Analysis

A traders' week ahead playbook - volatility and uncertainty on the rise

With a number of important catalysts this week, the market may obtain the answers they seek, however, will they like what they hear?

We lay out some of the core thematic’s front of mind, which may cause gyrations in markets for the week ahead.

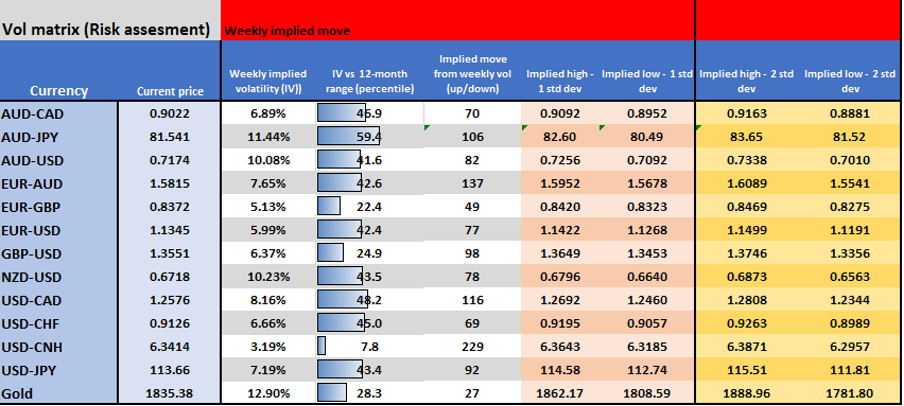

Implied volatility matrix – takes the 1-week implied volatility, calculates the implied move over the week and then adjust the price to get a 68% and 95% probability that price should be contained. A forward Bollinger Band if you will.

FX and Gold

(Source: Pepperstone - Past performance is not indicative of future performance.)

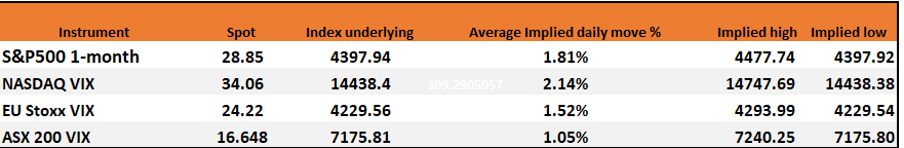

Equity indices (uses 30-day vol)

(Source: Pepperstone - Past performance is not indicative of future performance.)

10 market forces that are front of mind

1. Further rotation out of tech and broad equity drawdown – The NAS100 fell 7.5% last week – the worst week since March 2020 and is now testing the 4 October swing low. Technically the raft of equity indices are grossly oversold, while the internals show a level of pessimism priced, where 64% of stocks (in the NAS100) now sit at 4-week lows and 38% of members above their 200-day. Do we get a bounce? The prospects seem elevated post-Friday’s options expiry, and dealers may buy back unwanted S&P 500 and NAS100 futures hedges, which could set off a rally.

2. Watching the former liquidity beneficiaries - Much focus has been on the sharp drawdown and redemptions in the former liquidity beneficiary ETFs – ARK Innovation, FinTech innovation and Next Gen ETF. The poster child of momentum, these are a guide for risk and have been getting smashed – one for the radar.

3. US Q4 Earnings – It’s the week that matters with 34% of the S&P 500 market cap reporting this week. Many of the trader favourites hit us with numbers and with elevated implied volatility for the day of earnings we could get fireworks at a stock and index level – on the docket we get (with implied move on the day of earnings) - IBM -6.8%, Microsoft 5.3%, Intel 6.7%, Tesla 7.6%, Apple 4.2%, Amazon 4.2%, Alphabet 3.8% - for more intel see here.

4. Crypto drawdown – A monster weekend for Crypto, with Bitcoin trading below $35k. Talk the SEC may look at greater regulations for the exchanges, but the bigger driver has been macro forces – higher US real rates, lower inflation expectations and a focus on reduced liquidity from the Fed. Similar to the NAS100, I see the Crypto space as grossly oversold but momentum is to the downside and rallies are likely to be sold – the obvious downside target on Bitcoin remains the set of lows printed between May and July 2021.

5. FOMC meeting (Thursday 6:00am AEDT) – the marquee event risk of the week – we expect the Fed to solidify the view of a March hike, a fate that is priced at 85%. We should also get more colour on ending QE and the mechanics of reducing its balance sheet from around June and July. While the risk is low, if the Fed end QE at this meeting, instead of March, it could spark some sizeable volatility into markets. Risks for the USD seems skewed modestly lower.

6. US Q4 Employee Cost Index (Sat 00:30 AEDT) – not a data point that has caused typically wild gyrations in markets, but the Fed have told us they look at this closely, so the market may put more credence on it – with the pace expected to tick down to 1.2%, we may need to a number below 1% or 1.5% to get the USD firing either way.

7. Bank of Canada meeting (Thursday 2:00am AEDT) – 16 of 29 economists see the BoC keeping rates on hold, but the rates market disagrees, placing a 71% chance they hike – The CAD is moving with broad risk appetite, especially vs the EUR, JPY, and USD, so playing a view on BoC policy vs the AUD or NZD seems a cleaner play.

8. Geo-politics and Russia/Ukraine tensions – Pepperstone clients can trade the USDRUB or the VanEck Russia ETF. USDRUB is a momentum play having rallied towards 78 and the highest levels since April 2021. Undoubtedly a theme that has impacted equity and risk sentiment, we watch this space with intent as the news flow makes for sobering reading – it's unclear what scenario markets are discounting, but it seems likely one of a partial escalation – subsequently, any appeasing of tensions could promote buying in RUB, while the market is on edge for signs of Russian invasion and NATO support for Ukraine – the bear case scenario, which is not priced (in my opinion).

9. Aussie Q4 CPI (Tuesday 11:30am AEDT) – after last week’s blockbuster labour market read the market is on edge for Australia’s Q4 inflation data – expectations are for the headlines CPI YoY change to push up 20bp to 3.2% and for the trimmed mean print to rise to 2.3%. With the first hike from the RBA fully priced into Aussie rates markets by June and two hikes priced by August, the inflation read could solidify that pricing (or reduce it) – that said, the focus is on the prospect of a May hike (currently priced at 68%) which runs into a federal election. I prefer playing AUD vs NZD for domestic rates issues as AUDUSD is subject to risk sentiment and equity moves.

10. UK political forces impacting the GBP – ahead of next week's BoE meeting where a 25bp hike is almost fully priced, the market will learn of the findings of Sue Gray’s report into the “Partygate” scandals – the findings should come out before Wednesday, but more importantly will be any reaction from Boris Johnson’s key personnel – GBP traders would be looking for signs of a no-confidence vote, which would require 54 letters to the 1922 Committee to cause a vote. GBPUSD 1-week volatility sits at 6.3% - the 24th percentile of the 12-month range, so traders are not expecting UK politics to rock the boat too intently – that may change. Some clear risks to GBP longs, especially in EURGBP which printed a bullish weekly engulfing, and we watch for follow-through.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.