CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

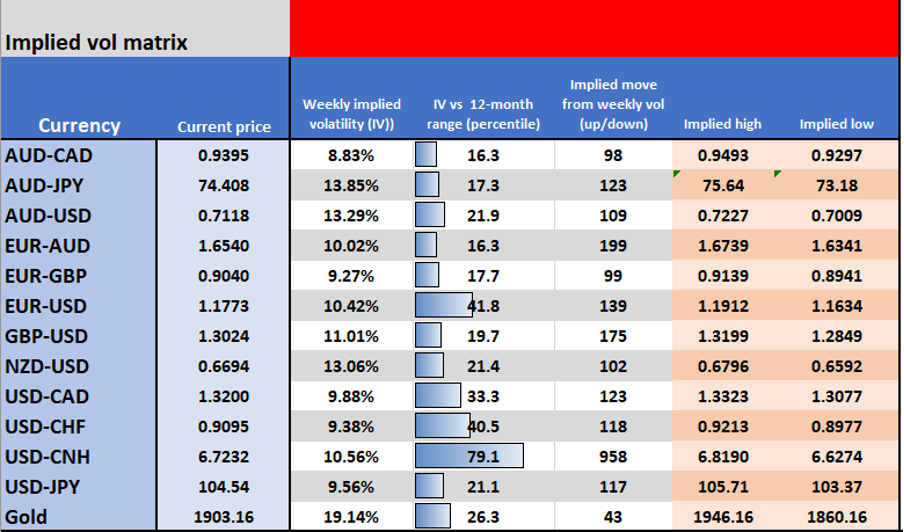

I’ve looked at 1-week implied volatility which expires on 4 November, although there is no certainty we’ll know who the president is on this date and whether one candidate accepts a loss, or it moves to litigation. Perhaps just as importantly we may not know the outcome of the Senate by then either and if the main market thematic is the size and scope of fiscal stimulus in 2021 and the ease by which it passes, then the Senate race is perhaps just as important. 1-week volatility captures the event but not the aftermath.

Looking at EURUSD vols which sit at the 43rd percentile of the 12-month range, one can assume that lockdowns are also a clear issue for markets and reflect in the anticipation of movement in EU assets.

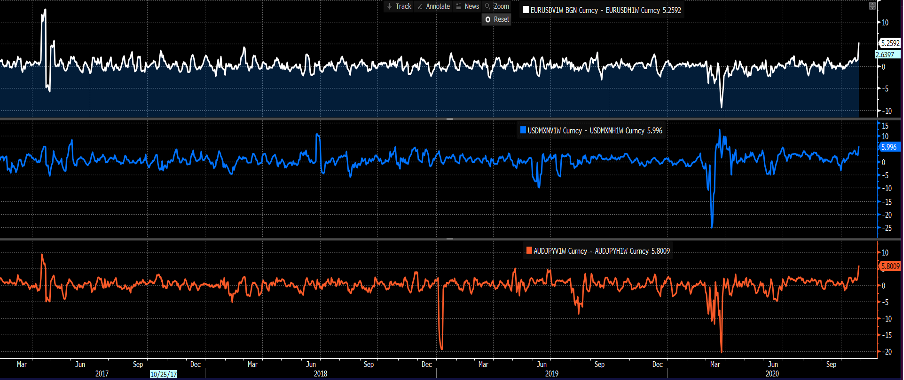

As I showed yesterday, realised volatility is just so incredibly low that this is playing a big part in implied volatility. Traders will not only look at what's to come but will consider the journey it’s been to get here. Here we see implied vols pulling away from realised and holding the biggest differential since 2017.

Select FX 1-week implied – 1-week realised volatility

(Source: Bloomberg)

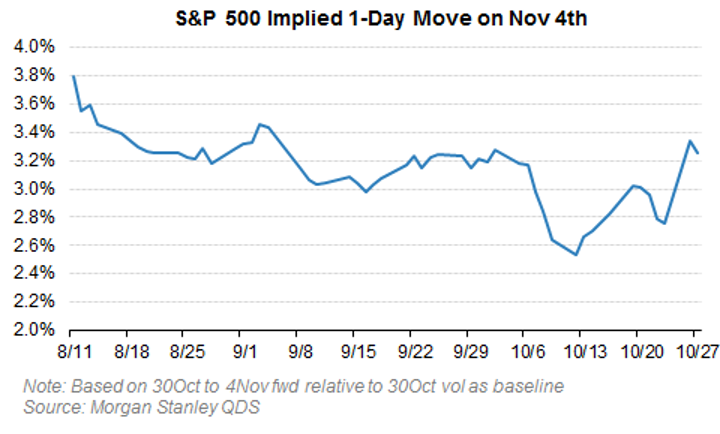

This is the election premium being priced and as the day has gone on the implied move has risen. We’ve seen that in equities for a while with the VIX index elevated but we’re now seeing options traders’ price in movement.

(Source: Morgan Stanley)

For context, we see the implied move (higher or lower) with a 68.2% degree of confidence. For example, the market sees EURUSD moving 139 pips by 4 November and I've put the breakeven levels, or the level where options volatility buyers move in-the-money. If we can understand movement it can be useful for risk management purposes and subsequently position sizing – depending on your timeframe of course.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.