Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

China’s Politburo Sparks Market Optimism: What Traders Need to Know

China flies, but can the buyers take the equity markets further higher?

The measures announced by Chinese policymakers at the Politburo have certainly struck a chord, and while ‘Trading China’ was not as active a market theme as chasing the NAS100, S&P500 or even the German DAX higher into year-end, China has come back squarely onto the radar as a tradeable theme that could offer a new source of alpha that could pump up the P&L into year-end.

The policymaker's change of stance to take monetary policy to a “moderately loose” setting is a much-needed psychological boost for China risk, and while many in the macro community question why this stance wasn’t adopted sooner, the change speaks to a new level of support and increased flexibility to counter the fallout from impending Trump tariff risk. A commitment of more proactive fiscal policies, married with measures to “forcefully promote consumption”, and to “stabilize housing and equity markets” were also big factors of note.

We should hear further complimentary intel from the CEWC over the coming days, but the real measures and substance around implementation won’t likely occur until the NPC meeting in March 2025, and conveniently after some time at the negotiating table with the Trump trade team.

The question that needs to be asked is whether these measures go anywhere near a “Whatever it takes” moment for China. Clearly, there is a commitment from the Chinese authorities to meet and exceed its growth targets, but for many in the international investment community there is an inherent view that actions and substance speak louder than words, and many have been burnt getting set for a sustained rally in China risk driven by concurrent fiscal and monetary stimulus that perennially fails to materialise.

However, for those that subscribe to the notion that the only fundamental input you need is price, then the gains on the day suggest this is a move that is certainly tradeable and worth cautiously participating in.

The news (from the Politburo) broke with an hour to go until the close of the China/HK equity cash markets, with the HK50 subsequently adding 3.2% into the close, with massive volume accumulation seen in both cash and futures. So, while this is partly now in the price, from the respective cash close, H-share, HK50 and CN50 futures have all rallied an additional 4% and our opening calls for the China/HK open subsequently look highly constructive.

The focus throughout the day will be on whether the buyers can build on the opening gains or whether traders throw doubt on the move and fade the strength – it will be very telling from a semantic perspective. There is still a huge level of scepticism from international investors and traders and that itself interests, as it’s in times of high doubt that rallies can kick, especially if China’s economic data flow starts to show signs of improvement and the consensus comes to a view that perhaps we won’t see tariffs raised to 60%. While we won’t know the answer to these factors anytime soon, in my mind, ‘Trading China’ is now one of the most interesting market themes at the end of the year and into Q125.

We can see commitments from the Politburo resulting in green on screen in the commodity and risk FX space too, with industrial metals, iron ore and gold all finding solid buyers. The China FX proxies, and high beta FX plays (ZAR, AUD, COP, and NZD) have outperformed with a mix of organic buying and shorts covering, with AUDUSD following Hang Seng equity futures for the most part, with the spot rate hitting 0.6471 before better supply has been seen.

The RBA meeting in focus through Asia AUD gets increased focus, not just because of its connection to China but we also navigate the RBA meeting (due at 14:30 AEDT) with Gov Bullock’s post-meeting presser out shortly after. The RBA will keep rates on hold at 4.35%, but in the wake of the recent GDP print, with signs that demand is coming into better balance with supply, the RBA should have increased confidence that inflation should move sustainably towards target.

Aussie interest rate swaps price a 25bp cut in the February RBA meeting at 50% - essentially, a lineball call, with the full 25bp cut priced for the April meeting and three 25bp cuts implied over the coming 12 months. The market will reconcile the statement and Bullock’s guidance to that of this forward pricing, and it’s here where the AUD will be driven higher or lower on the day. The RBA will maintain that they are guided by the incoming data, but the statement will need to show that they are open to easing to meet that market pricing.

US equity has struggled, with the NAS100 the notable weak link (-0.8%). I’m highly sceptical to think there will be an ongoing rotation from US/DM equity into China, but we can see traders rotating into energy, and materials, with Health Care also adding in points. We see Comm services, and financials under some pressure, with Nvidia (-2.6%) – who are under review in China for antitrust violations - also weighing on the tech space.

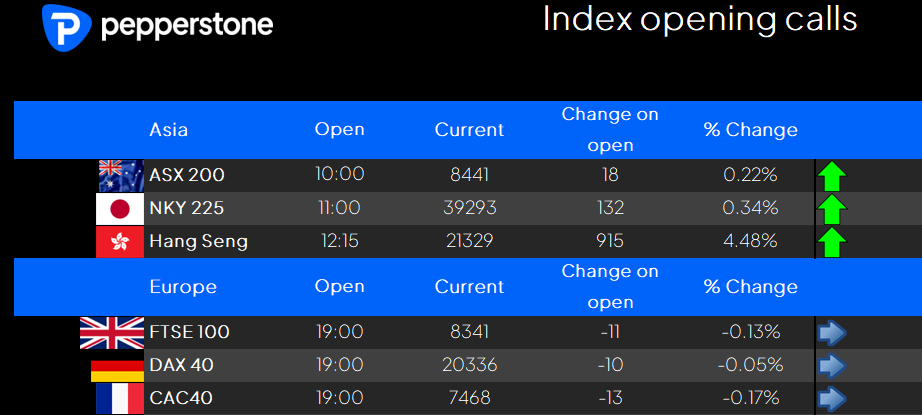

Looking ahead, and as we close out of US cash equity trade, our calls for Asia look constructive with the HK50 clearly outperforming. The ASX200 will be led higher by materials and energy, with BHP likely to open 2.5% to 3% higher. Tech may struggle, while the ASX banks may weigh on the index to a small extent, while consumer and interest rate sensitive plays will be keen to review the RBA statement and the appetite to ease. On the risk docket, we see the RBA meeting (as discussed), but we also focus on China trade data (no set time). Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.