CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

We welcome in a new era of Fed policy, but how they achieve it needs to be answered

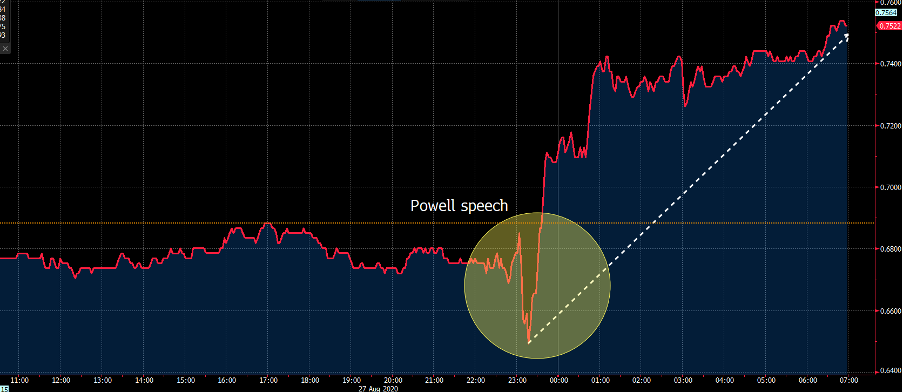

We just need to look at 10- and 30-year US Treasuries for the clearest reaction, with solid selling playing out despite Powell bring out the big guns. The move-in nominal Treasury yields outpacing inflation expectations, or ‘breakevens’, which were not overly impressed by Jay Powell’s speech, or should I say had gone some way to pricing the outcome and we see ‘real’ Treasury yields up 5bp in 10s.

Moves in UST10s – higher yields = funds selling the fact.

(Source: Bloomberg)

This is a reaction we had run as a clear risk, but we ask, "was this just a positioning move and a one-day affair or something more sustained"? I suspect the former.

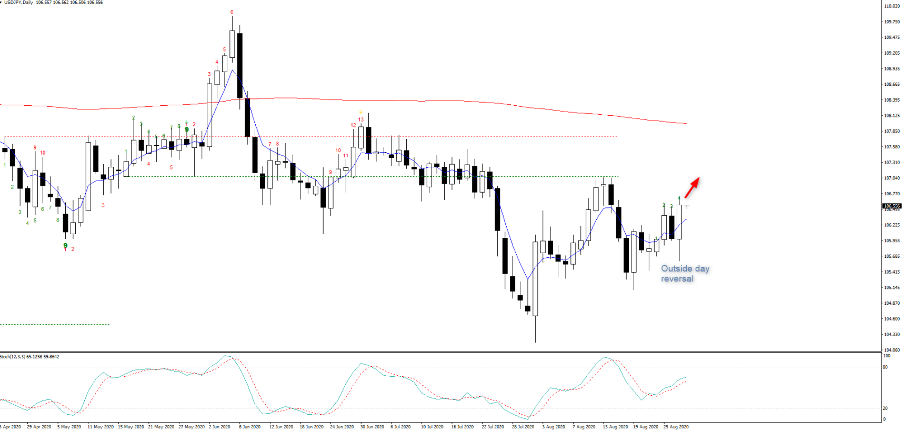

Expectations for a regime change were clearly elevated with high hopes that a move to average inflation targeting would be announced here – it was. That said, Powell disclosed just enough to keep real yields from moving significantly higher, an outcome that would have caused shockwaves through markets, not just the ripples we’ve seen. The move higher in Treasury yields post-Powell did promote a USD rally, although we find it flat on the day, with a mixed picture across the well-traded FX pairs. We see USDJPY has worked well to the upside, printing a bullish outside day reversal which I will be monitoring for follow-through and a potential move back into 107.05.

AUD has been perhaps the standout in our universe and rightly so. The Fed is not just moving to tolerate higher inflation but is actively seeking it. What’s a great hedge against inflation? Commodities - so the AUD and NZD are beneficiaries of this. AUDUSD reached a high 0.7291, but has crept back into the range. If this closes topside then put the pair on the radar, as it will prove to be a greater headache for the RBA going forward. EURAUD has broken through the 11 August swing low and I see risks this now heads to 1.6150 and would be short, with stops set on a daily close above the 5-day EMA. AUDJPY too is looking bullish and trading at the strongest levels since May 2018 – happy to be long this too.

A move to a new regime

Arguably the most important aspect of Powell’s speech was the move to ‘flexible inflation averaging’ and we focus on the line “following periods when inflation has been running persistently below 2 per cent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 per cent for some time.”

The Fed will proactively drive inflation expectations higher, which should keep real yields from moving too much higher and will just mean the Fed will have to be creative with its policy experiment for some time to come. This is also the case with economic trends and specifically unemployment, where Powell detailed a commitment to run the economy hot. Powell has effectively severed the link between full employment, wage pressures and higher inflation – aka the Phillips Curve – and will use policy to assist in creating full employment. However, should we see unemployment sub-5%, they will keep the pedal to the metal if inflation is still too low.

Gold and silver have struggled and simply worked counter to the USD move, where I expect it to hold a lock on for some time. If funds start selling USDs again, then gold heads to $2k, simple. So, if trading gold keep an eye on EURUSD and also USDCNH, which is seeing indecision on the daily candle, although price is still at the weakest levels since January and is eyeing a test of the January lows of 6.8450 – if the USD finds sellers vs the yuan, then it will resonate against other USD crosses.

We see the move in real yield has weighed on tech, with the NAS100 -0.4%, while value has outperformed and we see that with the Russell 2000 +0.3%. This is a function of real yield, but it's hard to think this has any real legs unless we see nominal Treasuries really move higher and the USD rally. The Fed has moved to a new era in policy settings and while the market has sensed this for a while, it holds huge implications for markets. The devil is now in the detail and the Fed can say they are going to drive inflation higher, but how exactly? The Fed will now need to really explore this new regime change in the 18 September FOMC meeting, as it's great telling us they plan but how they enact is what the market really needs to learn.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.