- English (UK)

Analysis

July 2025 US Employment Report: A Dismal Data Slate

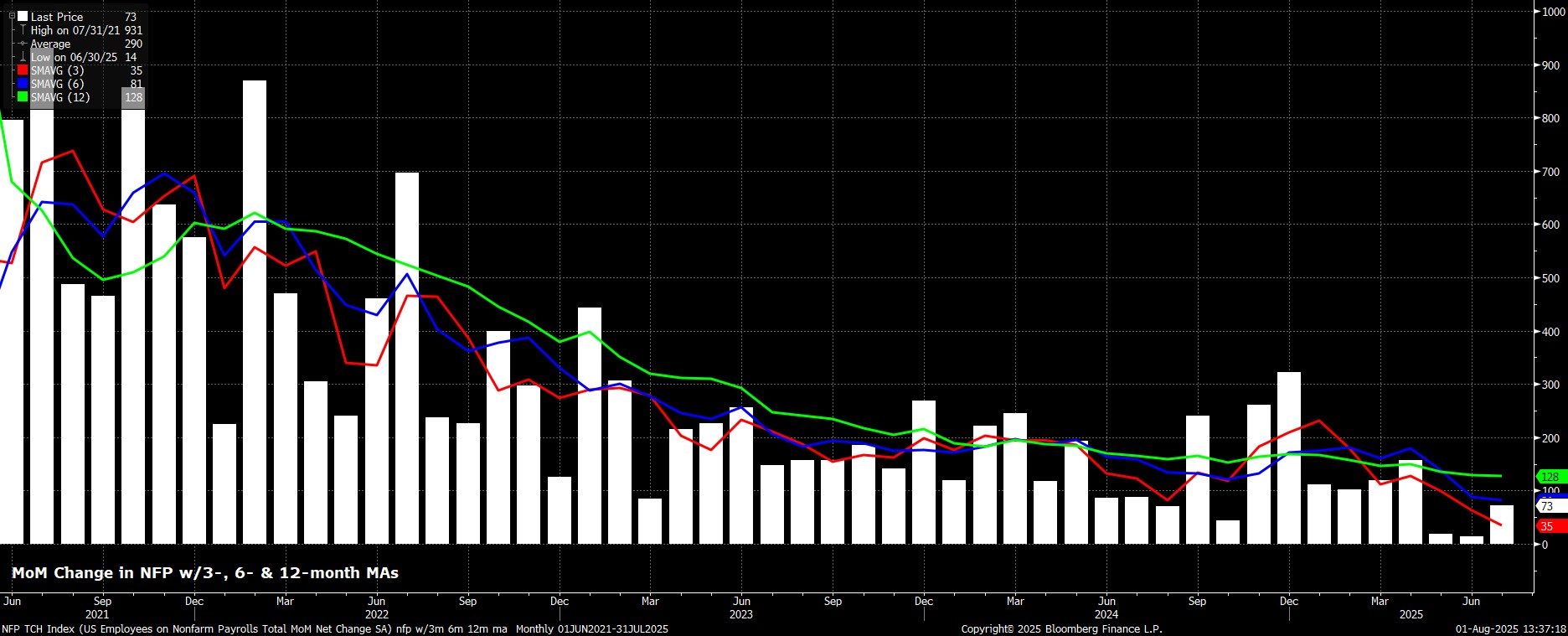

Headline nonfarm payrolls rose by just +73k last month, considerably below consensus expectations for a +105k increase, but within the ever-wide forecast range of 0k to +170k. Simultaneously, the prior two NFP prints were revised by a huge net -258k, taking the 3-month average of job gains to a meagre +35k, well below the breakeven pace, which sits around the 80k mark.

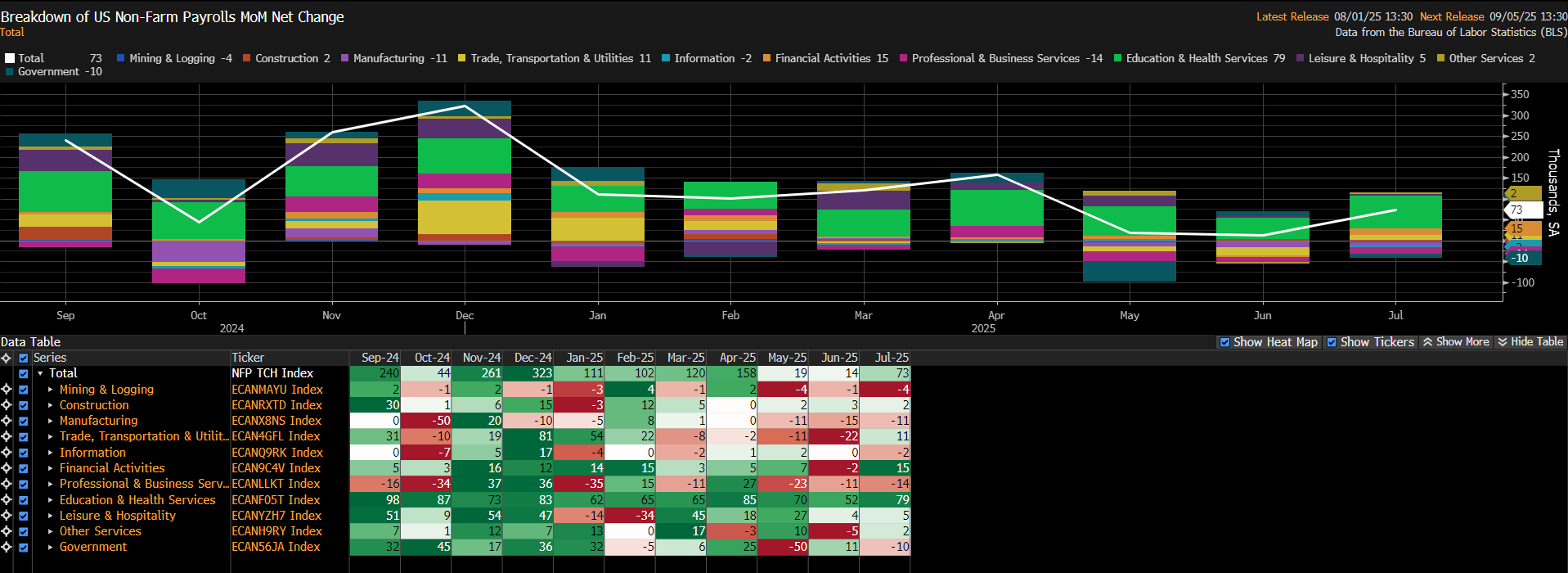

Digging a little deeper into the payrolls print, the largest drag on employment came from Professional and Business Services, as well as from Financial Activities, with Education & Health Services largely underpinning job gains.

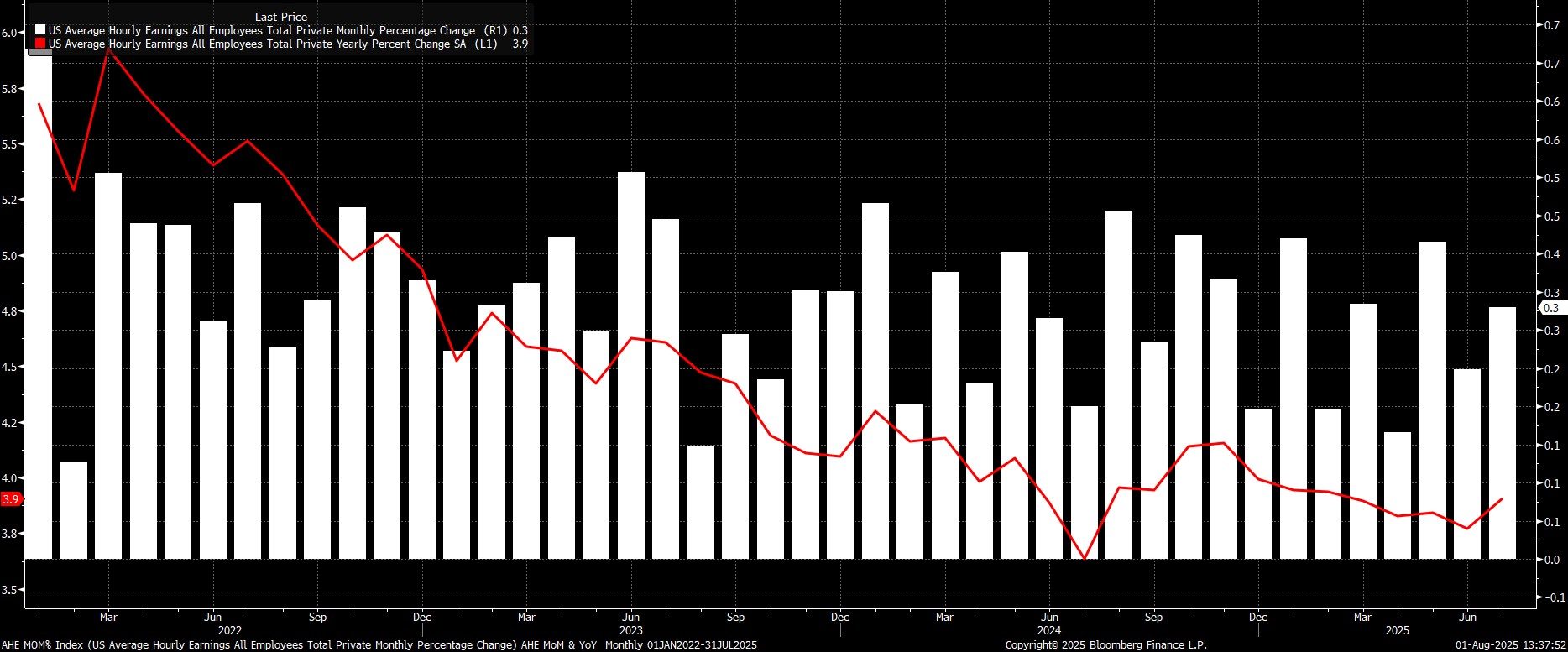

Sticking with the establishment survey, the jobs report pointed to earnings pressures remaining relatively subdued, again serving to reinforce the FOMC’s long-standing view that the labour market is not, at present, a source of significant upside inflation risk; even if, of course, those risks are present as a result of the tariffs that the Trump Admin have imposed.

In any case, average hourly earnings rose 0.3% MoM in July, bang in line with expectations, which in turn took the annual pace to a marginally hotter-than-expected 3.9% YoY.

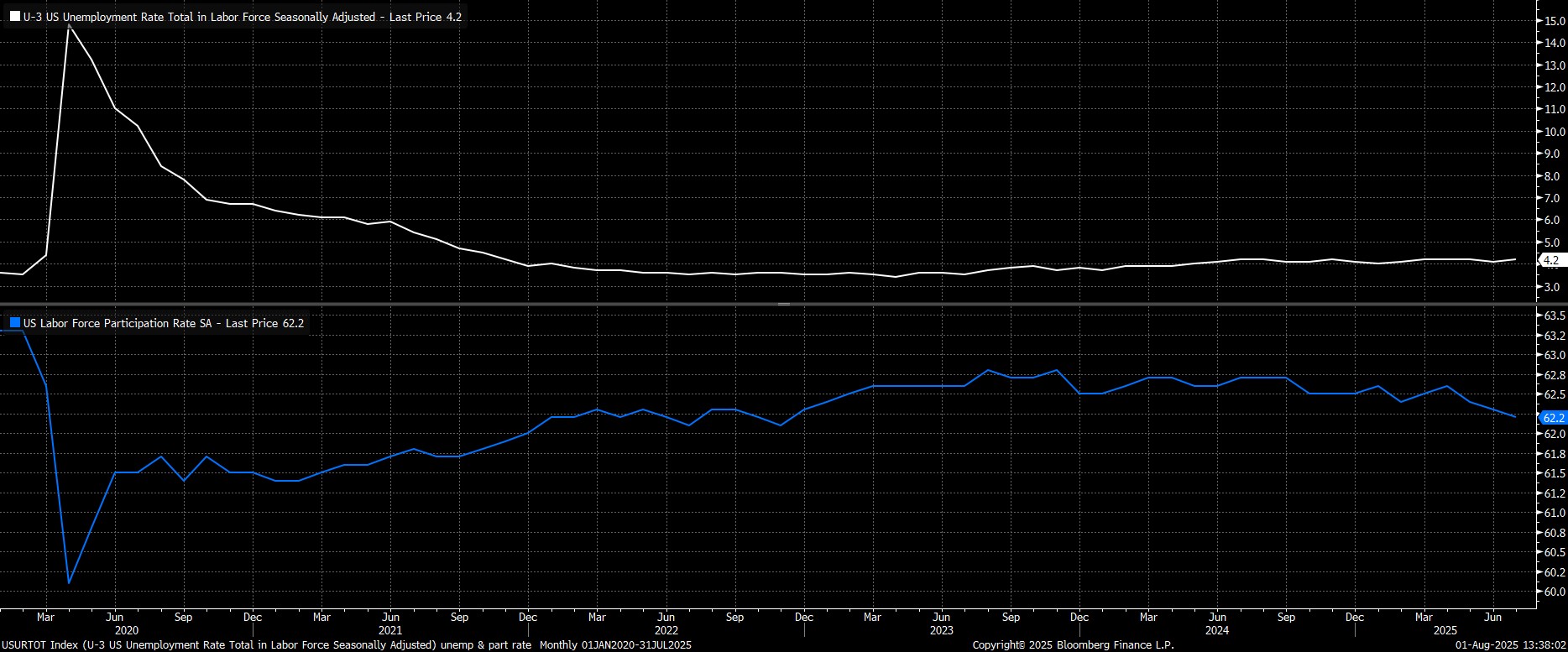

Turning to the household survey, unemployment ticked up to 4.2%, as expected, though labour force participation again declined, to 62.2%, a fresh cycle low, and again likely a result of much more stringent immigration enforcement.

Once more, however, one must continue to take this data with some degree of caution, given ongoing issues with declining survey response rates, and as the composition of the labour force continues to change in a rapid, and volatile, manner.

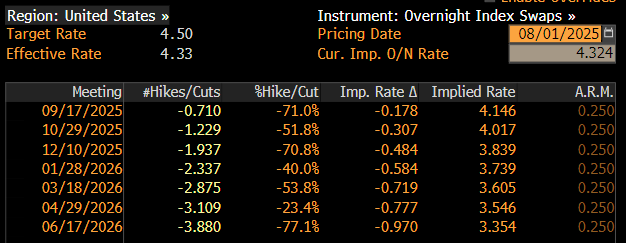

As the jobs report was digested, money markets repriced sharply in a dovish direction, with the USD OIS curve now discounting around a 2-in-3 chance of a 25bp cut at the September meeting, up from about 40% pre-release, while also pricing around 47bp of easing by year-end.

Zooming out, it’s important to note that policymakers will not over-react to one datapoint, and that there is another jobs report still to come before the next FOMC meeting. Still, Chair Powell did, on Wednesday very gently suggested that the September meeting is a ‘live’ one, and in my mind there remain two scenarios for Fed policy over the remainder of the year.

If inflation remains somewhat contained, and the labour market begins to crack, Chair Powell is likely to use the late-August Jackson Hole Symposium to embark on a dovish pivot, laying the foundations for cuts in both September, and December. My base case, however, is that tariff-induced inflation does prove somewhat stickier than expected, and the labour market holds up ok, meaning that the FOMC remain in ‘wait and see’ mode for the foreseeable future, in turn likely resulting in just one 25bp cut this year, most likely at the December meeting.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.