- English (UK)

Analysis

WHERE WE STAND – If I’m ever asked to explain to someone what a typical summer Friday looks like for financial markets, I’ll point them in the direction of how we ended last week.

It wasn’t so much that it was a subdued day for markets, it was more the case that there were almost no fresh fundamental developments whatsoever – besides confirmation that Trump & Putin will meet this Friday, and a rather ropey Canadian jobs report.

That does, at least, give me another chance to moan about the BoE! Chief Economist Pill gave his usual post-MPC agents briefing on Friday, where he noted that a “clear” decision was made to deliver an interest rate cut. Such a ‘clear’ decision, I should add, that the MPC had to vote twice to get to it, with Pill voting against that proposition both times. I wonder if they should just play a game of ‘rock, paper, scissors’ at the September meeting, it would probably be more straightforward than last week’s rather shambolic affair.

The quid was, rightly, rather uninterested in Pill’s mutterings, trading pretty much flat on the day, in keeping with the tone of the G10 FX landscape at large. I must admit to being somewhat surprised that the late-Thursday USD pressure on CEA Chair Miran’s elevation to the Fed Board didn’t persist, though the continued erosion of Fed policy independence is more of a longer-run structural headwind in any case, that clearly has not gone away.

Furthermore, Treasuries are probably the ‘cleaner’ play in this instance, where some modest pressure was seen at the back end of a steeper curve as the week drew to a close. My long-running range trading strategy appears to be paying dividends once more here, with the bears having re-asserted control upon a test of 4.20% in the benchmark 10-year yield, and upon a foray into the 4.7%s in the benchmark 30-year. One would imagine that, with both monetary and fiscal jitters at the forefront of participants’ minds once more, we start to look back towards the wider extent of the recent ranges – at 4.50% and 5.00% respectively – though a lot here will hinge on this week’s CPI print.

As for equities, the path of least resistance seems to pretty clearly lead to the upside once more, with benchmarks ending the day nicely in the green, and the Nasdaq notching a new record high. For the time being, equity bulls seem able to easily shake off concerns over a potentially slowing US economy, as solid earnings growth powers a big-tech led rally.

This, again, feels like a market that you just can’t keep down for long, especially with participants banking on another extension of the US-China trade truce, ahead of its scheduled 12th August expiry. We’re back to banking on TACO time, it seems.

On which note, Treasury Sec Bessent was out over the weekend saying he thinks trade talks will now wrap up by the end of October. That deadline has now shifted four times – from 2nd Apr, to 9th Jul, to 1st Aug, to Labor Day, and now to 31st Oct. At this rate, Bessent’s going to have a very sore foot from the number of times that he’s kicked this particular can down the road!

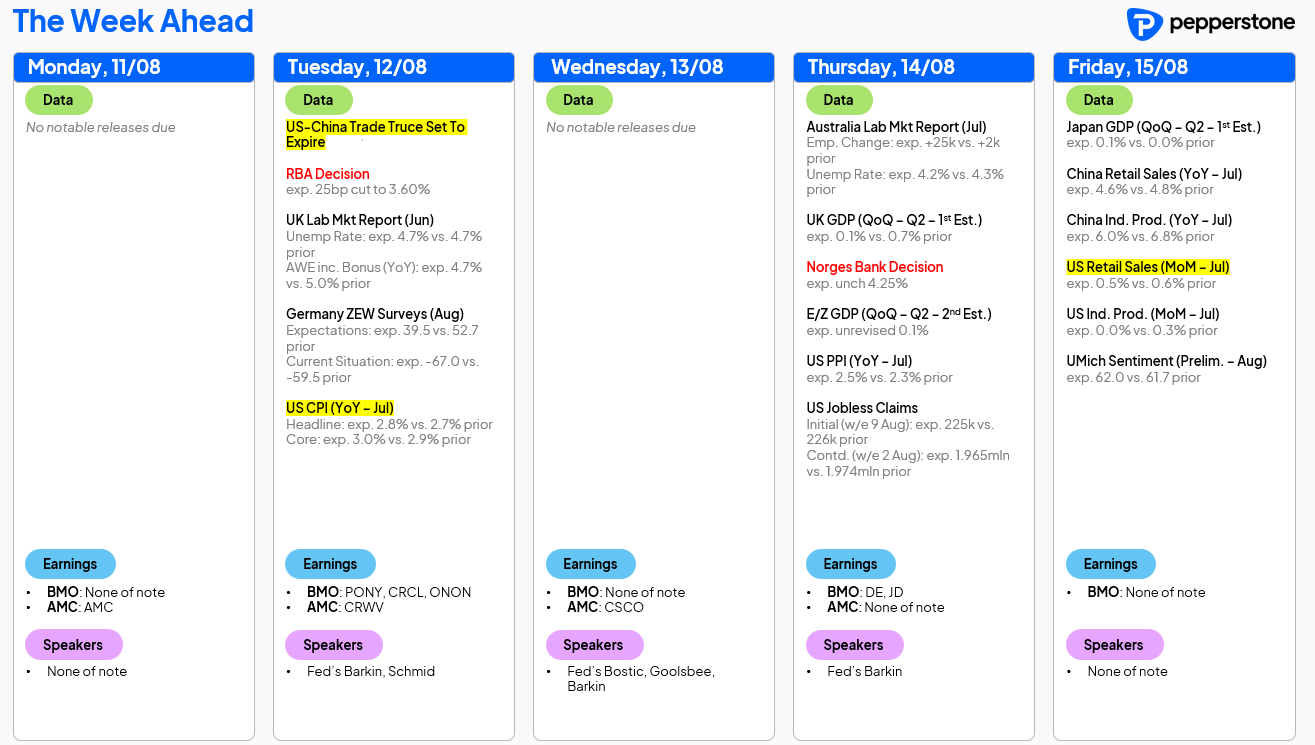

LOOK AHEAD – There are a few bits and bobs of interest on the docket this week, though that can’t be said about today, where there are no scheduled releases of any note whatsoever. Please, though, whatever you do, don’t go using the ‘Q’ word..!

As for the rest of the week, Tuesday’s US CPI release highlights the docket, with both headline and core inflation metrics seen rising 0.1pp to 2.8% YoY and 3.0% YoY, respectively. Focus will fall heavily on core goods prices too, which rose to near 2-year highs last time out, as participants and policymakers alike continue to attempt to gauge the degree to which tariffs are being passed on in the form of higher consumer prices. With most FOMC officials still seeing inflation as further away from its objective than employment, a hot print here would cast further doubt on the potential for a September rate cut, to which markets currently assign around a 90% chance. That, to me, seems far too high.

Elsewhere, we also get the latest US retail sales stats this week, which will be closely interrogated for any signs that a weakening labour market may be posing a headwind to consumer spending. Closer to home, here in the UK, the latest jobs and GDP figures are due, with the economy likely to have – at best – stagnated in the second quarter of the year.

On the policy front, while we’re set to hear from a smattering of Fed speakers through the week, decisions are due from the RBA, where a 25bp cut to 3.60% is nailed on, and from the Norges Bank, who will stand pat.

Other considerations for the week ahead include the looming expiry of the US-China trade truce, which every man and his dog expects to be extended, but which President Trump appears to want to drag out to the last possible moment. Earnings season also continues this week, albeit as we move towards the end of the Q2 reporting period, with figures this week due from the likes of John Deere, Cisco, and Pony.ai. I’m still staggered that someone actually named their company that, and suggest that the CEO goes and does some research into Cockney rhyming slang.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.