- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

August 2025 BoE Preview: Sticking With ‘Gradual & Careful’ Cuts

Policy Decision: A 25bp Cut On The Cards

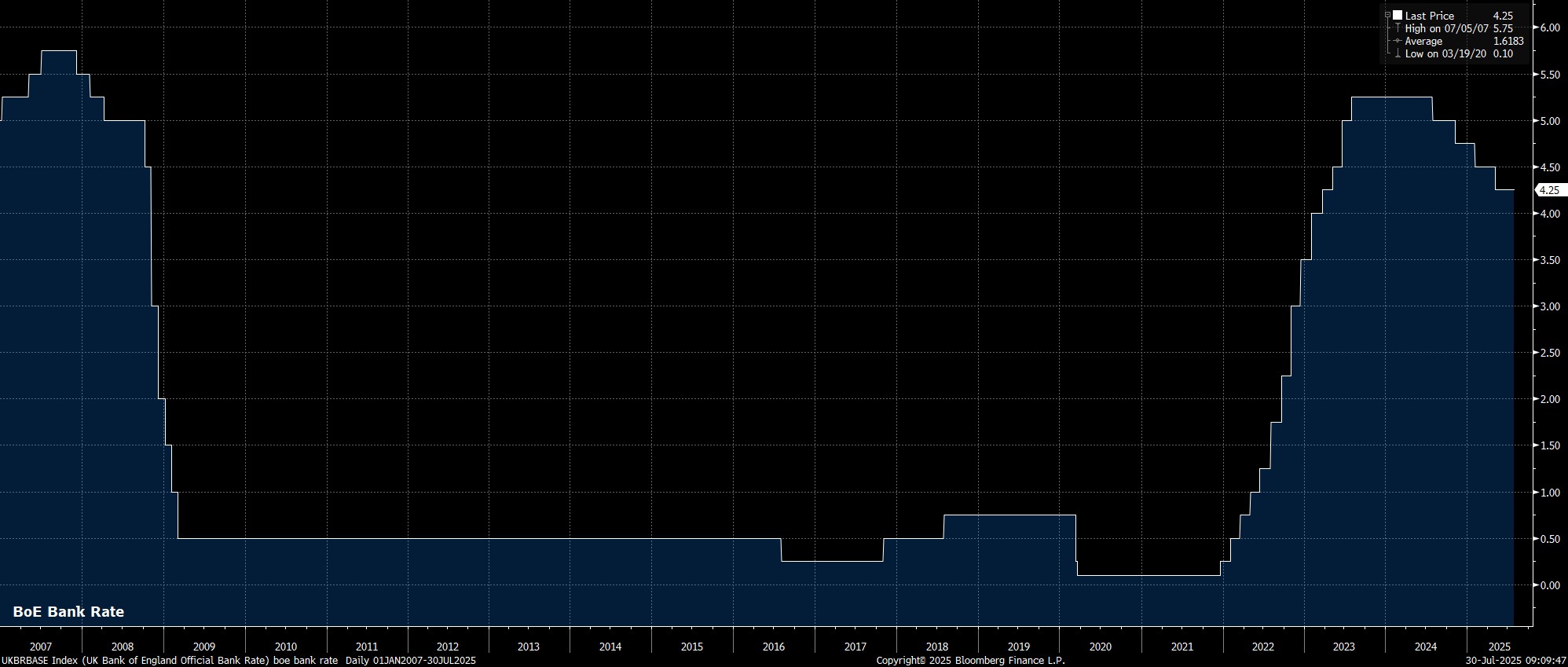

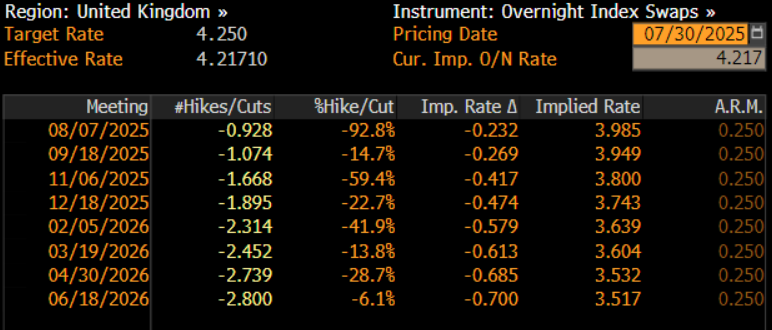

As noted, the MPC should deliver a 25bp cut at the conclusion of the August meeting, lowering Bank Rate to 4.00%, in a move that would mark the third such cut this year, and the 5th reduction in the easing cycle, which began a year ago. Money markets, per the GBP OIS curve, as near as makes no difference fully price such a move, while also discounting around a 90% chance of another such cut before the year is out.

Vote Split: Potential Two-Sided Dissents

While the policy decision itself might be relatively straightforward, in keeping with recent MPC meetings, the vote split is unlikely to follow suit. At the June meeting, despite holding Bank Rate steady, 3 policymakers favoured a 25bp rate reduction – namely, Deputy Governor Ramsden, along with external MPC members Dhingra and Taylor.

The first key question for market participants is whether any of those dovish dissenters from last time out dissent again, albeit this time in favour of a larger 50bp cut. Ramsden seems unlikely to do so, not least given the tendency for the ‘core’ of the MPC to vote as a bloc, while a dovish dissent from Taylor also seems unlikely, given his recent remarks that five cuts in 2025 are likely to be required, three of which will have been delivered by the conclusion of this meeting. That leaves uber-dove Dhingra as the lone possible dissenter, with such a dissent plausible, given her prior view that ‘gradual’ cuts (i.e., 25bp per quarter) would still keep policy restrictive all year.

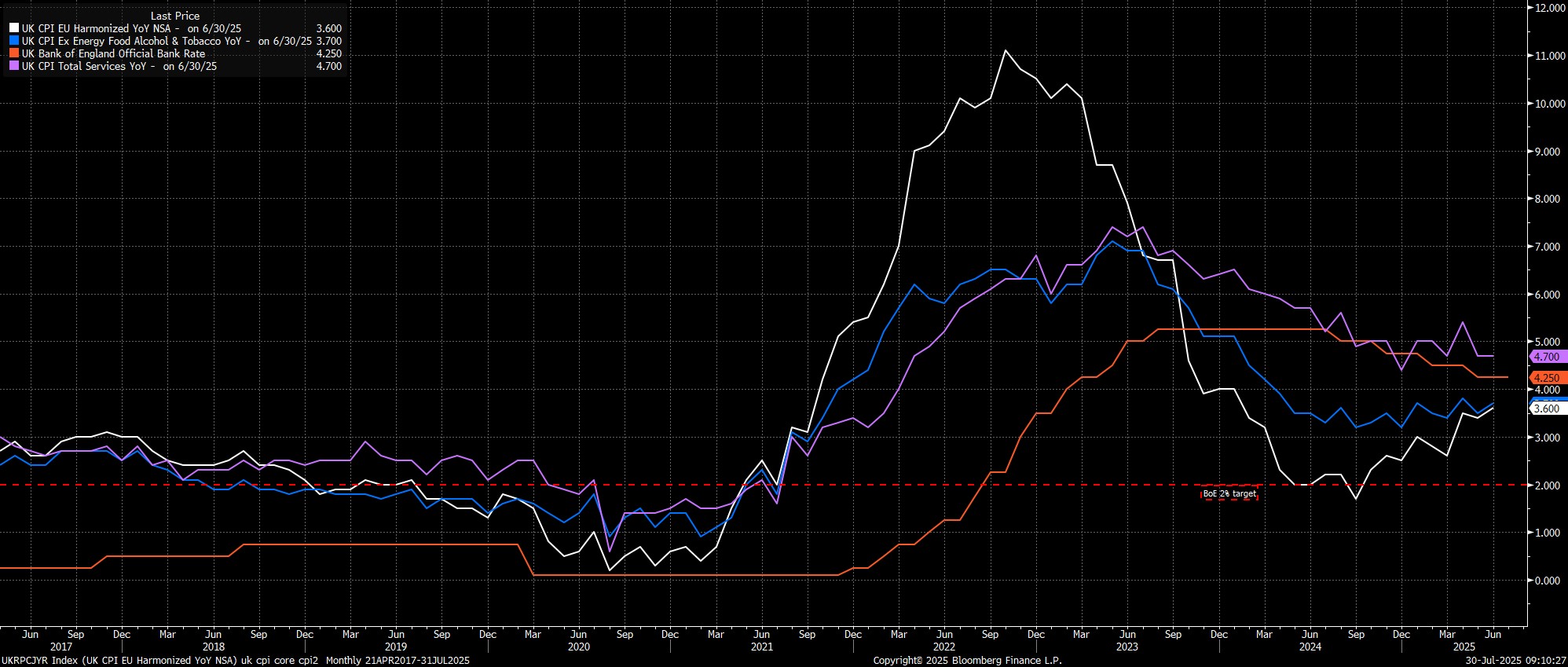

Meanwhile, there is also the potential for a hawkish dissent, possibly from external MPC member Mann, whose policy views have flip-flopped around the hawk-dove spectrum all year. Mann noted, recently, that inflation ‘remains a challenge’ being ‘well above’ the BoE’s 2% price target, though did also flag concern over the labour market in those same remarks. In any case, predicting Mann’s vote has become about a tough, if not impossible, nut to crack this cycle.

The base case, then, while a low conviction call, is for an 8-1 vote (25bp cut – 50bp cut), with Dhingra as the lone dissenter. A 1-7-1 vote (unch – 25bp cut – 50bp cut), however, remains a distinct possibility, and represents a hawkish risk.

Policy Statement: Familiar Language Likely

While the vote split is a bit of a headache, mercifully the policy statement is set to be a considerably more straightforward affair. Here, the MPC are near-certain to issue a ‘carbon copy’ of the forward guidance used in June, and with which markets have now become highly familiar. To be specific, this should see policymakers reiterate that a ‘gradual and careful’ approach will continue to be taken in terms of further rate reductions, and that policy must remain ‘restrictive for sufficiently long’, in order to reduce the risk of persistent price pressures embedding themselves within the economy.

This guidance, however, is unlikely to be what policymakers thought they would be issuing a few weeks ago, where a dovish pivot at the August MPC, opening the door to a faster pace of easing through the autumn to support ailing economic growth, had seemed plausible. Recent data, though, chiefly a rather concerning June inflation report, has served to vastly reduce the chance of such a pivot occurring just yet.

Economic Forecasts: Pessimistic Revisions

This recent uptick in prices, with headline CPI having risen to 3.6% YoY last month, its highest level in a year and a half, is likely to be reflected in the Bank’s updated round of economic forecasts, which are also set to be released at the conclusion of the August meeting. Presently, the BoE see inflation ending the year at 3.3% YoY, and peaking at 3.5% in the third quarter.

Quite clearly, that peak has already been exceeded, necessitating that the forecast is at least ‘marked to market’. Further out the horizon, though, the Bank will likely still project a return to the 2% inflation aim in early-2027, continuing to believe that the current bout of price pressures will prove temporary in nature.

In terms of the Bank’s other forecasts, revisions to the June outlook are likely to, on the whole, lean in a more pessimistic direction.

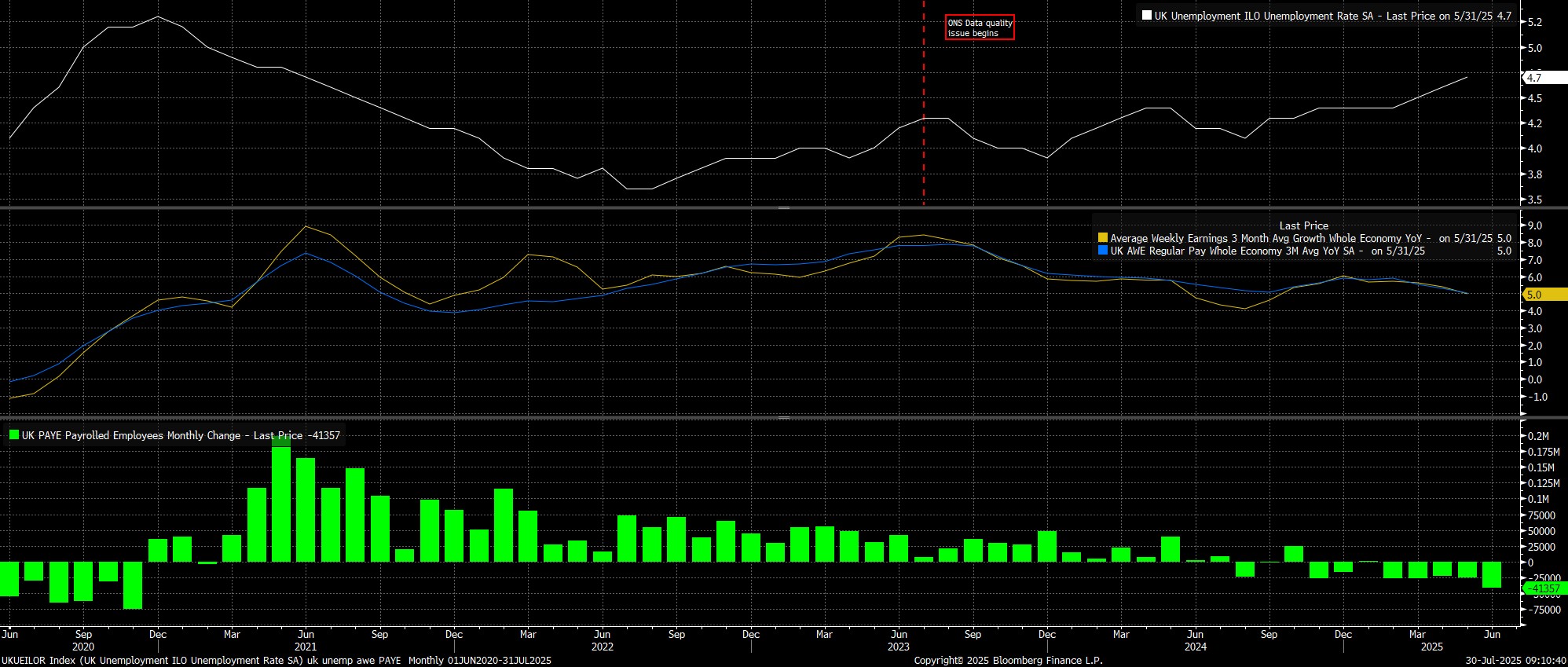

On unemployment, again the near-term projections will need to be ‘marked to market’, with headline unemployment having risen to a 4-year high 4.7% in the 3 months to May, even if data unreliability issues persist. The peak projection for joblessness, though, is unlikely to rise much above the present 5% mark, even as the labour market weakens, with policymakers likely to view the negative impacts of April’s National Insurance hike as a one-off shift to which employers must adjust, as opposed to a harbinger of more structural labour market weakness.

Such an assumption, however, could well prove misplaced, particularly as risks to the overall economic outlook continue to tilt firmly to the downside, not only as global trade uncertainty persists, but also amid the still-perilous fiscal backdrop, and subsequent high likelihood of further tax increases being delivered in the autumn.

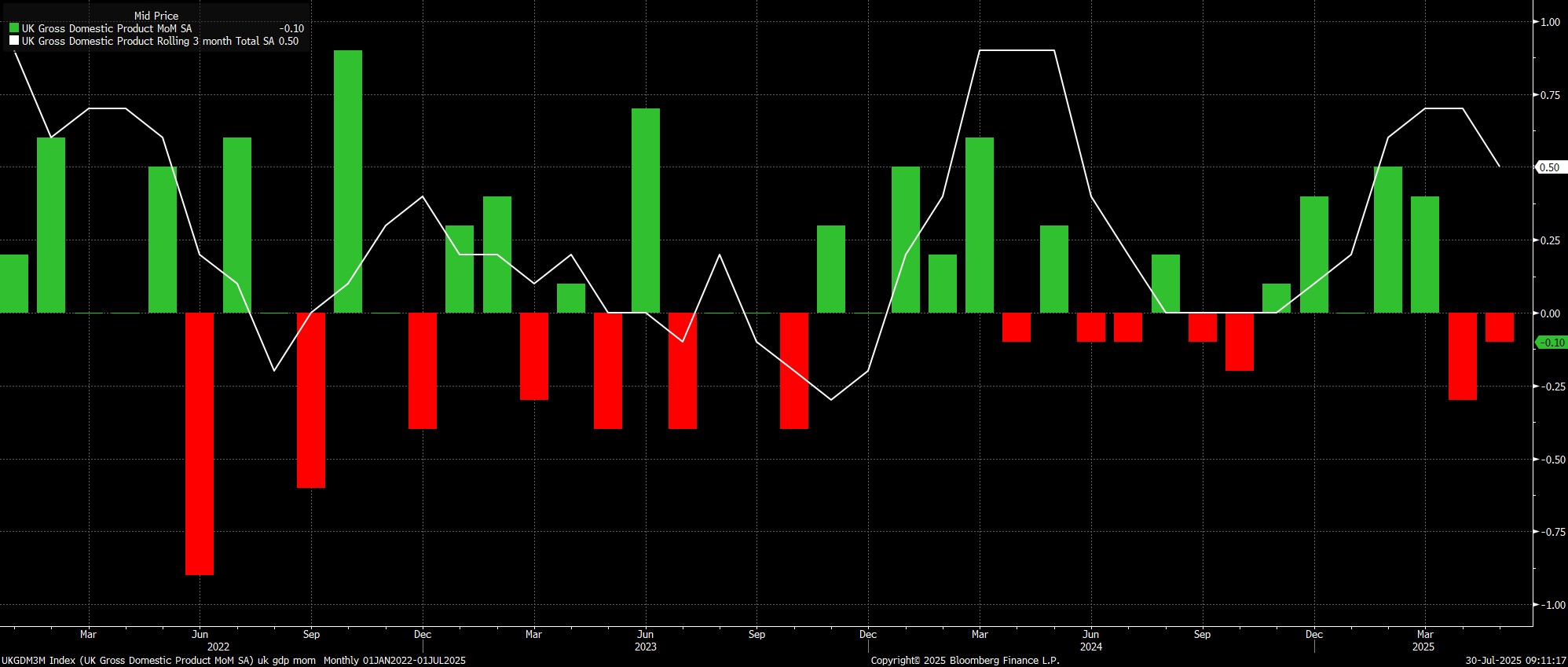

Against such a backdrop, and with the economy having contracted in both April & May, as well as with leading indicators such as the ‘flash’ PMI surveys pointing to momentum having waned further at the beginning of Q3, the Bank’s present forecast for 1.0% growth this year, and 1.3% next year, seem fanciful at best, and will likely be revised lower.

Bailey’s Presser: Little New Info

Discussing all of the above, at the post-meeting press conference, Governor Bailey is unlikely to offer much by way of fresh information, or concrete guidance, instead preferring to maintain as much policy flexibility as possible. Consequently, while re-affirming that the direction of travel for rates remains downwards, Bailey is likely to simply reiterate that a ‘gradual and careful’ approach to policy easing remains the appropriate one and, as alluded to earlier on, is highly unlikely to make any explicit dovish overtures.

Policy Outlook: Caution to Prevail

On the whole, despite a significant degree of labour market slack emerging, in relatively rapid fashion, policymakers are not yet able to shift their focus towards supporting an ailing economic backdrop, with inflation not only well above the 2% price target, but also still moving on a worrying, upwards trajectory. Consequently, it would appear that the ‘Old Lady’s’ ‘gradual and careful’ guidance is likely to remain in place for the foreseeable, leaving the base case as just one further 25bp cut being delivered this year, most likely in November.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.