- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

July 2025 US CPI: Headline For Show, Core For Dough

Headline CPI rose 2.7% YoY last month, bang in line with market expectations. However, underlying price metrics showed signs of inflationary pressures continuing to intensify, with core CPI rising 3.1% YoY, the fastest pace since February, and ‘supercore’ inflation (aka core services less housing) rising by 3.2% YoY, up from 3.0% YoY last time out.

On a MoM basis, meanwhile, it was again a case of ‘headline for show, core for dough’, to coin a golfing analogy. Headline prices rose 0.2% MoM last month, matching expectations, though this cooling was largely due to a drag from energy prices. Removing this impact, though, and focusing on the core metric, points to underlying inflation persisting, with prices ex-food & energy having risen by 0.3% MoM, an 0.1pp quickening from the pace seen in June.

Annualising these metrics also helps to provide a clearer picture of the underlying trend:

- 3-month annualised CPI: 2.3% (prior 2.4%)

- 6-month annualised CPI: 1.9% (prior 2.5%)

- 3-month annualised core CPI: 2.8% (prior 2.4%)

- 6-month annualised core CPI: 2.4% (prior 2.7%)

In addition, considering that the bulk of upside inflation risk currently stems from the Trump Admin’s ever-changing tariff policies, the composition of the uptick in inflation is pivotal, particularly considering that market participants and policymakers alike continue to grapple with the question of how the tariffs are being paid for.

On this note, core goods prices rose 1.2% YoY last month, the fastest pace in over two years, and a clear sign that tariff-induced price pressures are increasingly showing up in the data. Core services, meanwhile, rose by 3.6% YoY for the 4th month in a row, again raising concern over the potential for price pressures to embed themselves within the economy.

Taking the July CPI figures into account, headline inflation has now been running north of the Fed’s 2% price target for the last 53 months running. At the same time, headline unemployment has been running under 4.5%, a level generally considered to represent ‘full employment’. I would, hence, argue, that not only are many FOMC officials correct in their assertion that inflation is currently further from their objective than the labour market, but also that the market is somewhat complacent in its pricing for the September meeting.

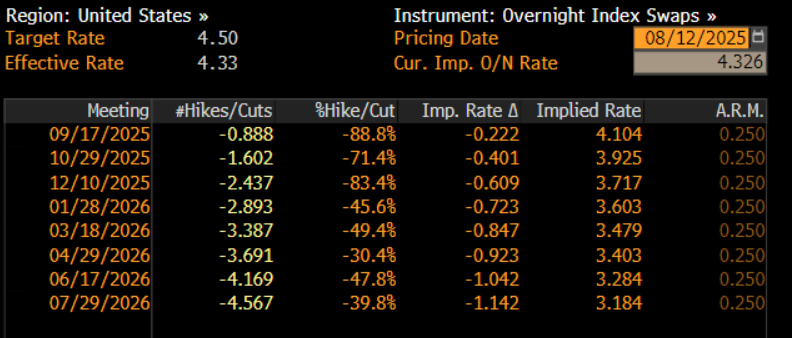

Per the USD OIS curve, money markets now price around a 9-in-10 chance of a 25bp cut in September, up from about 85% pre-release, while also now discounting over 60bp of easing by year-end, about 3bp more than before the CPI figures dropped.

Taking a step back, in light of not only today’s data, but also the fact that inflation risks remain tilted firmly to the upside, and the aforementioned commentary from many FOMC members, my base case remains that policymakers will stick with their ‘wait and see’ stance for the time being, delivering just one rate cut this year, most likely at the December meeting.

There is, however, a more dovish path that the Committee may choose to follow, if participants believe that the potential cracks emerging in the labour market should take precedence over ensuring that tariff-induced price pressures remain in check. Such a path would likely lead to rate cuts being delivered in both September and December, with Chair Powell potentially using his remarks at Jackson Hole late next week to open the door to such a possibility.

For now, though, my assumption remains that Powell & Co will stand pat for the time being, albeit with continued dovish dissents from Govs Bowman and Waller. In any case, while Jackson Hole will be important, there is also the small matter of another jobs report, and another CPI print, before the next FOMC meeting. Plenty, hence, could change between now and 17th September.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.