Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

US PPI inflation came in at 0.2% m/m, where we take elements from this inflation read and feed them into the core PCE calculation (due on 26 April). We also take elements from the CPI basket, where it now suggests the Fed’s preferred inflation gauge is running around 0.28% m/m in March or 2.7% y/y. Certainly not low enough to compel the Fed to cut rates anytime soon, but it does reduce some of the concerns that arose yesterday from the hotter US CPI print.

The PPI print has taken some of the impetus to push US bond yields further higher, where another session of big selling in US bonds (taking yields higher) – especially when married with further USD strength – would have likely seen US equity indices trade through key support/technical levels and promote a new wave of deleveraging and selling from more systematic players.

New highs in the NAS100 incoming?

New all-time highs in the NAS100 is where my directional bias falls right now, which is not a huge call given we’re only 1% away from this level. The US500 needs a bit more convincing though, with trend resistance (drawn from the 1 April high) seen just overhead and offers a headwind for the bulls in the near-term – subsequently, a upside break of 5237 and I would be looking at momentum longs, for new highs here.

Tech aside, I’d be wanting the US banks to fire up and investors will need to hear something in the session ahead that compels new money to be put to work in this space, with earnings from Citi, Blackrock, and JP Morgan on the docket. The implied moves on earnings from these names sits at -/+ 3 to 4%, so it could get lively in these individual names, while the XLF ETF (S&P financials ETF) may get some focus from clients.

ECB meeting review

The ECB meeting received interest from traders and expectations for a June start date for a cutting cycle have been galvanised. The bigger issue now facing the individuals within the ECB is providing a more compelling thesis as to why they shouldn’t cut. The question traders are also asking is around the ongoing pace of cuts when they do potentially start in June, and what will be the frequency of cuts in the meetings ahead – this is where central bank policy divergence with the Fed will be seen more intently and it's where EURUSD could trend.

We can already see that the US 10yr Treasury yield commands a 211bp premium to German 10yr bunds and this is near a multi-year high – a factor supporting the USD and one dynamic that should see traders selling strength in EURUSD and suggests the path of least resistance is for EURUSD to gravitate towards 1.0500. For bearish momentum to get going it will require a break of the 14 Feb swing low of 1.0695 – but should this break play out then shorting EURUSD will likely be all the rage.

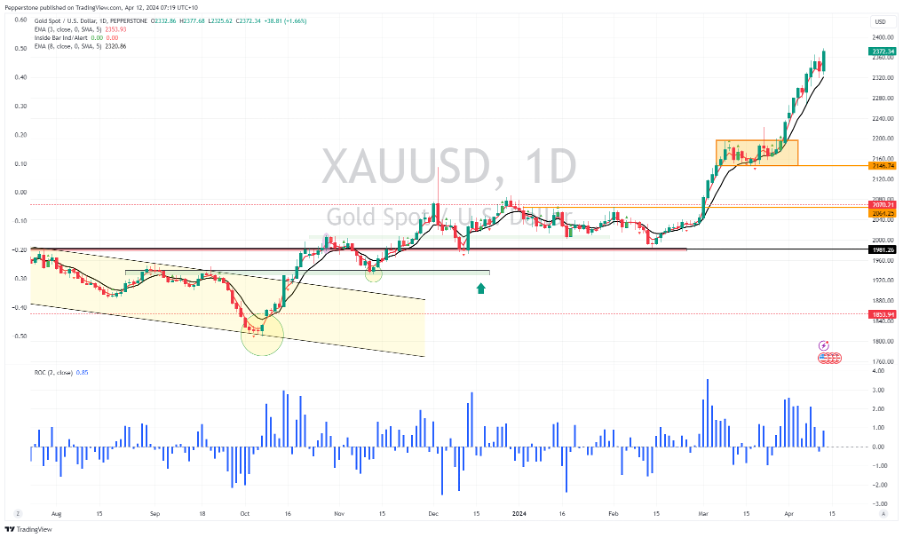

On the flow side, we’ve seen upbeat interest in gold once again into new highs. I had been looking for a bit more heat to come out of the move to reengage with longs, but it seems $2320 was as deep as the pullback was to be. Onwards and upwards it seems, and momentum remains the powerful force. Once again, adopting a more systematic approach would have kept you in the move higher and unemotional. Using a simple use of a 5-day moving average (i.e. exit when price closes below the short-term average) or a 3 vs 8-day MA crossover as an exit signal would see longs remain in place and the art of holding winners is still the play.

Asia equity opening calls

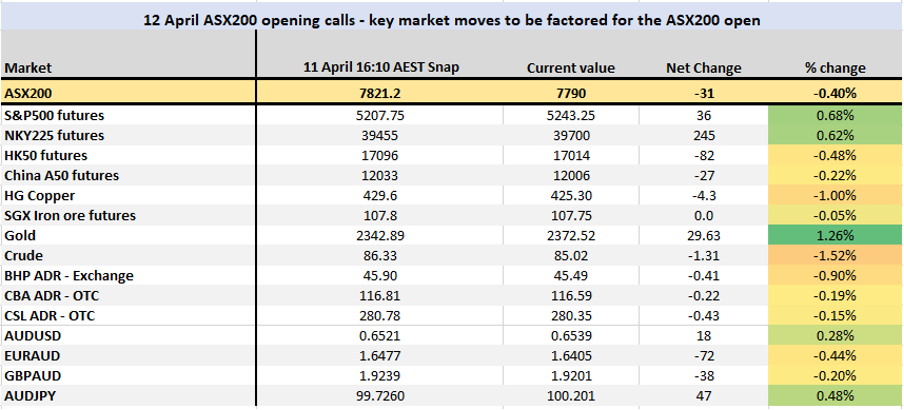

Turning to our opening calls for Asia equity markets, we see the ASX200 opening on the back foot, which is interesting given that S&P 500 and Nikkei futures are 0.7% and 0.5% higher from the ASX200 close (at 16:10 AEST). A weaker open in HK is a factor, and we can see modest headwinds arising from copper, iron ore and crude. As we’ve seen of late, one consideration for traders is holding risk into the weekend and the prospect of a geopolitical headline leading to gapping risk on the Monday re-open. This could keep would-be buyers away and could see gold push higher through the day.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.