- English

- 中文版

After another lively week in markets, we look at what’s on the radar this week:

- USDRUB to guide risk – headlines around Russia likely to dominate, with German Chancellor Scholz due to travel to Moscow tomorrow. When in doubt, hedge with SpotCrude

- ECB speakers – can they calm the blowout in sovereign spreads (Italian vs German debt)?

- Fed speakers – this week we hear from Bullard, Mester, Evans, Waller, and Williams – they should remove any pricing of an inter-meeting rate hike before March

- Aussie jobs (Thursday 11:30 AEDT) – The market eyes no net jobs created, with the unemployment rate due to remain at 4.2%.

- CPI prints in the UK, Canada, and China

With US Security advisor Jake Sullivan putting us on edge of an imminent Russian invasion of Ukraine, traders did what they felt best – hedge risk through long crude exposure, while a strong rally in USDRUB pushed equities lower. Traders bought volatility with the VIX index pushing up 3.4 vols to 27% and we see the daily implied move (higher or lower) in the US500 at 1.5%.

SpotCrude daily chart

(Source: Tradingview - Past performance is not indicative of future performance.)

Crude has broken out, and calls for $100 will be all the rage this week – one way to see the underlying demand is in calendar spreads – focus on the difference between our SpotCrude price and the 8th-month future (TradingView code = PEPPERSTONE:SPOTCRUDE-NYMEX:CLV2022) - this shows the extent of backwardation in the futures curve - if the spread is going up it shows huge incentive to be long as traders hold futures for the roll yield - the higher the spread the greater the demand for front-month (spot in our case) crude.

I know the market has been buyers of crude to hedge against geopolitics, but the shape of the futures curve is key for corporates and futures traders.

XAUUSD daily

(Source: Bloomberg - Past performance is not indicative of future performance.)

Gold has been well traded, with the August 2020 trend break getting plenty of airtime – a 12bp drop in US real rates has also provided a strong tailwind. Can the momentum continue into the new week, or will we see the trend break prove to be a fake-out? 76% of open positions in XAUUSD (held by clients) are now on the short side.

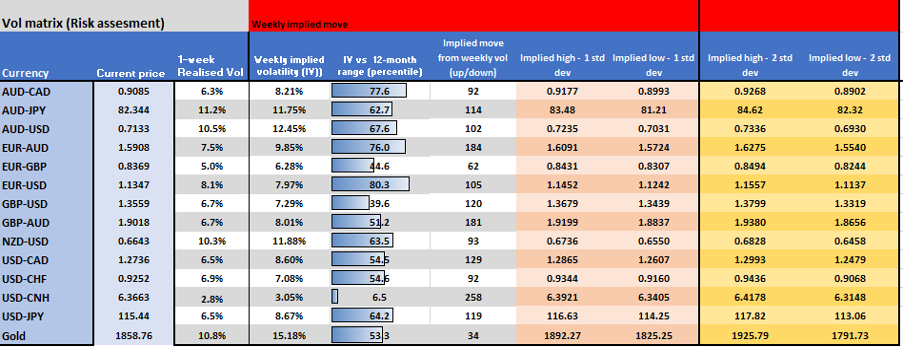

Implied volatility matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

EURUSD is also getting a working over and rightly so – EURUSD 1-week implied volatility is pushing into the 12-month highs and traders are betting on increased movement. The vol matrix from Friday sees the weekly implied range of 1.1452 to 1.1242 with a 68% level of confidence or 1.1557 to 1.1137 with a 95% level of confidence – traders can use for mean reversion levels or simply to guide risk, predominantly for those working off swing or position timeframes.

Keep an eye on sovereign spreads – with Italian 10yr bond yields widening to a 165bp premium over German bunds and Greek 10yr yields widening to 234bp over German 10yr bunds. Clearly, this is a worry for the ECB, although if they are going to cut its APP program later this year and open the door to rate hikes then they must expect this. Expect the ECB speakers this week to focus on trying to calm the moves, but there is little doubt the moves in sovereign spreads and the sell-off in German bonds were the main story in macro, injecting real movement into EURUSD, EURJPY and the crosses.

Another focus is on the prospect of an inter-meeting rate hike from the Fed. We should see any pricing of an early rate hike priced out and all the focus falling on the 16 March FOMC as the stage for a lift-off. USDJPY remains the clear expression of this in G10 margin FX and is being thrown around by movement in US 2yr Treasuries.

CPI prints in the UK and Canada could be a volatility event for GBP and CAD, with the market firmly debating a 25bp or 50bp hike from both the Bank of England and Bank of Canada at their respective March meetings – the consensus is calling for UK core CPI at 4.3% and Canadian core CPI at 2.2% - we can devise the playbook from this, but needless to say, it could be highly influential in rates pricing for the March meeting.

GBPCHF has been getting some focus here, but the bulls really need 1.2600 to give way for a stronger momentum move to play out.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.