Dividends for Index CFDs

Trade the world’s top companies in one instrument. Take advantage of 22 diversified instruments that reflect changes in the overall value of the world’s biggest share CFD markets - from the United States, Europe, Australia and Asia. Start trading Index CFDs now.

What are dividends?

A dividend is a distribution of a portion of a company’s earnings to its shareholders. Dividends are often issued as cash payments if you own the underlying share, although they can also be paid out to investors in the form of additional shares. For a long open trade you will collect the dividend, for a short open trade you will be charged the dividend.

Dividends will be charged between 00:00-00:45 platform time (MT5).

Upcoming Index CFDs Dividends

| Index | 26/02 Tuesday | 27/02 Friday | 02/03 Monday | 03/03 Tuesday | 04/03 Wednesday |

| NETH25 | 1.07 | ||||

| AUS200 | 1.95 | 2..14 | 6.93 | 2.78 | 4.41 |

| FRA40 | |||||

| CHINAH | 0.67 | ||||

| HK50 | |||||

| SPA35 | |||||

| US30 | 7.33 | 35.16 | 11.45 | ||

| NAS100 | 0.24 | 2.90 | 0.57 | 0.72 | 0.70 |

| JPN225 | 29.84 | ||||

| US2000 | 0.05 | 0..58 | 0.32 | 0.12 | 0.14 |

| SCI25 | |||||

| SWI20 | |||||

| CA60 | 0.87 | 0.16 | 0.03 | 0.37 | |

| US500 | 0.03 | 0.66 | 0.57 | 0.27 | |

| EUSTX50 | |||||

| UK100 | 4.01 | ||||

| CN50 | 2..30 | ||||

*Expected dividend adjustments stated in full index CFDs points per contract. Figures stated are forecast amounts sourced via Bloomberg. The final adjustment may differ from the forecast amount previously displayed.

Why trade dividends for Index CFDs with Pepperstone?

Advantages

Trade confidently and securely with Pepperstone.

Get 99.59% fill rate^ and fast execution.

Award-winning customer support, available 24 hours 7 days per week**.

Risks

Leveraged trading imposes additional risk of loss to your capital

No ownership interest – you don’t own the underlying asset when you trade CFDs or Margin FX, so you are not entitled to some benefits ordinary investors would be.

Spreads -while we provide exchange spreads for our CFDs, like any market the underlying spread may widen during periods of volatility, increasing your costs.

Key features of dividends:

- Dividends are an incentive and a form of compensation for the shareholder, normally paid out quarterly or semi-annually.

- They're one of the primary reasons investors are attracted to a business.

- Ordinarily, the greater the cash flow of the business and profitability, the more likely a percentage of that capital will be returned to shareholders.

- Dividends are a great way to assess the financial health of a business to investors.

Of course, not all companies make these payments. Many high growth companies may choose not to return cash to shareholders but will re-invest the funds into the business if they feel the capital can better reward shareholders through greater earnings growth. In this case, investors are happy to forgo a dividend in the hope of increased capital appreciation.

What does ex-dividend mean?

The ex-dividend date is the day on which the share CFD no longer includes an entitlement to the upcoming dividend payment.

- It's usually one business day before the dividend is paid out by the company.

- Traders opening a position on the ex-dividend date will not be entitled to, or are required to pay, the dividend on their positions.

- The value of the share CFD will fall on this date because of the dividend payout.

What do dividends mean for traders?

When a company pays out a dividend, all things being equal, the share price of that company should fall by that amount. This is because the company has paid cash held on its balance sheet to shareholders and that cash component is a consideration for attributing a theoretical value to the company.

For a share index CFDs, if some of the constituent companies pay dividends out at the same time, the value of one of the many indices CFDs we offer can be affected. Each company has a percentage weighting on the index CFDs, which will be determined most commonly by market capitalisation. The adjustment to the index CFDs will be greater when the most heavily weighted companies pay dividends.

- Always remember that because dividend payouts are scheduled events, market forces aside, traders aren’t able to gain or lose from the ensuing price action.

- If a trader has an open position during a dividend adjustment, we ensure there's no financial impact on your trading account.

- We do this by either debiting or crediting you with the same amount you've incurred on the running profit or loss due to the dividend adjustment.

Clients will find this amendment in trading account history, which you can find on each platform.

Timing the adjustment & Fair Value

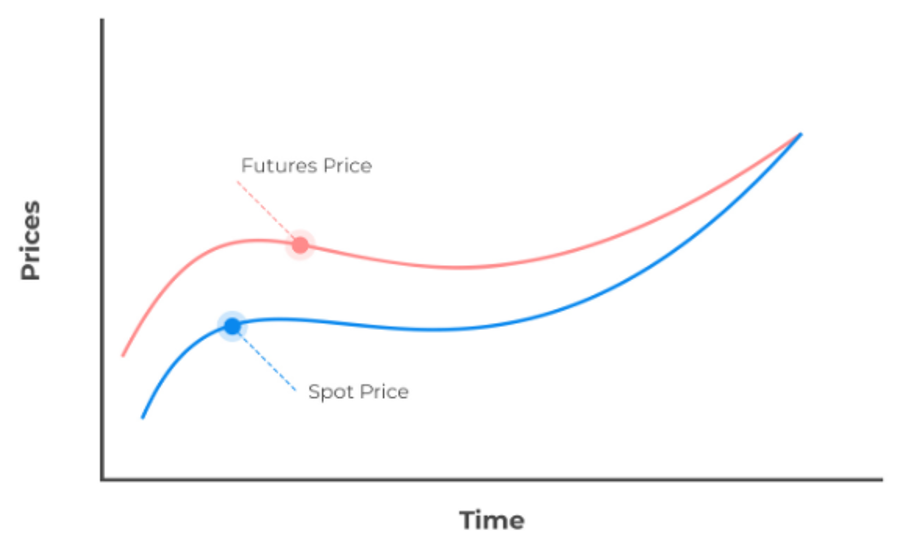

Our liquidity providers are key to creating a rolling cash equity index CFDs product for clients to trade. They start with the front contract in the futures market and derive an index CFDs price for clients according to the underlying index CFDs level and the futures price.

- This fair value is effectively the difference between our cash price and front month in the futures market.

- It's a blended calculation of interest and expected upcoming dividends from the present to the expiry of the index CFDs futures contract.

As each day passes, our cash index CFDsand futures price converge. One key reason for that are dividends. Cash markets tend to trade at a premium to futures markets, simply because while the futures index CFDs has interest (up to the expiry) encapsulated in the price, expected dividends (from the index CFDs constituents) are removed.

Spot Price V Futures Price

When a company pays a dividend and the share price drops on the open, our cash equity index CFDs will fall too, as the dividends are removed and we move closer to the futures price.

As the price of the individual share drops when the official market opens, in the vast majority of our equity indices CFDs this is the time when our liquidity provider will then correct the fair value and reflect the dividend adjustment in the index CFDs.

Example:

Five companies in the US30 go ex-dividend on the 8th October. The aggregation of the dividends and the index CFDs weight of the share CFDs equates to 20-index CFDs points. With the US30 trading at 28,000, upon the re-open of the market the five share CFDs fall by the dividend amount and our US30 price falls to 27,980 as the fair value is adjusted.

For a client that is long, their account will be cash adjusted by 20-points, multiplied by their stake.

* Spreads may vary under extreme market conditions. Fixed spreads apply under normal market conditions. Pricing and spreads are direct from liquidity providers without broker intervention.

^99.59%. Fill rates are based on all trades data between 01/07/2025 and 30/09/2025

**All spreads are generated from data between 01/12/2025 and 31/12/2025, covering all trading sessions, including rollover periods.