- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

July 2025 FOMC Review: Standing Pat Amid Dual Dissent

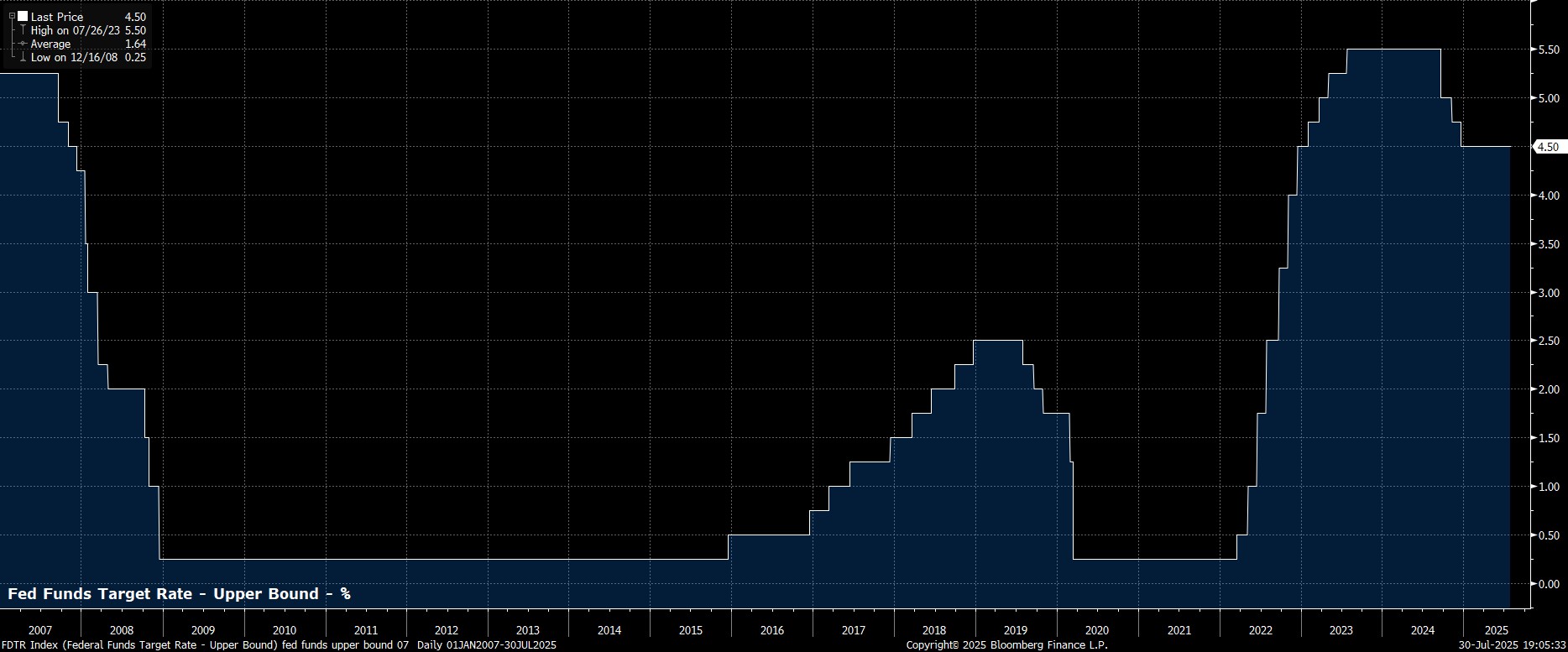

In line with expectations, and the outcome that money markets had fully discounted in advance of the decision, the FOMC maintained the target range for the fed funds rate at 4.25% - 4.50% at the conclusion of the July meeting.

Said decision sees policymakers continue with their now-familiar ‘wait and see’ approach, as the Committee continue to assess how changes in tariff and trade policies are impacting the economy, and shifting the balance of risks to each side of the dual mandate.

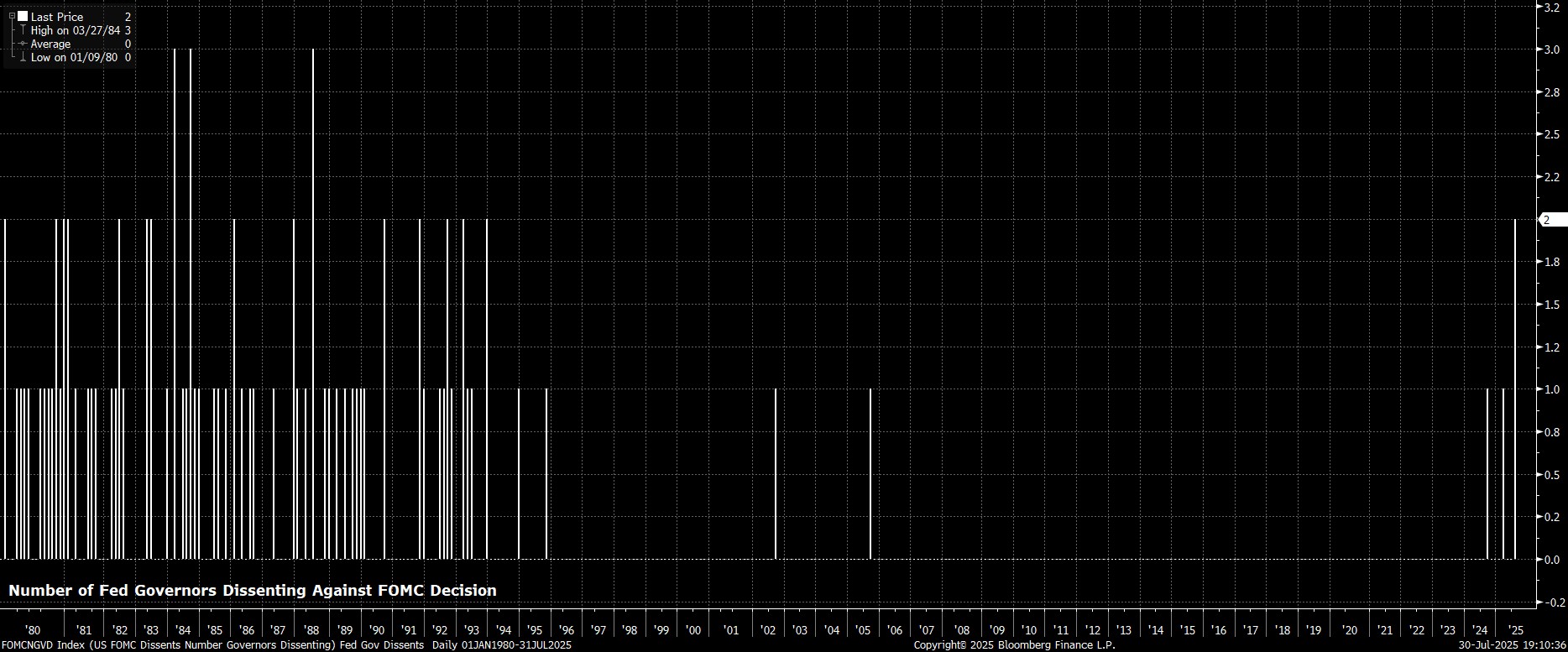

Though the Committee stood pat on policy, doing so was not a unanimous decision.

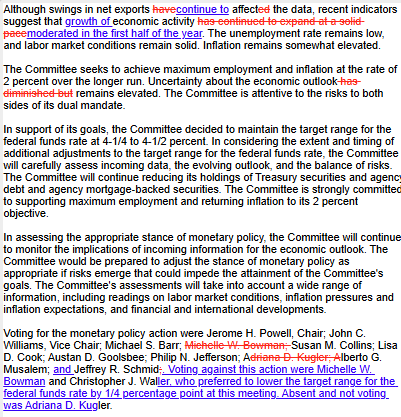

Governors Waller and Bowman instead preferred to lower the fed funds rate by 25bp at this meeting, marking the first time that two Governors have dissented against an FOMC decision for more than 3 decades. While both are likely to explain their dissent in detail at the conclusion of the ‘blackout’ period, their dissents had been well-telegraphed prior to the July confab, with Waller in particular having flagged the need for an ‘insurance’ cut, amid what he perceived to be a faltering labour market. Governor Kugler, meanwhile, did not vote, and was absent from the meeting.

Besides those dissents, there was little by way of fresh, or interesting, developments to stem from the final FOMC meeting before the summer holidays.

The policy statement, largely, proved to be a ‘carbon copy’ of that issued after the prior meeting, in June. Consequently, while the Committee described growth as having ‘moderated’ in H1, the labour market remains ‘solid’, and inflation is still ‘somewhat elevated’. Furthermore, the committee reiterated its attentiveness to risks on ‘both sides’ of the dual mandate, while noting that economic uncertainty ‘remains elevated’, doing some housekeeping to remove the reference to that uncertainty having ‘diminished’.

Turning to the post-meeting press conference, Chair Powell – as expected – stuck resolutely to the script that he has now been using for some time.

As such, Powell once more reiterated that policy is ‘well-positioned’, with the robust underlying nature of the US economy allowing the Committee continue with its present patient approach, as policy remains ‘modestly restrictive’. Powell did, though, very, very slightly crack open the door to making the September meeting a ‘live’ one, flagging on numerous occasions the significant amount of data that will become known by the time of that decision.

Unsurprisingly, and wisely, Powell was not drawn on any of the recent political shenanigans regarding either the Fed’s building renovations, or Trump’s reported attempts to fire him, while also making no comments with regards his own future, after his term as Chair expires next May.

Zooming out, it’s safe to say that, despite the dovish dissents, the July FOMC decision will not be one for the history books, going down as little more than a ‘placeholder’ meeting. Clearly, the majority of policymakers continue to view the present ‘wait and see’ approach as prudent, with there being little need to rush into any policy action, given persistently elevated economic uncertainty.

In my view, there remain two plausible paths that the FOMC may follow over the remainder of the year. Were inflationary pressures to remain relatively contained, and/or the labour market begin to weaken more rapidly, then a cut could come as soon as September, with Chair Powell potentially teeing up such a move at the late-August Jackson Hole Symposium. Such a move would open the door to two 25bp cuts this year, with the second coming in December.

My base case, though, is that the labour market does indeed remain resilient, allowing policymakers to maintain their present stance for the foreseeable, as tariff-induced price pressures work their way through the economy over the next couple of months. Such a policy path leads to the likelihood that just one 25bp cut is delivered this year, most likely at the December confab.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.