CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

After nearly two months of consolidation, Bitcoin has finally broken out of its range-bound structure. From late May through early July, BTC oscillated between $100,000 and $110,000 for more than 50 days, forming a solid technical base.

Over the past week, the price has decisively cleared key resistance levels around $108,200 and $110,000. On July 11, Bitcoin futures briefly spiked to $116,871—marking a new all-time high and reigniting market enthusiasm.

From a technical standpoint, the RSI is hovering near overbought territory but hasn’t yet reached extreme levels. This suggests that while bullish momentum clearly dominates, the market hasn't entered a euphoric state. Short-term profit-taking may introduce pullbacks, but fading this strength remains risky in such a momentum-driven environment.

Institutional Demand Reshaping Market Structure

At the heart of this rally lies sustained structural inflows from institutional players. Since the start of the year, spot Bitcoin ETFs have seen a cumulative net inflow of $14.4 billion, with over $200 million pouring in on July 9 alone. BlackRock’s IBIT continues to lead the pack, highlighting growing confidence among mainstream investors in Bitcoin’s role as a portfolio asset.

Corporates are also ramping up participation. Strategy (formerly MicroStrategy) and GameStop have continued adding Bitcoin to their balance sheets, while Trump Media’s filing to launch a “crypto blue-chip ETF” further underscores institutional alignment with long-term Bitcoin adoption.

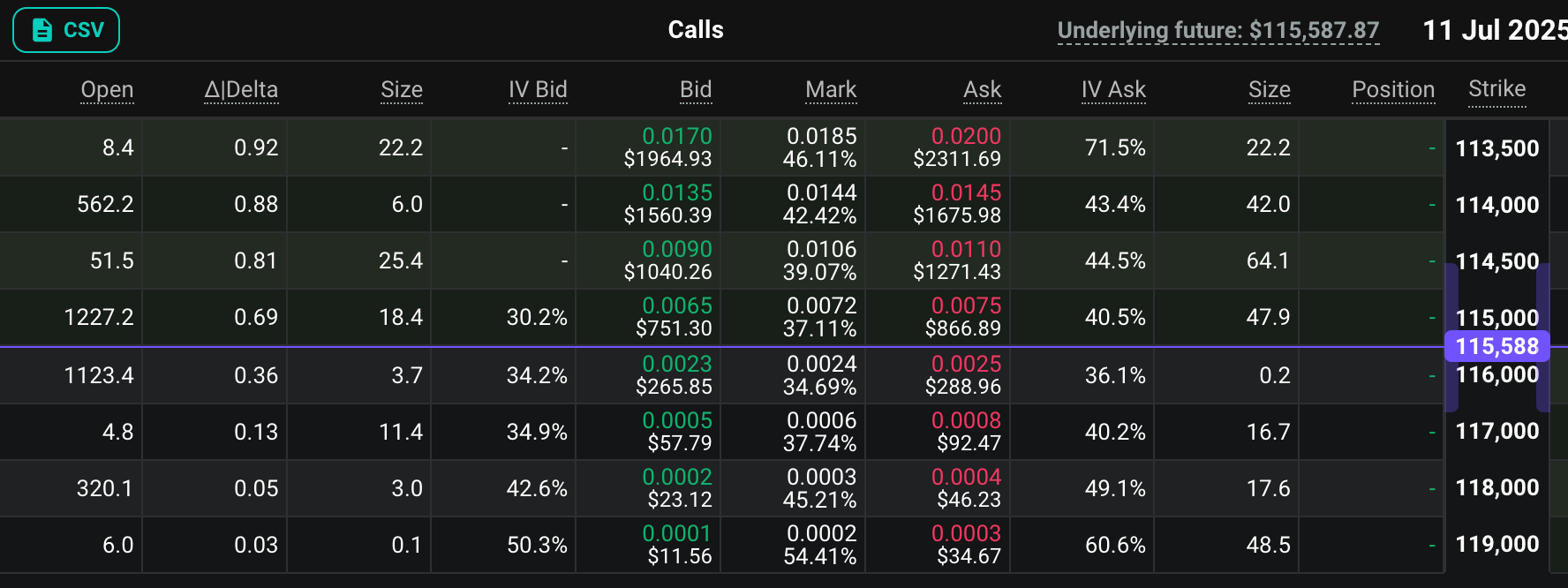

Derivatives markets are echoing this optimism. Data from Deribit shows a heavy concentration of open interest in BTC call options between $115,000 and $120,000, with some whales even positioning for $130,000 via longer-dated options. This positioning reflects a strong medium-term bullish bias and suggests there's still room for price discovery.

Macro Tailwinds: Liquidity Hopes Meet Hedging Demand

While institutional flows are powering the engine, macro conditions are paving the way. Although the Fed has yet to officially pivot, its June meeting minutes showed that a majority of participants view a moderate rate cut this year as appropriate. This has capped further dollar strength and improved the appeal of dollar-denominated assets like Bitcoin.

Meanwhile, Trump’s July 4 “Big & Beautiful” fiscal package is expected to widen the US budget deficit by $3–5 trillion over the next decade. Against this backdrop of deteriorating fiscal sustainability, investors are again gravitating toward scarce assets such as gold and Bitcoin—natural hedges against the erosion of fiat credibility.

Geopolitically, while Trump has issued tariff letters to 22 countries, enforcement has been postponed to August 1. Markets appear to be adjusting to his now-familiar “TACO strategy,” showing less sensitivity to trade noise. As a decentralized, non-sovereign asset, Bitcoin is increasingly valued for its policy-immunity traits—an emerging pillar of its long-term valuation logic.

AI Spillover + Regulatory Support Boost Confidence

Beyond macro drivers, surging tech sector performance has added a secondary lift to Bitcoin. Nvidia’s strength has led a broader rally in AI-related equities, elevating risk appetite and encouraging investors to extend that “AI premium” logic to digital assets. This cross-sector correlation is now helping to amplify Bitcoin’s short-term price elasticity.

Regulatory tailwinds are also taking shape. The SEC recently voiced support for the tokenization of securities, with Paul Atkins calling tokenization a “major innovation.” Robinhood’s debut of tokenized stock trading marks another step toward bringing blockchain into mainstream finance. This shift in tone has sparked renewed optimism, as more market participants begin to believe the may be warming to crypto innovation.

Outlook: Beginning of a Repricing Cycle - or Just a Peak?

In short, Bitcoin’s latest breakout appears to be the result of a structural rally driven by institutional flows, supported by a favorable macro backdrop and reinforced by a shift in regulatory sentiment. In today’s asset allocation landscape, Bitcoin is no longer just a speculative instrument—it straddles the line between a digital hedge like gold and a growth asset like tech equities. The current bull case is both strong and multifaceted.

Looking ahead, two key catalysts are likely to dominate investor focus in the short term.

First, the upcoming“Crypto Legislation Week”in the US (July 14 - 18) could be a game-changer. Lawmakers will review several critical proposals, including the GENIUS Act (stablecoin oversight), the anti-CBDC surveillance bill, and - most importantly - theCLARITY Act, which aims to define regulatory boundaries between the SEC and CFTC and offer a clear compliance path for digital assets.

If passed, the CLARITY Act could remove key barriers to institutional participation and unlock regulatory certainty for sectors like DeFi and real-world asset (RWA) tokenization. This could trigger the next wave of capital inflows and signify a true inflection point in US crypto policy.

If legislative momentum remains strong, ETF inflows persist, and the Fed signals dovish intent, Bitcoin retesting the $120,000 mark before August would not be far-fetched.

The other key variable ismacro data and policy timing. The July 15 US CPI print will be a pivotal moment. A surprise rebound in inflation could temper rate cut expectations and dampen crypto sentiment. Meanwhile, the delayed Trump tariffs (set to go into effect August 1) could weigh on broader risk appetite. Lastly, if crypto legislation stalls or proves vague in execution, the market may treat recent optimism as a “buy-the-rumor, sell-the-news” event.

Should these headwinds materialize, a pullback toward the $108,000–$110,000 support zone would not be surprising. Nonetheless, the broader bull thesis remains intact. Traders should stay agile, with close attention to upcoming policy signals and data catalysts.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)