Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Trader Insights – massaging positioning ahead of the ‘key’ US CPI print

The broad collective in the market is seemingly more intently focused on managing positioning ahead of tomorrow's US CPI print, where a core CPI print above 0.35% m/m, and certainly above 0.4% m/m, should see Fed rate cuts further reduced (we now see 2.5x 25bp cuts priced by December) and see US 10yr real rates push towards 2.10%.

Potential market moves in a hot US CPI print

In this scenario, it’s easy to think equity will face more lasting headwinds, notably, the momentum plays that were so hot in Q1 would see traders reducing length, with increased hedging, and I’d certainly expect greater interest to eye short exposures in the US equity indices, as well as single stock growth equities – I also don’t see this scenario being this as a one-day affair, which would be a new phenonium, as it's been tough going for the short sellers, with pullbacks lacking any real duration.

We’d be looking for the read-through into the USD, and while US data has largely ticked the ‘exceptional’ box of late, and Fed rate cut expectations have been massaged out, the backdrop has failed to set off a bullish trend in the USD. I suspect that may change if equity goes into a more prolonged drawdown, and we see a VIX index heading towards 18-20%.

USDJPY would break 152.00 and BoJ/MoF intervention talk would be deafening. One would also expect the PBoC to keep USDCNY suppressed through its daily CNY fixing (at 11:15 AEST), a factor which is already highly apparent and USDCNY should be trading far higher than it currently is.

Potential market moves in a lower-than-expected US CPI print

Conversely, few want to get set in outright bearish risk positions in case we get a below-expectations US core CPI print, with core CPI below 0.3% m/m and certainly sub-0.25%. Relief would ripple through markets, with high short-interest names, lower quality plays and high growth equity going hard. As we saw from the sectors and factors in today’s session, growth and momentum have worked well, with buyback names outperforming.

One suspects a low CPI print would bring a June cut (from the Fed) more firmly onto the table, which the rates market prices at a coin toss.

This scenario would offer a solid runway for US earnings with the big US banks/money centres likely offering further tailwinds to risk. That said, the tape of the XLF ETF (US financial sector ETF) already reflects this vibe, with price having rallied 33% since October and the financial sector outperforming the S&P500 by 1.6% YTD.

Gold has worked well in a rising and falling rate environment – it is an out-and-out momentum play and until price can close below the 5-day EMA then the path of least resistance is skewed higher. Would a stronger CPI print matter for gold? Ironically, given calls that it worked as an inflation hedge, a big CPI print would promote gold sellers into the mix and see some of the heat coming out. I also think gold has a larger upside move on a downside CPI surprise, with gold ETF inflows a new source of upside potential.

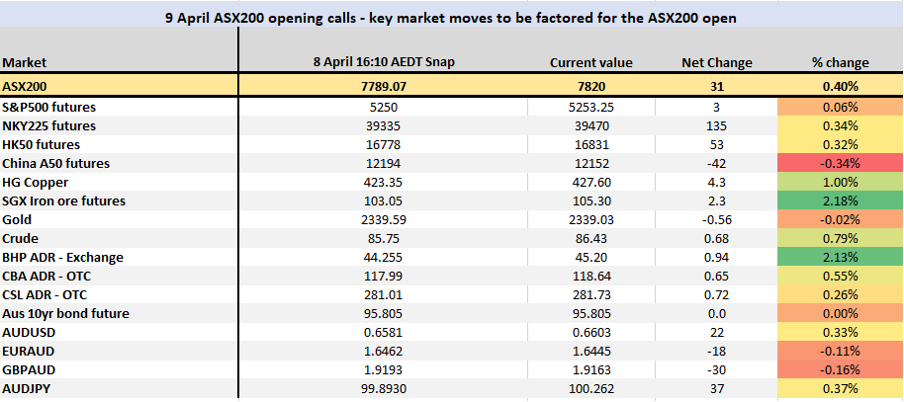

ASX200 opening calls – price moves since from the official close

Turning to the session ahead, our calls for Asian equity markets suggest the various bourses open on a constructive tone with the ASX200 looking to outperform on a percentage basis. We’ll see if the buyers can build on the gains on the open and push the index towards 7850, although I’d see traders fading rallies here intraday. BHP looks set for a positive open, indicating that materials plays will fire up, which suggests Aussie banks may open on a flat tone. With little data to trouble risk on the session (Westpac and NAB business confidence won't impact) the intraday tape through Asia is certainly one that I will refrain from predicting.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)