CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

There are, however, some signs emerging that suggest this dynamic may be, slowly but surely, starting to shift, providing an increasingly supportive backdrop for equities at large.

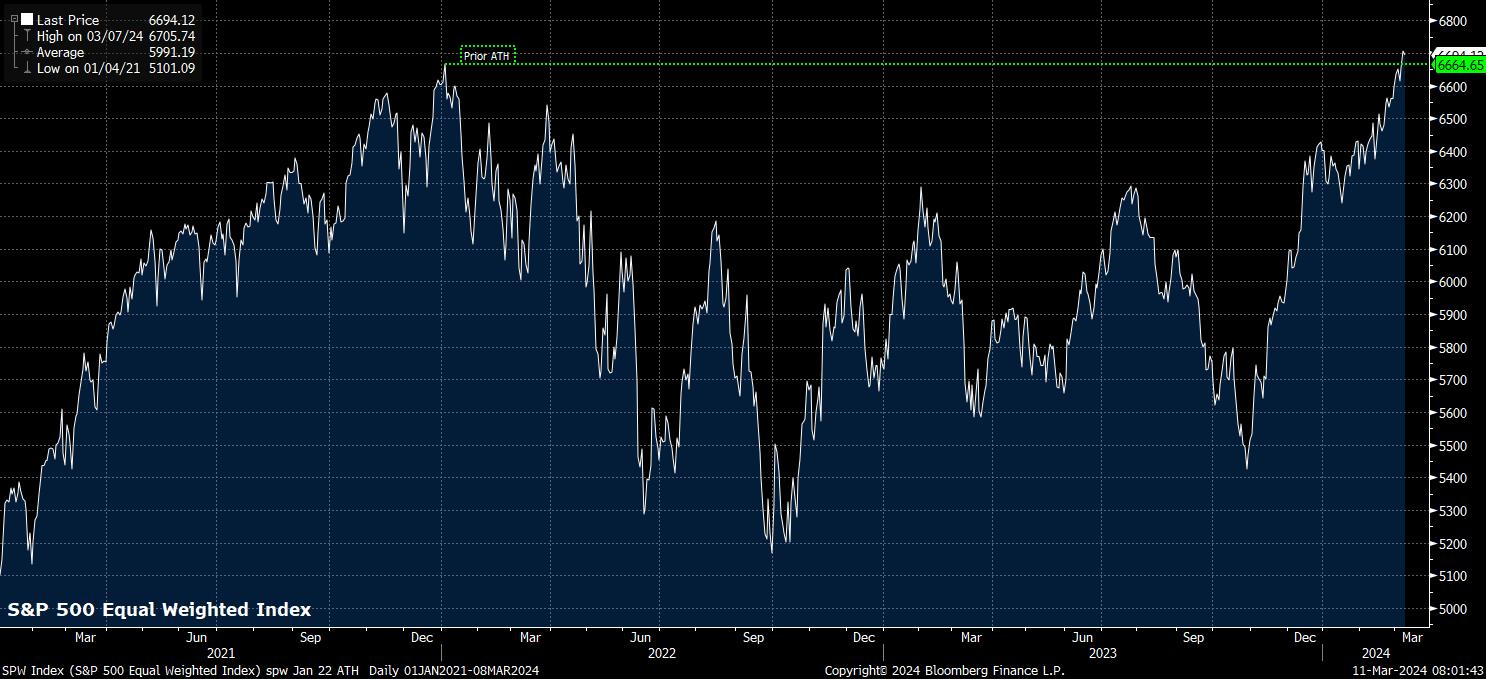

Perhaps the most obvious of these can be found by glancing at the equal weighted S&P 500 index; simply, an index which contains the same 503 constituents as the conventional S&P 500, but assigns each the same weighting, as opposed to weighting index members according to their market cap. Last week, the equal weighted S&P 500 extended recent gains, rallying to a fresh record closing high for the first time in over two years, surpassing the prior all-time high set in January 2022.

Similar signs of equity gains broadening out are also evident elsewhere.

The ‘magnificent seven’ stocks, for example, are no longer all indiscriminately rallying with a near perfect correlation to each other, with stock- or sector-specific developments seemingly having a much greater impact this year, than they did last. Tesla, for instance, has slumped around 30% YTD amid worries over slumping EV demand, while Apple has also fallen substantially since the turn of the year, owing primarily to the deteriorating China sales outlook.

Meanwhile, Nvidia has continued to outperform, as the ‘picks and shovels’ play on the ongoing AI frenzy persists, while Meta has also continued to race higher amid thriving ad revenues.

_mag_7_2024-03-11_08-02-05.jpg)

Together, this all points to a substantially lower degree of speculative frenzy than some had feared might have been setting in last year. That fundamentals do still matter, and influence price, for each of these behemoths suggests that trading is of a much more considered nature than the ‘buy every MAG 7 stock’ mode that had appeared to be dominant in the minds of market participants last year. The lack of a speculative mania suggests that the risks of a ‘bubble’ are relatively low, and that there is likely room for further upside in the medium-term.

A look at the market more broadly suggests similar. Returning to the idea of breadth, as the rally has broadened out in recent months, just under 30% of S&P 500 constituents have hit a record high this year, even if industrials is the only sector where the majority of members have achieved this feat. Nevertheless, not only does this suggest a rally that is broadening out, it also suggests one that likely has more room to run higher, with plenty of space for other stocks to also participate in the gains.

In addition, there are a number of other supportive factors for risk.

Naturally, one of these remains the policy backdrop, with G10 central banks set to embark on a ‘summer of easing’ as inflation remains on track to return to 2%, with rate cuts also set to coincide with an end to quantitative tightening programmes, thus leading to a further increase in liquidity as the year progresses. With, of course, policymakers being able to deliver further targeted support were any specific areas of the economy to encounter specific issues. In other words, the central bank ‘put’ is back once more, giving investors increased confidence to increase risk exposure.

Furthermore, the growth backdrop – particularly stateside – looks set to remain supportive, with incoming economic data continuing to point to resilience across the economy, and with consensus real GDP growth expectations continuing to be revised higher, which should further support earnings growth as the year progresses.

In summary, then, it remains difficult at this juncture to construct a convincing bear case, with equity internals pointing to the potential for further gains, the policy backdrop remaining supportive, and an improving economic backdrop also likely to provide a further tailwind.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.