CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Cash equity volumes have been strong and some 20% above the 30-day average, while 2.04m S&P 500 futures contracts traded, which is heavy. The pain trade for equity remains higher.

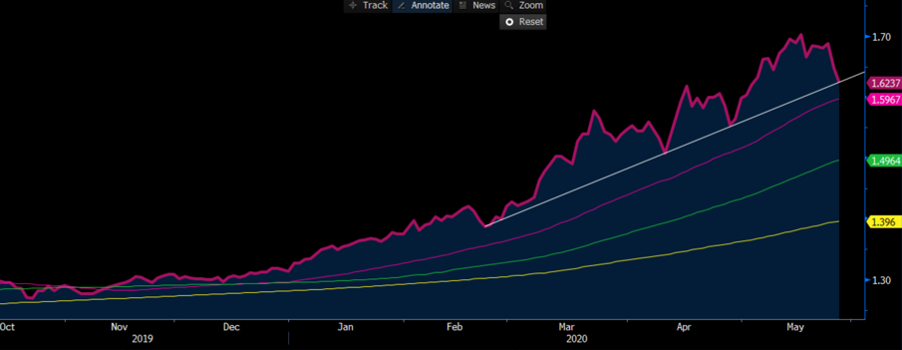

Once again, we’ve seen cyclicals outperform defensives, while small caps are dominating, with the Russell 2000 +3.1%, while value continues to outperform growth as a factor. Financials are flying, and this despite the US yield curve 2bp flatter on the day, and also despite talk from St Louis Fed President James Bullard that yield curve control is something the Fed could consider, with NY Fed president john Williams also touching on it in a TV interview.

(Russell 1000 value/Russell 1000 growth index ratio)

(Source: Bloomberg)

Yield curve control a renewed talking point

There is little doubt that the Fed is doing a job in capping yields, as the 10yr should be closer to 90bp, so there is little need for the Fed to buy duration assets until the market turns and starts to sell. Therefore, inflation expectations (through breakevens or swaps) are critical, because if they move higher then I’d argue Treasury volatility will rise, as too will FX volatility too.

(US 5-yr Breakevens - inflation expectations)

(Source: Bloomberg)

Capping long-end interest rates when if and when we see signs of inflation in Q4 20 and into 2021 is not something the banks want to see – when you borrow at short-term rates and price lending off the long-end, in effect, the Fed just cap margins, and one just has to look at the equity of Japanese and European banks over recent years to see how yield curve control (YCC) has gone down.

However, the rotation into banks is a healthy sign and should see Asian banks follow suit on open today, with the ASX 200 looking lively - can it hold the early strength this time around? ‘Buy the unloved’ is the theme, but the bulls will like the fact that tech is still higher on the day, as is energy and materials, despite crude being -6% and copper -1.3% and there has only been small selling in volatility structures, with the VIX index -0.37 vols at 27.64.

So, despite equity moving along with gusto the tide did not lift all ships, and we’ve seen credit markets underperform a touch too.

Risk FX looking at China and not the S&P 500

Risk FX has also underperformed. The BRL being the exception, but BRL shorts are still working their way of the system. The AUD fascinates because it has broken away from moves in the S&P 500 futures, a relationship that recently been so strong of late, and has reverted to watching the USDCNH and USDCNY. The move in the yuan being one of the two big stories in FX markets. That and the EU’s proposed €750b Recovery Fund, which is certainly a step in the right direction for the EU, and while expected, the finer details were made clear, and the market liked what they heard - EURUSD rally sharply from 1.0934 to 1.1031 and BTP-bund spread to tighten 5bp to 191bp.

A focus on the yuan

The interesting angle is we saw the PBoC ‘fix’ its CNY mid-point 201-points lower yesterday at 7.1092, which was lower than expected (i.e. yuan stronger), yet despite this statement from the PBoC USDCNH went on to rally from 7.1425 to 7.1965, with the move stopped right on the September 2019 highs. A break of 7.1965 today, should it play out, would be telling and would likely weigh on the AUD and NZD and EM FX more broadly. I suspect the PBoC will want to curb excess CNY/CNY selling, so it would not surprise to see USDCNH lower short-term, so today’s PBoC daily CNY fix (11:15 AEST) should get renewed attention FX traders, and could be a source of intra-day volatility - I will post the outcome of the CNY fix on the Telegram channel.

Daily chart of USDCNH

All eyes remain on the US-China relationship, and therefore the likes of AUD, NZD, TWD and KRW will probably look more closely at the CNH than S&P500 futures in the near-term. Comments from Mike Pompeo that HK doesn’t assert a high degree of autonomy from China have resonated, and with China’s National People Congress concluding today, the national security law could be formally voted through. Premier Li Keqiang is due to speak at 18:00 AEST/09:00 BST and one questions if this will be market moving.

Wilbur Ross also detailed that “Trump is considering a whole menu of options against China”, and the market is on edge to hear exactly what those measures are, and how China absorbs them. This is a risk for markets and the situation is clearly fluid - one questions if the equity markets are too complacent here? The CNH is our best guide, although calls for the HK50 sit lower despite the moves in US equities and it wouldn’t surprise if our flow here today was aimed more on the short side.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.