Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

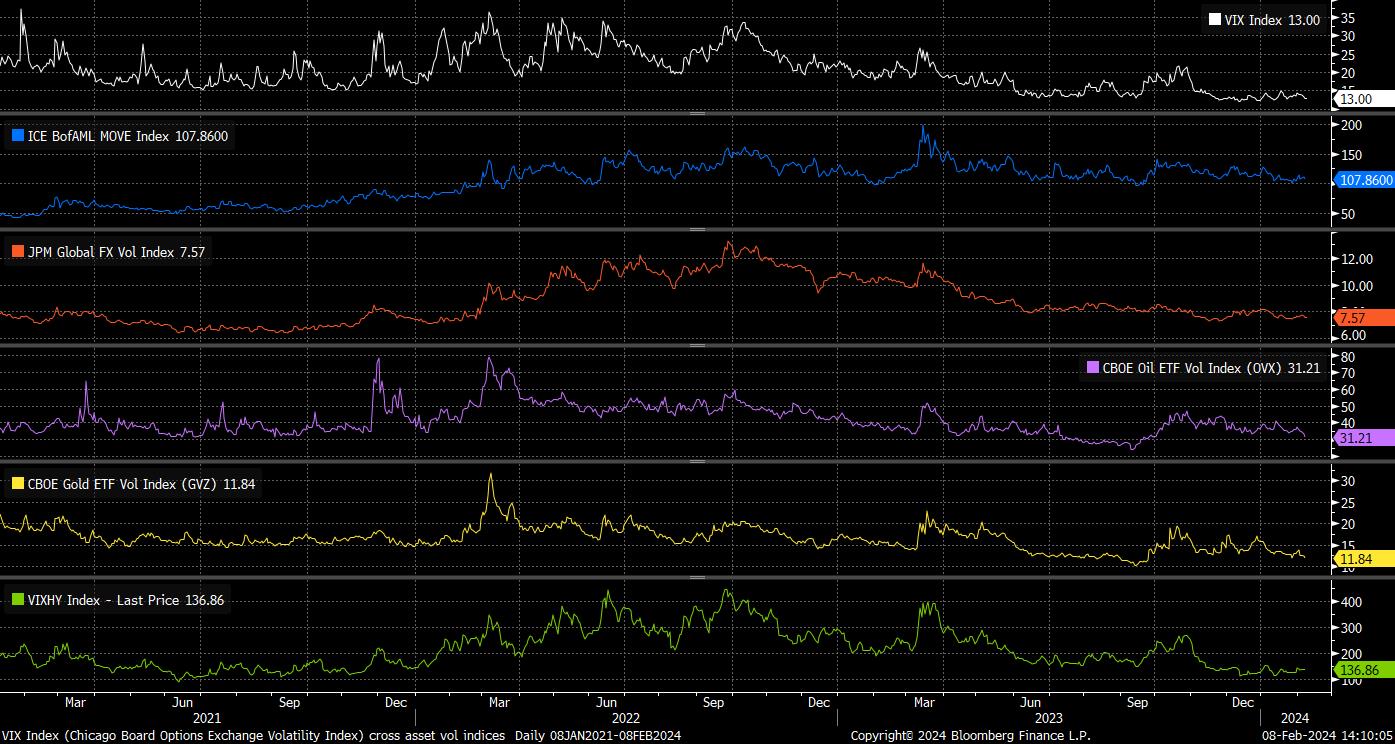

Before discussing that, a look at various gauges of implied vol is probably worthwhile, see chart. As is relatively obvious, cross-asset vol has continued to decline since the turn of the year, particularly in the commodities space, while the VIX remains close to post-covid lows, and BofA’s MOVE index is planted at the bottom of the range that has been in place since the FOMC began their tightening cycle in early-2022.

A similar trend is in evidence in the FX space, with JPMorgan’s proprietary gauge of global FX volatility, covering 27 DM & EM USD pairs, having recently slipped to its lowest level since the fourth quarter of 2023. Anecdotally, as most G10 FX traders can probably attest to, the DM FX space has been particularly subdued of late, and at times akin to watching paint dry.

This lack of movement, and subsequent lack of discounting any fresh risks facing the market, begs the question as to whether markets are ‘priced to perfection’, or whether there are potential tail risks (both left & right) that have not yet been adequately priced.

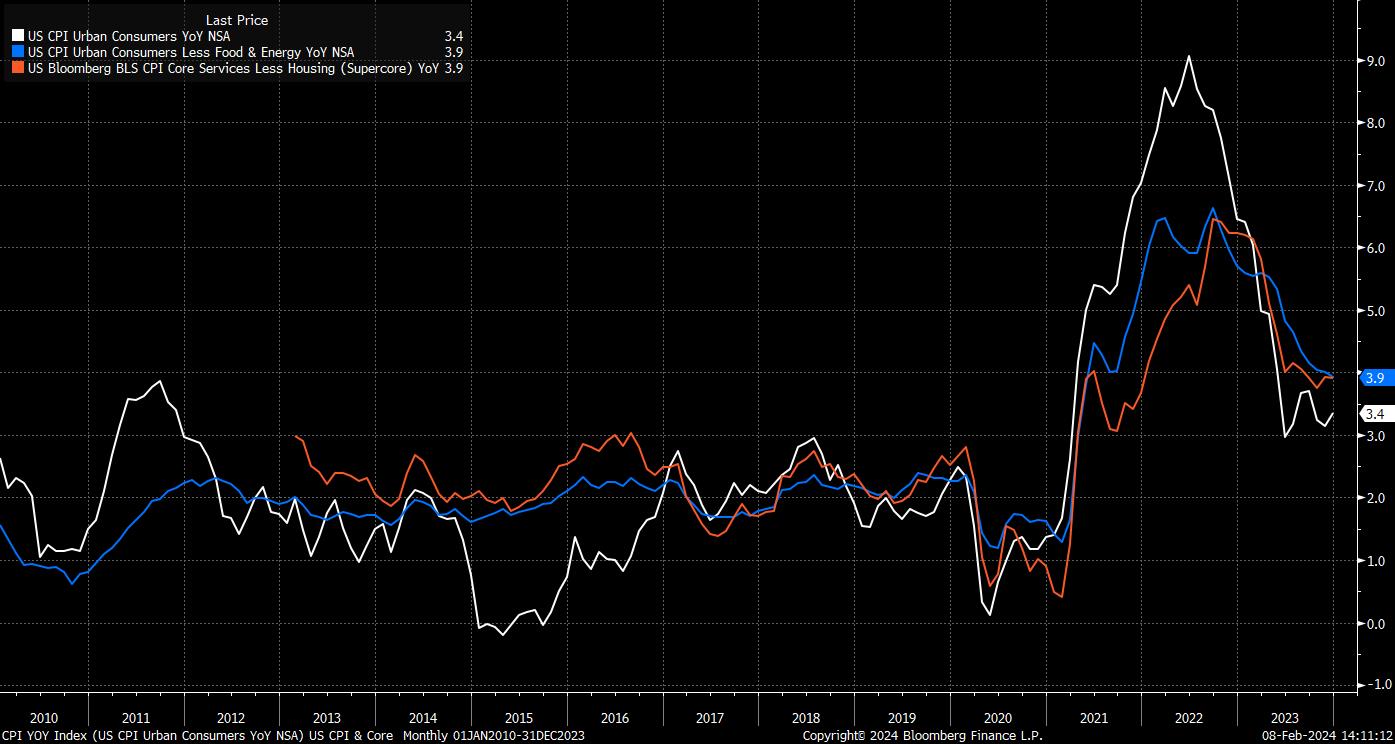

On the one hand, and the camp that I tend to subscribe to at the moment, is the idea that the drop-off in, and continued low levels of, vol is justified. The most obvious rationale for this is that, across developed markets, ‘immaculate disinflation’ appears poised to continue, with headline price gauges set to return steadily towards 2% as the year progresses, and the US economy – in particular – on track for a ‘soft landing’.

While downside growth risks are more prevalent elsewhere, most notably in the eurozone, and of course in China, this backdrop does mean that the global monetary policy outlook, at presents, points to most DM central banks embarking on relatively synchronised, and steady, easing cycles, with money markets fully pricing the first Fed and ECB cuts for June, and the first 25bp cut from the BoE in July. There is a similar degree of commonality around the degree of total easing that markets price by the end of the year.

There is also, of course, the relatively barren spell that markets are currently passing through in terms of major data catalysts. After the blowout January NFP print, there is little of any particular interest on the calendar until next Tuesday’s CPI report; after that, we then look toward earnings from NVDA – the darling of the ‘magnificent seven’ – on 21st February, before focus then turns to the PCE report a the end of the month.

All that said, the economic outlook portrayed above is conditioned on a number of assumptions, chief among which being that the continued lagged effects of the tightening cycle don’t bear down more heavily on economic activity, and that the ‘last mile’ of returning inflation to target proceeds as smoothly as the journey has done thus far. Sticky services prices seem the greatest risk here.

There are, of course, numerous additional risks in the longer-run that markets must remain cognisant of, though which we are probably too far away from at present to be tradeable themes.

Elections in the UK and US, along with 38 other democracies across the globe, are likely to play an increasing role in influencing traders’ psyche as the year progresses, particularly in terms of any fiscal promises – most likely increased spending/lower taxes – that the campaigns for each are likely to bring. It will be of particular interest to see how market participants weigh up a loosening of monetary and fiscal policy at the same time, and how any additional liquidity may provide a tailwind for risk.

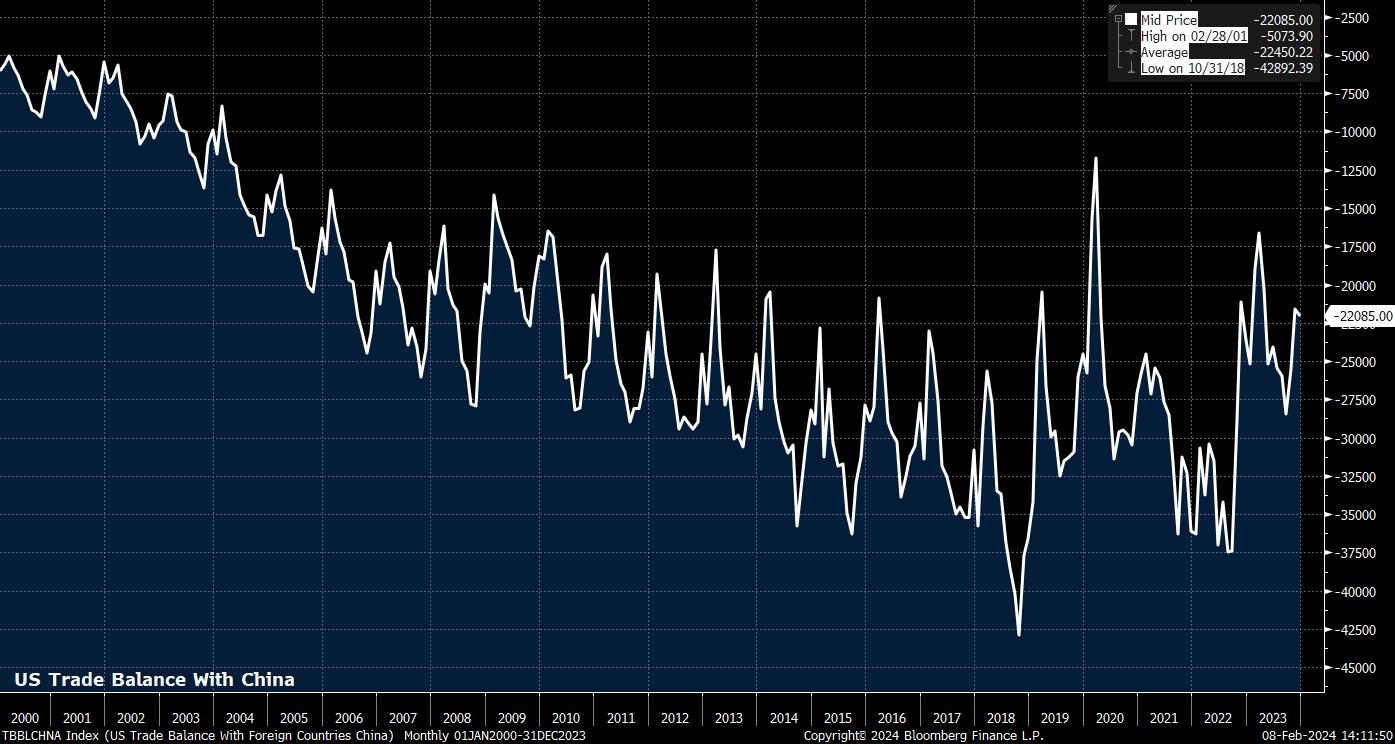

Geopolitical developments of course also remain front and centre, with tensions remaining elevated in Ukraine, the Middle East, and Taiwan, the latter being of particular importance given that competing with China, and ensuring fairer trade, is one of few issues that unites figures on both sides of the political aisle in DC.

In any case, these are longer-run catalysts. For now, it would appear that the ‘path of least resistance’ will continue to lead higher for equities (particularly on Wall St), and to the upside for the USD, though equity upside is likely to be more broad-based across sectors than seen last year. Low vol, then, seems justified, for now.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.