24-hour share CFD trading

Trade 100+ US share CFDs 24/5 with Pepperstone’s around-the-clock trading hours.¹ Stay in action with non-stop market access day and night.

No more waiting. Move with the market

Act on key news and earnings releases whenever they happen.

Avoid price gaps, overnight surprises and missed opportunities.

Trade with low commission from just US$0.02 per share.

Access on TradingView, MetaTrader, cTrader and the Pepperstone platform.

Beyond the bell: Extended-hours and 24/5 trading

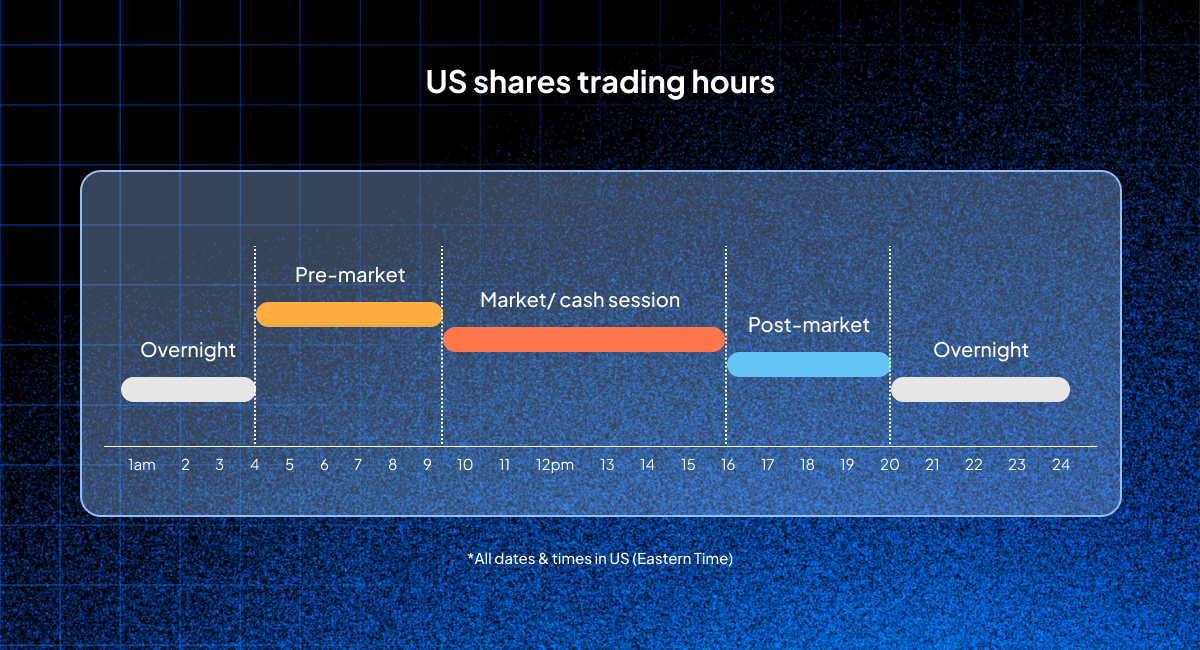

Most traders are familiar with US shares being available during regular market hours (the ‘cash session’), from 9.30am to 4pm US Eastern Time (1.30pm - 8pm GMT), Monday through Friday. However, market volatility and trading opportunities continue to flow beyond these hours, especially around major news releases and corporate earnings.

- Extended-hours trading refers to pre-market and post-market sessions that allow you to respond to critical events in real time, before or after the day’s cash session.

- 24/5 trading includes pre-market, post-market, and overnight sessions – providing you with continuous market access 24 hours a day, five days a week.

Our 24-hour share offering

Here’s a breakdown of the trading sessions available for you to speculate on the price movements of major global US shares:

Trade your favourite names around the clock

Initially, the following stocks will be available to trade as part of the new pre-, post-, and overnight market offering:

- AAPL: Apple

- ABBV: AbbVie Inc.

- ABNB: Airbnb Inc

- ABT: Abbott Laboratories

- ACN: Accenture Plc

- ADBE: Adobe Inc

- AMCR: Amcor PLC

- AMD: Advanced Micro Devices

- AMZN: Amazon

- ASML: ASML Holding NV

- AVGO: Broadcom Inc.

- AXP: American Express Co

You can access our 24-hour markets by selecting symbols with the '-24' suffix on our platforms. For example, AAPL.US trades during the cash session, while AAPL.US-24 trades 24/5

Why trade 24-hour share CFDs

- Make the most of earnings reports: According to research, 95% of US firms release earnings before or after regular market hours.² With 24-hr share trading you can act on this information as soon as it drops, not the next day.

- Capture big price moves: Earnings and guidance updates often trigger sharp price swings during extended hours. Responding as soon as they’re released helps you avoid large price-gap surprises when the cash market opens the next day.

- Trade for your time zone: If you're outside the US, 24-hour share CFDs let you trade at times that suit your local time zone. No need to stay up late or wake up early just to catch the US cash session. Perfect for traders in Asia or other regions.

- Trade breaking news as it happens: You can access markets whenever unexpected news hits, like mergers and acquisitions or geopolitical events, and respond instantly without waiting for the market to open.

Risks of 24-hour share CFD trading

- Lower liquidity: During pre- and post-market hours, trading volume tends to drop. Reduced trading volume leads to lower liquidity, meaning there are fewer buyers and sellers available in the market. This can make it more challenging to buy or sell at the desired price.

- Wider bid-ask spreads: With fewer participants, the gap between the price buyers want to pay (bid) and the price sellers want to accept (ask) can widen. This is especially noticeable at the edges of the extended-hours session, when activity is at its lowest.

- Increased volatility: Lower liquidity can lead to larger and faster price fluctuations during overnight hours, even with small trades. This can be risky, as prices can significantly jump or drop and move against you quickly.

Margin requirements³

Margin requirements on our platforms remain the same during out-of-hours trading. However, increased volatility and lower liquidity can magnify risks.

Here's why:

- Margin amplifies gains and losses. If the market moves against your position, you could face a margin call requiring additional funds to maintain your position, especially with wider price swings happening after hours.

- Lower liquidity and position closure. If there aren't enough buyers or sellers available at your desired price, it may be difficult to close your position and limit potential losses.

Managing risk during 24-hour share CFD trading

To carefully manage your risk when using margin during around-the-clock trading, consider the following:

- Use a smaller position size or a lower leverage ratio compared to what you might typically use during regular trading hours.

- Monitor liquidity conditions and be cautious when placing orders. Set your limit orders to control entry and exit prices.

- Be ready to adjust your risk management strategy as volatility can spike unexpectedly. Use tighter stop-loss levels to protect your capital.

- Stay up to date with key events such as earnings releases, geopolitical updates, and economic data and do not trade blindly into high-risk events.

- Stick to your plan. Avoid overtrading and taking emotional decisions when markets are quiet or volatile.

Ready to trade the moment?

Earnings season is packed with market-moving events, and global headlines don’t wait for market hours.

Join Pepperstone and seize potential opportunities the moment they arise.

124-hour trading 5 days per week on select US share CFDs. For exact timings, please refer to the instrument specifications within the trading terminal.

2‘Do investors need time to process earnings news before markets open?’ (2017). ‘Warp Speed Price Moves: Jumps after Earnings Announcements’ (2023). Available on SSRN.

3Day and after-hours instruments, while having the same underlying asset, will have different margin requirements. Therefore, if you want to hedge one with the other, the full margin requirement for both instruments will apply.