CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

US Q3 earnings - trade a new level of flexibility and control

For traders wanting to trade US quarterly earnings or perhaps hedge their underlying exposures, share CFDs (Contracts-for-difference) allow active traders the ability to express a view on the direction of a share price, over a timeframe of their choosing. Just as one would when trading physical shares.

However, if one has the risk tolerance and their strategy dictates, then share CFDs incorporate leverage and the potential ability to go long or short, which can greatly change a trader’s approach and control to trading price moves in stocks.

US earning allow the market to price reality

It's through US quarterly earnings where the market gets to see the reality of a company’s financial health versus what’s been expected and whether the outlook that the market has discounted into valuations is one that is portrayed by the company. The divergence between the company’s outlook and market positioning is where we often get short-term volatility, especially if a share price has had a big move into the earnings and a lot of that speculative positioning is unenthused and will need to manage that position.

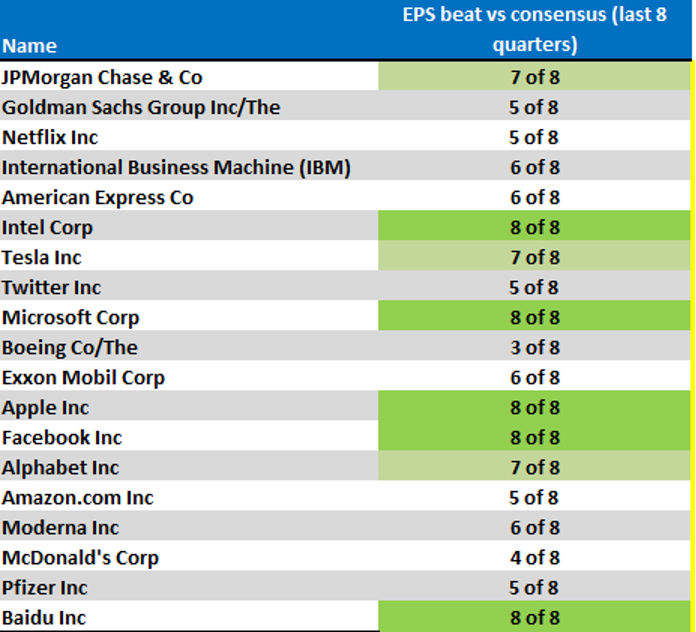

Trading around news can be challenging, but traders will try and skew the probabilities by looking at a company’s pedigree at earnings and whether the company has a long-forged history of beating or missing expectations – names like Apple, Intel, Facebook, and Alphabet are market darlings when it comes to beating earnings expectations and they do so time and time again.

(Source: Pepperstone - Past performance is not indicative of future performance)

However, earnings pedigree is one aspect that can instal a sense of confidence, but there's so many more considerations than just beating earnings and sales estimates, especially when analysts are usually lowball in their estimates.

Investors live in the future, so the vision, the guidance and the expected operating environment can often be far more influential for the share price reaction than the numbers seen in the reporting quarter. If the investment case shifts, a money manager will often trim, increase, or hedge the position – for equity CFD traders, taking a position can often be in anticipation of a reaction, or reacting to the fact and whether the adjustment is perceived to be more than a one-day affair.

Scanning stocks for movement

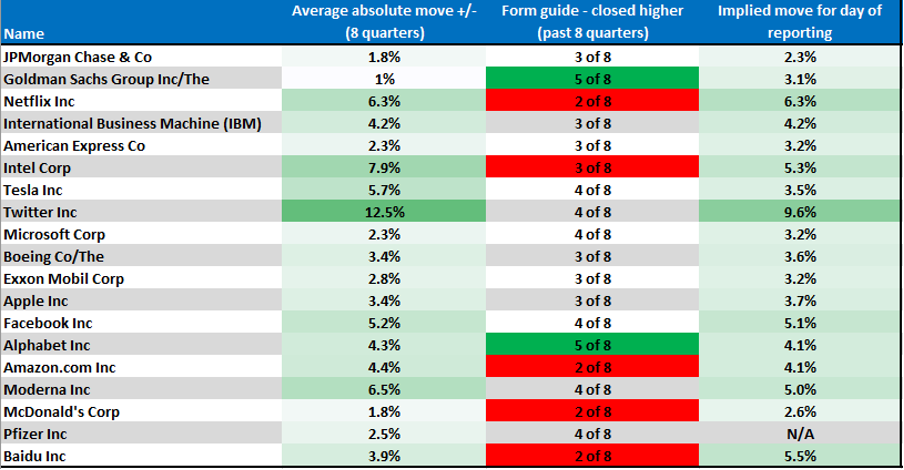

Typically those who do choose to trade earnings look at their history and whether shares have had outsized moves over multiple quarterly earnings periods – For example, In the past eight quarters, Facebook, averaged absolute moves of 5.2%, while Netflix and Twitter average absolute moves of 6.3% and 12.5% respectively. We can look the propensity for future movement, and looking at the options market to see the implied volatility (high or lower) through to the reporting date and see if the market is expecting big movement.

(Source: Pepperstone - Past performance is not indicative of future performance)

Traders look for companies that have a history of beating or missing expectations and if the share price moves in alignment – life is far simpler like this. For example, Apple and Amazon have both beaten consistently on expected EPS and sales, yet have subsequently fallen on the day of earnings for four straight quarters – will we see a fifth straight quarterly loss on the day of earnings? Intel is another example of a company consistently beating quarterly estimates only to see shares down sharply for five straight quarters, by an average of 9.3%.

There are many other examples, but one could argue when a stock is priced for perfection that the company not only needs to beat expectations, but it needs to truly inspire and almost blow the lights out.

So traders want a pedigree of exceeding expectations, they want movement and importantly they want to know whether there is a trend in the share price performing well or poorly on the day of reporting. They may also want to understand the level of short interest in the position and where analysts are positioned in the case of upgrades/downgrades – this all leads to more outsized moves and moves that can last.

US Q3 earnings are fast approaching, with JP Morgan getting the ball rolling on 13 October – share CFDs could be a vehicle that you can use to harness the movement and volatility that ensues.

The Pepperstone edge

With Pepperstone, we offer US share CFDs with:

- No minimum commission – this means on a $25,000 notional position in Tesla (for example) the commission to open and close would be $0.66. Great for higher frequency traders

- Very low commission – 2c a share – for active traders this should reduce the drag that costs wear on portfolios

- The guaranteed market price – some zero commission brokers will wrap their own spread to the market bid-offer spread – this is often not picked up by clients

- The ability to trade all sessions – this means clients can trade the post-market session and the period when many of the marquee stocks report earnings. If news breaks don’t be left waiting for the market to re-open. Trade when the news breaks and react in real-time

- The ability to go long and short with ease – there are no ‘borrow’ restrictions with Pepperstone, and clients can trade stocks long or short without restrictions

- No currency fee – if buying (or selling) US share CFD and the account is in AUD or GBP most brokers would charge a high FX exchange fee – that can add up.

For more intel about trading US earnings and share CFDs with Pepperstone, visit our website.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.