- English

- 中文版

For every unit created, the fund buys 1/110th of a fine troy ounce of gold. NewGold then stores the physical gold for an annual fee of 0.3%.

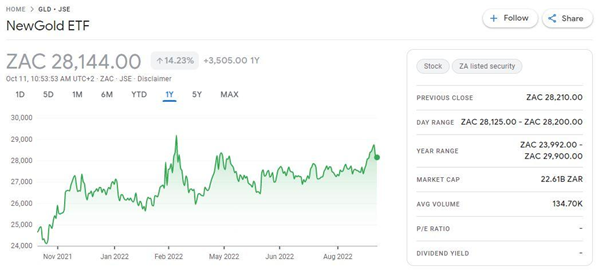

Google.com

*An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, an index or, in this case, a commodity. An ETF is traded like share CFDs on a share CFDs exchange. It is a pooled investment fund. Trading CFD ETFs through Pepperstone is a derivative of the underlying product.

Why invest in NewGold

The NewGold ETF is an alternative solution to gaining exposure to gold.

Many investors look to invest in precious metals in times of uncertainty and regard gold as a safe-haven.

Take the COVID-19 pandemic as an example.In the chart below we can see the timeline when the World Health Authority (WHO) announced the first case of COVID-19 on January the 9th 2020. Gold went on to gain in value by over 24% in the coming months (Gold priced in USD).

Figure 2 rise in spot gold after COVID-19 was announced

Buying and selling physical gold comes with its difficulties. Where can you buy gold bullion at the market price? Where are you going to store your newly purchased treasure? What if you want to liquidate your gold holding quickly. Are you going to get a fair price from your local bullion dealer? You can see it is fraught with obstacles and is likely to be an expensive endeavour.

An Exchange Traded Fund (ETF) is traded on the share CFDs exchange like a share CFD, making it easy to buy and sell your investment.

Currency exposure

With the NewGold ETF being priced in South African Cents (ZAC / ZAR South African Rand), it is exposed to currency fluctuations against the US Dollar.

When the South African Rand is weakening (USDZAR strengthening) NewGold will outperform spot gold. When the South African Rand is strengthening (USDZAR weakening), NewGold will underperform spot gold.

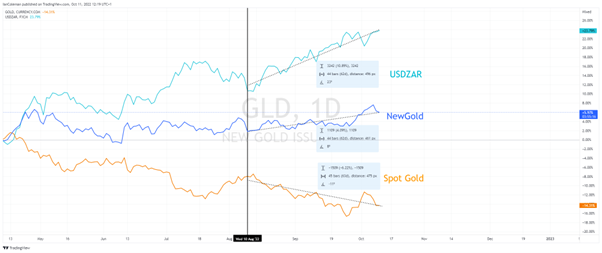

Let us look at a chart to get a better understanding of this phenomenon. We will look at the period starting from the Wednesday the 10th of August to date (Until 11/10/2022):

- USDZAR has increased by +11.96%. This is a weakening

- Spot gold has

- NewGold increased

It should be noted that the difference between spot gold and NewGold is 11.12%, close to the percentage gain on USDZAR (11.96%)

Figure 3 TradingView comparison chart

Other ways of gaining exposure to gold

Pepperstone offers various ways to gain exposure to Gold through Contracts for Difference (CFDs).

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.