USD Under Pressure Ahead of FOMC

The US dollar (USD) remains under pressure, trading lower for the third consecutive session. The dollar index (DXY) is down 0.4%, falling below 101 points, reflecting a decline in value against major currencies. This downward trend is attributed to growing expectations that the FED will adopt a more "dovish" stance than previously anticipated.

Federal Reserve Expectations

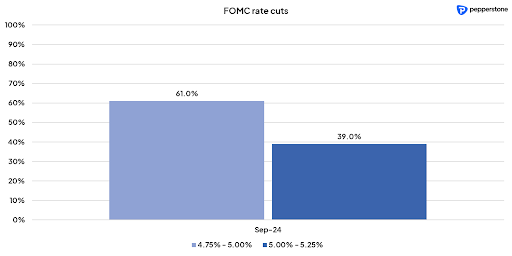

Markets are adjusting their outlook for the upcoming FED meeting. The odds now favor a 50 basis point rate cut, with a 61% probability compared to the 39% chance of a 25 basis point cut. This shift in expectations comes despite higher-than-expected inflation data in August, as recent labor reports suggest a slowdown in the US job market.

Investors are eagerly awaiting US retail sales and industrial production data, scheduled for release on Tuesday, to gain further insight into the health of the economy and potential future moves by the FED.

Impact on the Currency Market

The weakening dollar has had a significant impact on major currencies. The Japanese yen (JPY) has shown notable strength, trading near its highest levels since July 2023. This movement reflects the growing divergence in monetary policies between Japan and the United States.

The BOJ is expected to keep interest rates unchanged at its meeting this week. However, recent statements from members of its board suggest a possible rate hike in the near term, perhaps as early as October. Naoki Tamura, a BOJ member, suggested that rates should rise to at least 1% by fiscal year 2026 to steadily achieve the 2% inflation target.

The British pound has also seen gains, surpassing the $1.31 mark. Investors are closely watching the release of UK inflation data and the BOE meeting. While the BOE is expected to hold rates steady at 5% this week, there is an 80% chance of no changes, especially after last month’s 25 basis point rate cut.

Momentum in the Commodities Market

Expectations of interest rate cuts are also supporting the commodities market. Copper futures have risen towards $4.20 per pound, reaching their highest level in three weeks. A weaker dollar tends to make metals more accessible for holders of other currencies, stimulating demand. However, China’s economic data, the world's largest consumer of metals, has raised some concerns. Industrial production, retail sales, and fixed asset investment in the Asian giant failed to meet expectations in August. In the energy market, Brent crude has experienced an increase, trading around $71.8 per barrel. Expectations of a FED rate cut have fueled projections of increased economic activity and, consequently, higher demand for oil. Nevertheless, the resumption of refining activities along the US Gulf Coast and disappointing economic data from China are limiting gains and raising doubts about the short-term outlook.

Technical Analysis

USD/JPY Daily Chart:

The USD/JPY chart shows a significant weakening of the dollar against the yen, currently trading at 140.446, marking a steep decline from recent highs near 160.

The key support level at 150, previously acting as a psychological barrier, was breached, accelerating the fall. Now, the price seems to be approaching a critical support level at 140, which, besides being an important psychological point, converges with an oversold Relative Strength Index (RSI) at 29.29. This indicator reflects excessive selling, suggesting a potential short-term technical rebound.

The RSI also indicates signs of bullish divergence, implying a possible correction if buyers regain control. In the short term, a break below 140 could signal further declines toward 137.5, the lows of July 2023. However, if a rebound occurs, the price could head toward the 144 level, where it found support during August. The uncertainty surrounding the monetary policies of the FED and BOJ will continue to dictate the pace of USD/JPY.

Conclusion

The upcoming week is marked by important monetary policy decisions that will shape market direction in the coming days. The weakening dollar, the strength of the yen, and movements in the commodities and energy markets reflect investors' sensitivity to changes in interest rates. Upcoming economic data and central bank statements will determine whether USD/JPY finds support at current levels or continues its downward trend.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.