Treasury yields - so as is the way with gold, many look for some sort of explainer, with China reserve accumulation doing the rounds, while short covering and position adjustment ahead of today’s US CPI print also makes its way into the discussion.

We can also focus on technical factors, where on Monday spot gold and gold futures pushed into the range highs in the 8-day sideways consolidation phase. It’s noticeable that when gold futures broke convincingly through Monday’s high of $2700 and out of the consolidation phase, gold futures volumes really kicked up, with increased volume in the GLD ETF 20 Dec call options.

Bitcoin found sellers through early US trade

Crypto has found sellers easier to come by, and despite a heft skew in the IBIT ETF (iShares BTC ETF) call to put options, traders spent the early stages of US trade working Bitcoin from $98k to $94,300, before the buyers stepped back in. Talk that Microsoft shareholders had voted against adding BTC as an asset to its balance sheet has been touted as a headwind on the day, although I’m not sure expectations of it passing were ever that high to begin with.

Again, we can focus on technical factors, where the upside momentum has firmly come out of the various coins, and the trade for now – at least in Bitcoin – seems to favour playing a range of $100k to $90k. Either way, in the absence of any new inspiring news that can get crypto firing up again and bull trending, then we run the risk of more near-term choppy conditions.

In FX markets we see a dispersion in the daily moves in major FX, with the MXN and BRL outperforming, while the AUD and NZD have lost ground. Sellers in both Antipodean currencies are taking steer from the rollover in the price action and lack of follow-through buying in China/HK equity post the Politburo meeting, while the RBA are seemingly more open-minded about a rate cut in either February or April 2025.

Aussie interest rate swaps price some 15bp of cuts for the Feb ‘25 RBA meeting, implying a 62% chance of a 25bp cut – obviously a lot needs to fall in place for the RBA to ease in February, and the bank will need to see the next two Aussie jobs prints (including one tomorrow) come in on the soft side, with the Q4 CPI print (due 29 Jan) also needing to come in well below 2.8% y/y.

US CPI a risk event to navigate

USD traders are set to navigate today’s US CPI print, although expectations that the inflation data will lead to pronounced moves in rates, US Treasuries and the USD are low. With the market looking for both headline and core CPI to come in at 0.3% m/m (annualised core CPI unchanged at 3.3% y/y), we may need to see a core CPI print firmly above 0.4% m/m to get the USD pumping. With a low bar for the Fed to ease next week, the US CPI print is unlikely to derail that outcome, although it could throw some doubt into the mix, and more importantly impact expectations and pricing towards policy changes in future Fed meetings. Conversely, a CPI print that rounds down to 0.2% would bring out better USD sellers and could lift sentiment towards risky assets (equity).

Shortly after the US CPI print, FX traders will navigate the Bank of Canada meeting, where a 50bp cut is almost fully priced. With CAD swaps pricing an additional three 25bp cuts over the coming 12 months (including this potential 50bp cut), the BoC’s guidance on its future policy path is also important and will need to offer a high degree of confidence that market pricing is on the money, or we could see some solid volatility in the CAD.

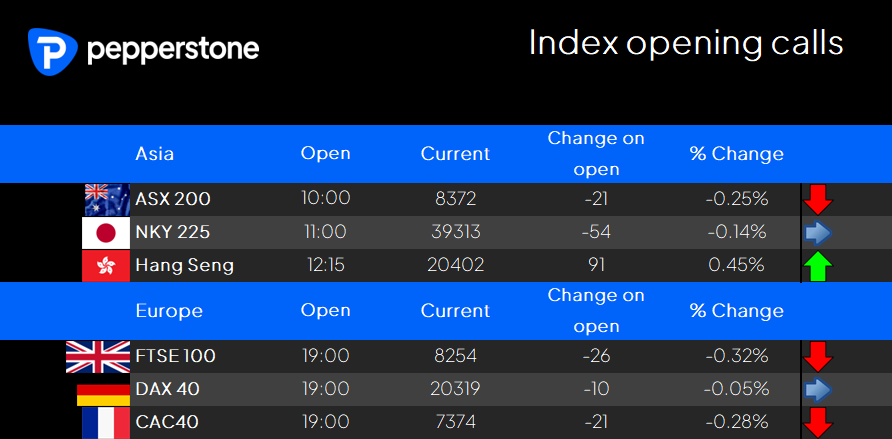

Turning to the Asia equity open, the leads from the US suggest modest downside for the ASX200 and NKY225 open, while the HK50 and China indices will focus firmly on domestic factors and the China CEWC. The S&P500 sits near session lows, with 70% of companies in the red, with tech, REITS and materials plays underperforming. Comms services, staples and consumer discretionary sectors sit in the green, although the discretionary sector has been driven primarily by Alphabet with the street applauding the development of its Willow quantum chip.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.