Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

November 2025 BoE Preview: Standing Pat Once Again

No Rate Shifts On The Cards

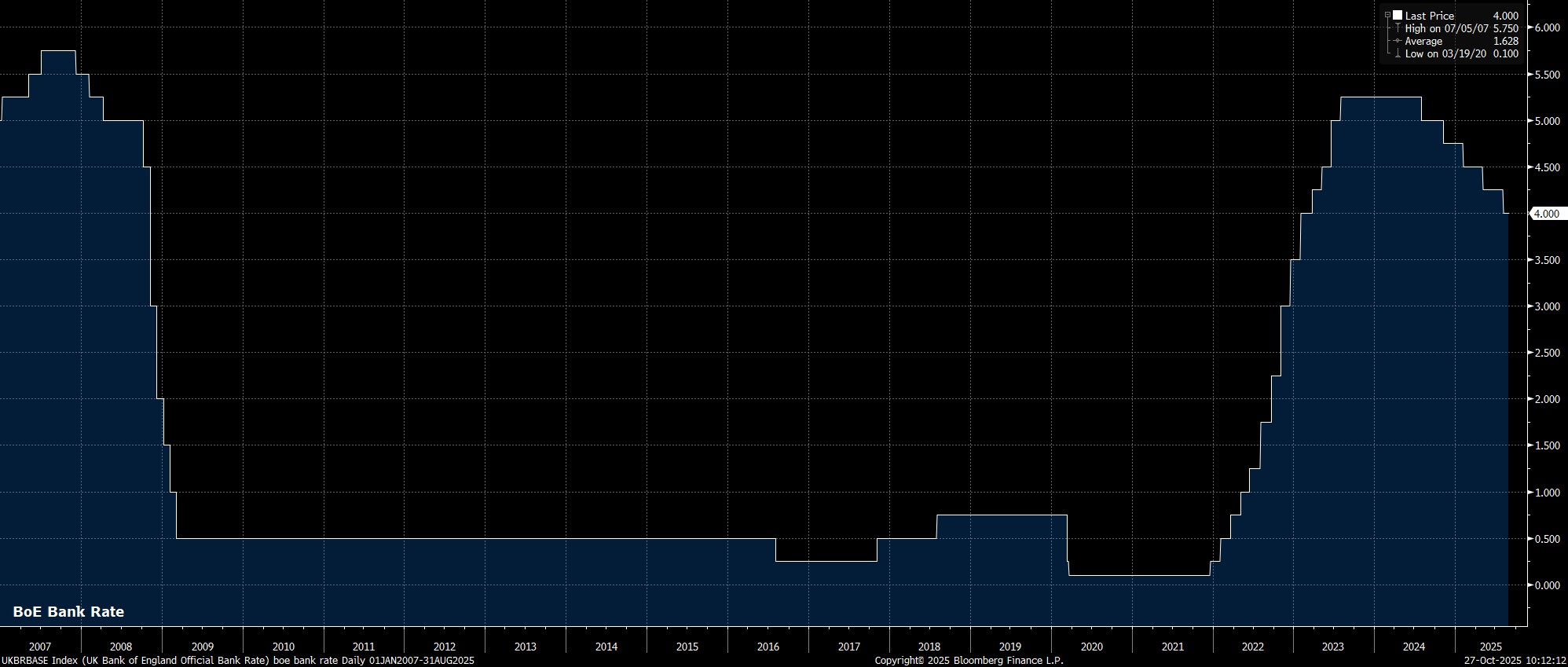

As mentioned, Bank Rate is set to be maintained at 4.00% at the conclusion of the upcoming policy meeting. This decision to stand pat, for a second straight meeting, would represent the first interruption to the predictable pace of quarterly rate reductions since the easing cycle began last summer, though by and large should be seen as a ‘skip’, as opposed to said cycle being at an end.

Money markets, per the GBP OIS curve, also discount such an outlook. While the curve discounts around a 1-in-4 chance of a 25bp cut at the November meeting, and an approx. 60% chance of a cut by year-end, the next 25bp move is not fully priced until February 2026, followed by another such cut being discounted by next June.

Vote Split To Provide Intrigue Again

Once more, the decision to stand pat on policy is unlikely to be a straightforward one, with this diversity of thinking having become something of a hallmark of the MPC this cycle.

Last time out, in September, the MPC voted by a 7-2 margin to hold Bank Rate steady, with external members Taylor and Dhingra dissenting in favour of a 25bp cut. The base case is that an identical vote split occurs this time around, especially after a host of recent comments, including those from Governor Bailey himself, have given little by way of notable hints at the need for further near-term easing, and with a host of ratesetters, including Chief Economist Pill, and external member Greene, having flagged a desire to slow down the easing cycle.

Three Reasons To Stand Pat

The case to hold policy settings steady in November, and to indeed slow down the pace at which restriction is being removed, boils down to three main factors.

Firstly, the MPC will vote on policy precisely three weeks before Chancellor Reeves delivers the autumn Budget. While it is common knowledge that a fiscal ‘black hole’ of between £20bln - £35bln will need to be plugged, and that the bulk of said fiscal tightening will come via tax increases, there is little-to-no certainty as to the form that said tax hikes will take. The MPC will want to avoid easing policy now, lest the Budget bring a further round of inflation-inducing tax hikes as was seen last year.

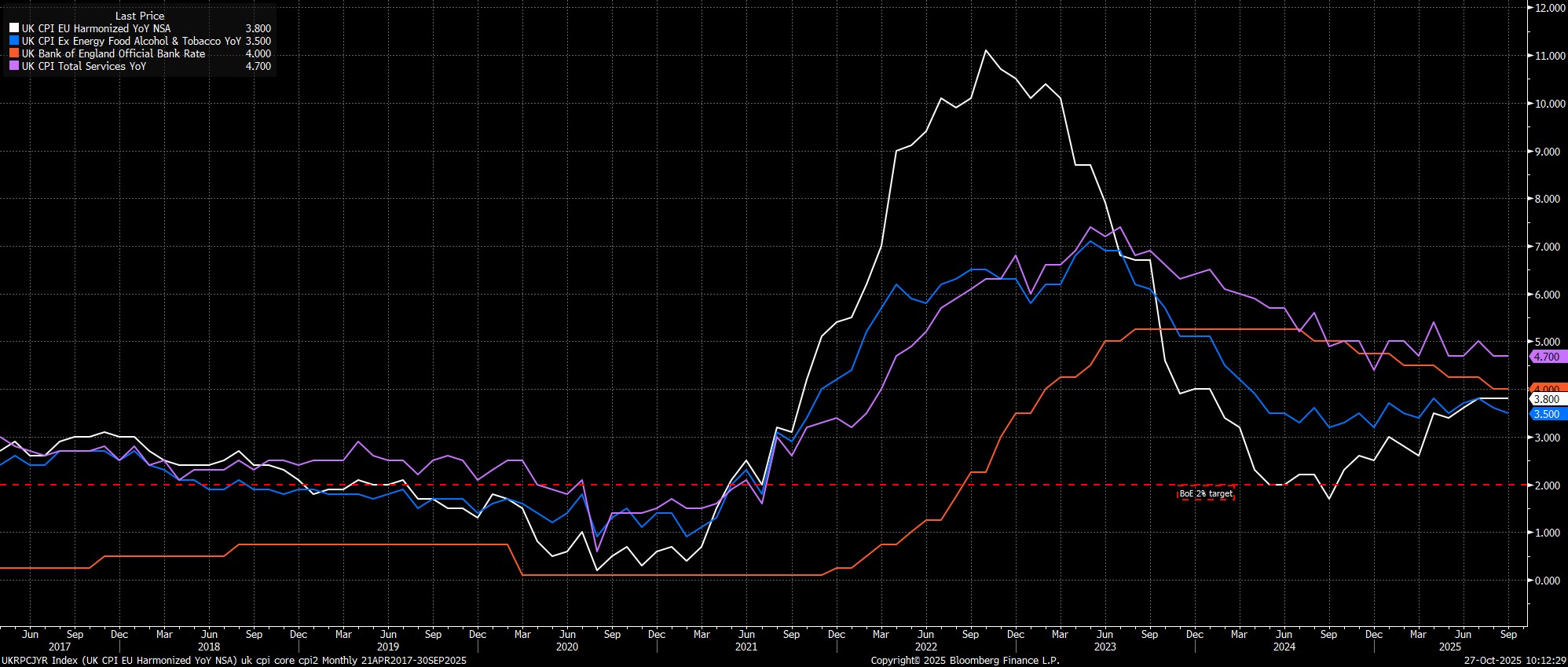

Secondly, it is as yet impossible to be convinced that price pressures have definitively peaked. While September’s CPI figures did print cooler than expected, at 3.8% YoY vs. the 4.0% YoY MPC forecast, and underlying price metrics also demonstrated a notable cooling, one month of data is simply not enough to convince policymakers that the worst of the inflationary impulse is in the rear view mirror.

Thirdly, and lastly, while the MPC have been divided in recent months on the appropriate timing of rate reductions, there appears to be little divide when it comes to which macroeconomic factors must take precedence in policymakers’ reaction function. For the majority, it remains the case that bearing down on the risk of persistent price pressures continues to outweigh a need to support the stalling UK labour market, hence meaning that unemployment having risen to a 4-year high 4.8% in the three months to August is likely to have little bearing on the upcoming decision.

Familiar Guidance To Remain

Taking the above into account, the MPC’s policy statement is likely to be relatively little changed from that issued at the conclusion of the September meeting.

Consequently, policymakers will likely reiterate that a ‘gradual and careful’ approach to the withdrawal of policy restriction remains an appropriate one, though clearly such guidance can no longer be taken to explicitly guide towards one 25bp cut every quarter. In light of this, it would be prudent for the MPC to repeat the ‘data-dependent’ nature of their current policy stance, with the path for Bank Rate not on a ‘pre-set path’, and policymakers to remain responsive to the ‘accumulation of evidence’ as data is released.

Updated Forecasts, But Little Change

The November meeting will also see the publication of the quarterly Monetary Policy Report, and an updated round of economic forecasts.

These forecasts, however, are not only likely to be relatively little-changed from those issued in the August report, but will also have a much shorter ‘shelf life’ than usual, given that they will not incorporate any potential fiscal policy changes that may be announced in the Budget on 26th November. Consequently, a ‘pinch of salt’ is likely to be required when interpreting the projections.

In many ways, then, it is no bad thing that the forecasts aren’t likely to be especially different to those issued last time out. The Bank may ‘mark to market’ the inflation profile, given the lower-than-expected peak CPI level seen in September, though are again unlikely to project a return to the 2% price before 2027.

Meanwhile, despite unemployment having continued to rise, some real-time indicators, such as the HMRC payrolls data, points to the labour market potentially being close to bottoming out, likely lessening the need for a significant revision. The growth profile also seems unlikely to be revised too notably, given the aforementioned fiscal uncertainty.

Governor Bailey’s Non-Committal Press Conference

Reflecting on all the above, at the post-meeting press conference, Governor Bailey is unlikely to make any explicit pre-commitments to the pace, or timing, of further Bank Rate reductions.

That said, Bailey should repeat what has become familiar rhetoric in that a ‘gradual and careful’ pace of removing restriction remains appropriate, and that the direction of travel for rates remains lower. In addition, Bailey will again flag some caution in terms of the speed at which further cuts may take place, likely alluding once more to the UK not being ‘out of the woods’ when it comes to the risks of persistent price pressures.

Next Cut Not Until February

Looking ahead, my base case remains that the MPC will now not deliver another 25bp cut until February 2026, again standing pat at this year’s final confab, in December.

While significant, and unexpected, further labour market weakness could spur action before the end of the year, policymakers have traditionally been reluctant to move at meetings where there is neither a forecast round to reinforce their decision, nor a press conference for that decision to be explained. Though those factors don’t preclude a December cut, it also seems unlikely that at least five MPC members would be confident enough in inflation having peaked to vote for a cut at that meeting.

Consequently, all signs point to next February as being when the MPC take their next step towards a more neutral policy setting. That step is likely to be followed by a resumption of the quarterly pace of cuts seen for the bulk of the cycle so far, in turn seeing Bank Rate cut to its terminal level, likely 3.25%, by next summer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.