- English

- 中文版

Just because there has been a strong selloff, doesn’t make them a buy

The cryptocurrency major’s basket (CRYPTOMAJOR on Trading View) has seen a decline of 88.5% from the 1st of January 2021 peak of 560.46. This doesn’t necessarily mean that all cryptocurrencies are now a bargain and should be bought. So, what is the best cryptocurrency to invest in 2022?

Figure 1 Trading View Crypto Majors monthly chart

A breakdown of some of the ‘majors’ from a technical viewpoint.

Limited Data available

Not all cryptocurrencies offer a technical analyst long term data to work from. Although most chart packages will show data on Bitcoin (BTCUSD) going back to 2015, popular products like Polkadot only offer data from August 2020.

Why is this an issue? As we are looking at a long-term forecast, we need to look at higher time frames. On the monthly chart you may not get enough candles to be able to place trend lines. What if you look at the 200, 100 or 50 moving averages. Will you get enough data points for a true reading?

Using BTCUSD as a benchmark

The most liquid, traded, and mature cryptocurrency is Bitcoin. I believe that we can use this ‘major’ as a benchmark for possible turning points in the cryptocurrency basket to answer our question, what is the best crypto currency to invest in 2022?

One technical viewpoint

The latest Bitcoin crash looks to have formed a bearish Flag pattern on the weekly chart. To calculate the measured move target of the flag, we take the length of the flagpole (A-B) and project that measurement from the high of the flag, down in the C-D leg. This gives us a projected level of 12173. For more about technical analysis, please click on the link

BTCUSD weekly

Figure 2 Trading View BTCUSD Flag target

A look at the daily chart and we could be forming a bullish cypher pattern known as a Crab. This offers technical support at 12876 – 12560, just above the aforementioned Flag target of 12173. This is approximately -37% lower from the current price.

BTCUSD Daily

Figure 3 Trading View BTCUSD -37%

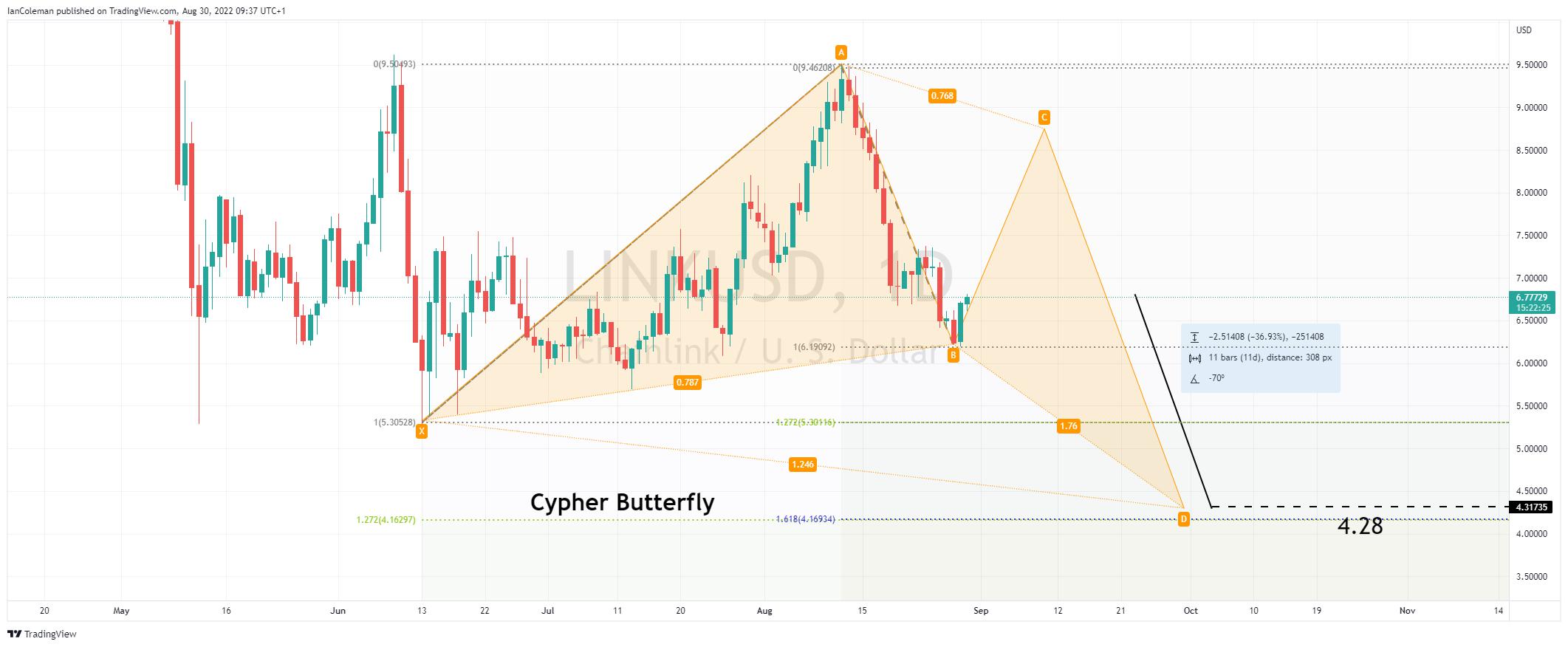

A look at Chainlink (LINKUSD). A -37% drop from current price would take the cryptocurrency to 4.28. We have a Fibonacci confluence zone at 4.16. This would form another bullish technical Cypher pattern known as a Butterfly

LINKUSD Daily Chart

Figure 4 Trading View bullish Butterfly

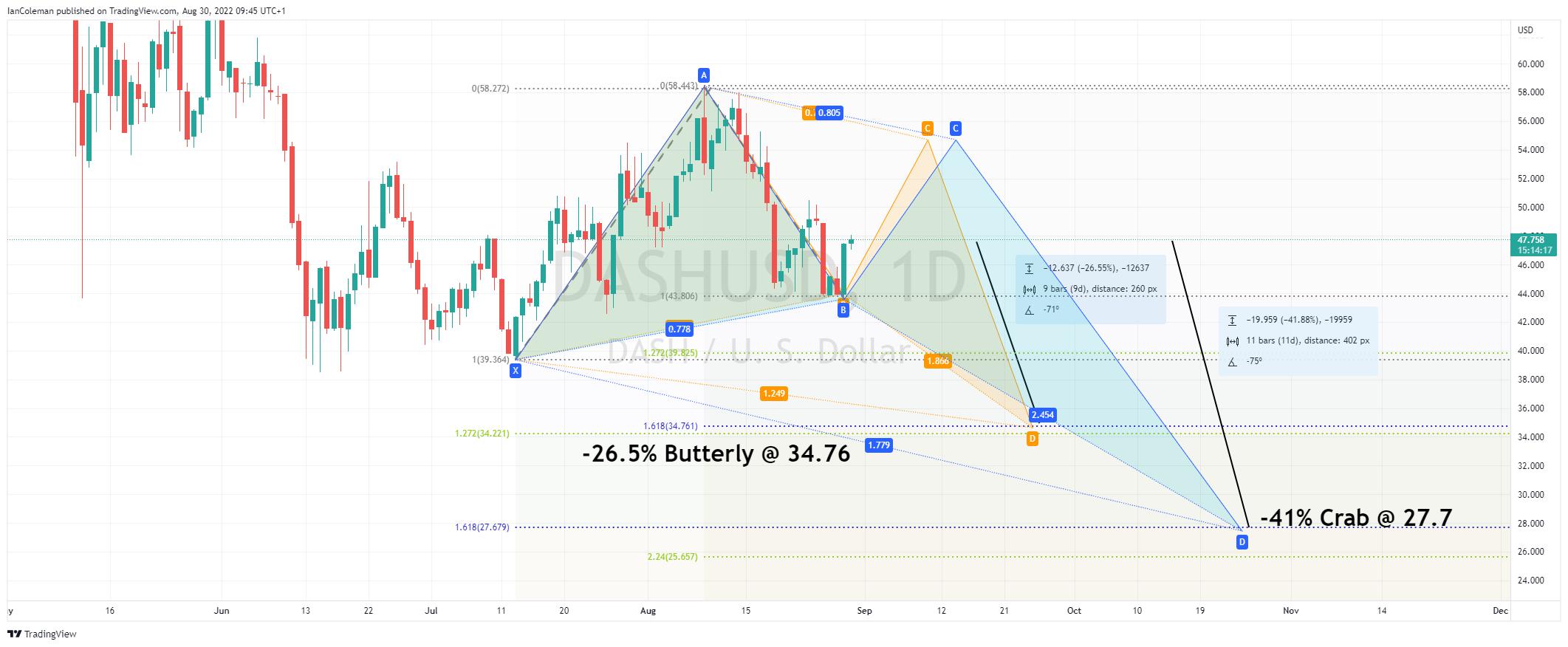

Dash (DASHUSD) offers two levels of technical support. This first at 34.76. This is a bullish Butterfly after a decline of -26.5%. The next is at 27.7 forming a bullish Cypher known as a Crab. This is after a further decline of -41%.

DASHUSD Daily Chart

Figure 5 Trading View 2 bullish patterns

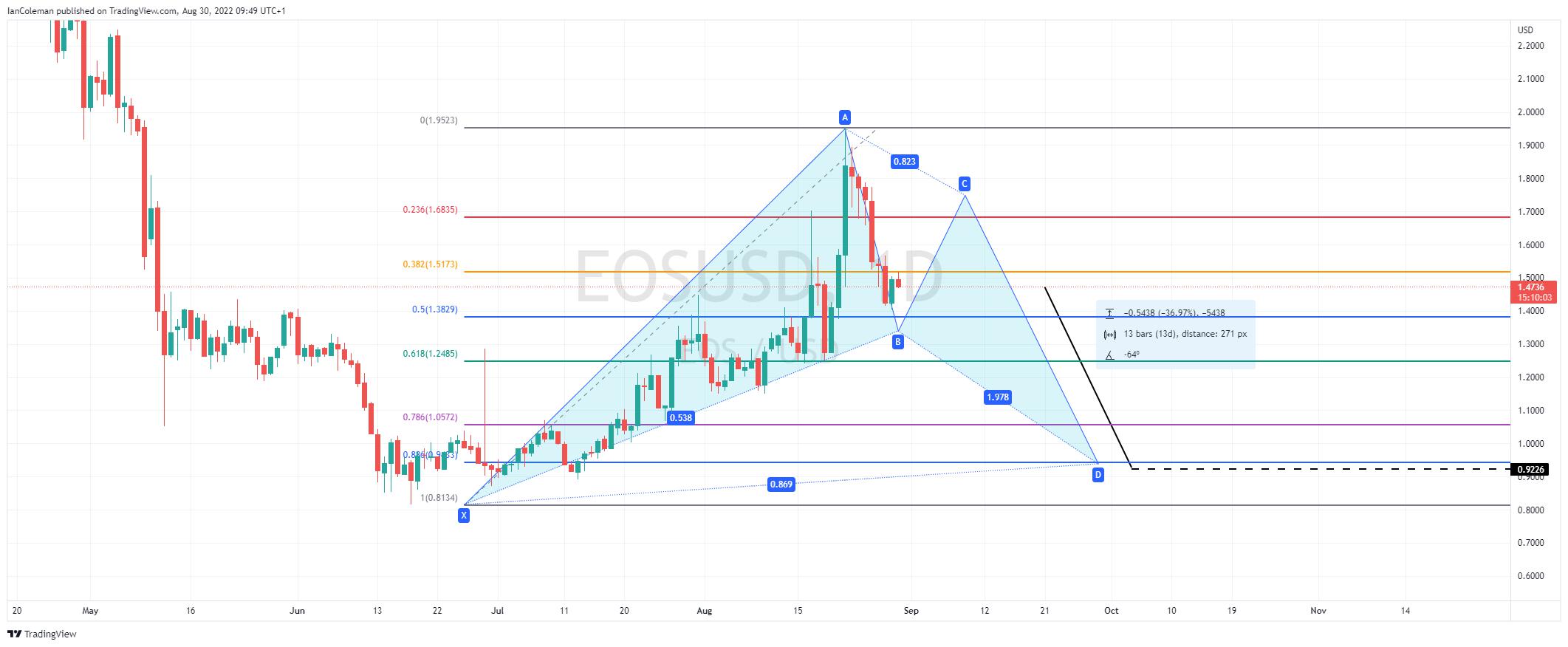

A decline of -37% in EOS (EOSUSD) would take the product to the 88.6% pullback level of 0.9400 (from 0.815 to 1.95), possibly forming a bullish Cypher BAT formation.

EOSUSD Daily Chart

Figure 6 Trading View bullish Bat

What is the best crypto currency to invest in 2022?

From a purely technical analysis viewpoint, and using BTCUSD as a benchmark, we could see a further decline in cryptocurrencies.

It may be worth setting chart alerts of the different products to see if they ‘line up’ soon enough in the future before deciding which one offers the most potential. One way to gauge this is to look at all cryptos forming a bullish setup and deciding on the one that experienced the least amount of losses. In this case, that specific crypto could be the one experiencing the most buying on dips and likely to rally the hardest.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.